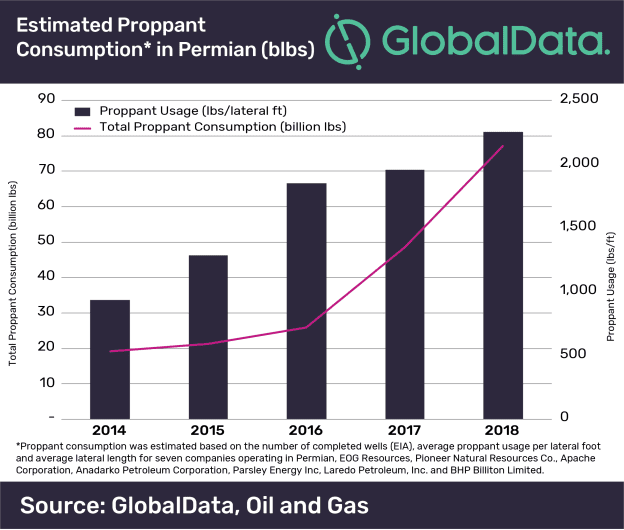

Rapidly growing sand demand in the Permian Basin is raising questions on whether there will be enough supply of proppant available. It is estimated that the total sand consumption in the Permian will reach more than 77 billion pounds this year. The demand growth is mainly due to increased wells lateral length and a larger amount of proppant injected per well, which grew by more than 70 percent in the last three years.

However, the share of locally produced sand is expected to grow to more than 40 percent, increasing the competition to the white sand supply from the upper Midwest to the Permian. In fact, there are at least five sand mines opened in the Permian by Hi-Crush, Black Mountain and U.S. Silica in 2018 with a proppant supply of 35 billion pounds per year. Many more mines are expected to be opened soon, which will likely solve the basin’s sand shortage problem over the near future.

Despite the worse quality of regional sand, it is much cheaper, and operators choose to mix it with premium white sand to keep their costs down. In fact, Pioneer Natural Resources acquired an interest in U.S. Silica’s La Mesa sand facility, which is expected to provide the operator with four billion pounds of sand per year by 2020.

However, the ample local sand sources can easily translate into an excess supply whenever drilling activity reduces its pace due to the logistic bottlenecks in the Permian Basin. If this is persistent sand prices will fall benefiting operators that don’t face any pipeline restriction.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.