U.S. benchmark (West Texas Intermediate, or “WTI”) and international Brent crude oil prices have plunged by more than a third from an October 3, 2018 high of $76.41per barrel (/bbl) and $86.29/bbl, respectively—the largest percentage decline since early 2016. Currently, WTI prices stand in the low $50s/bbl range, with Brent prices hovering at the low $60/bbl range.

How Healthy Are Your Hedges?

Oil producers that made money in the crude oil “upturn” earlier this year locked in prices for their production as much as three years into the future, all while doling out dividends to shareholders, executing share buybacks decline since-investing in operations. In fact, about 48% of oil production was hedged at an average price of $57/bbl atone point earlier this year, according to media reports. But, is that enough?

Letting history be our guide, we turn to 2014. This was the start of the last major decline in the crude market. At the end of that year, WTI closed just above $53/bbl. This is very similar to current trading ranges. The biggest difference is the probable hedge price. Based on our analysis of the futures market, at the end of 2014, E&P companies’ probable hedge price would have been $95/bbl. Currently, we estimate potential hedges in place at around $55/bbl—a staggering $40 per barrel difference that directly impacts future operations.

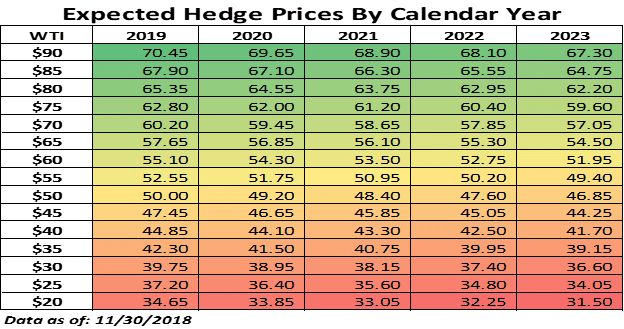

What to Expect with Hedge Prices?

While we are clearly in a bear market, there is room for some optimism going forward. First, the rate of hedge compression in the futures market appears to be slowing. Oil producers use futures contracts to hedge their exposure to production in an effort to shield themselves from losses should the price of crude fall suddenly. For example, when the price of crude traded around $50/bbl, historically an E&P company could hedge their Calendar 2019 production at the following prices:

- During 2015 – $65.00/bbl

- During 2016 – $54.50/bbl

- During 2017 – $51.00/bbl

- During 2018 – $51.75/bbl

Second, although we have seen annual compression in hedge pricing, the breakeven costs across shale plays have also continued to decline. In my opinion, this lockstep movement should signify efficiency, rather than pressure in the hedge market. For instance, during 2016, when WTI prices were around $25/bbl, the Calendar 2019 hedges were priced around $44/bbl. This price level is consistent with many of the breakevens we are hearing across major shale plays.

Finally, hedging is a process. The recent oil market sell-off has been exacerbated by a host of factors, from President Donald Trump’s outspoken advocacy of keeping a lid on higher crude prices to U.S. sanctions on Iranian oil. In addition, OPEC and Russia recently reached a collective deal to curb output by 1.2MMbbl/d for the first six months of 2019. Whether they will adhere to the production cut agreement remains to be seen; however, all these uncertainties can offer opportunity.

Although I think we are in a long-term bear market, my short-term technical models are pointing to a reprieve. I currently believe crude prices will rebound back toward $70/bbl in 2019. If that does occur, I would expect to see hedge prices ranging between $60/bbl to $57/bbl across the forward curve.

(Source: Ryan Dusek, Opportune LLP)

More information about the chart above: The below matrix represents expected hedge prices by calendar year (Horizontal Axis) for any given WTI price (VerticalAxis). Values are derived from historical forward curves for NYMEX CL futures.

Ryan is a Director at Opportune LLP. His industry experience includes commodity trading, risk management, supply chain optimization and derivative valuation. He is an expert in developing financial models to quantify complex/uncertain issues and deliver real-world solutions. He has extensive experience in the pricing, hedging and portfolio management of the retail natural gas markets. Ryan has led all aspects of commercial-deal structuring and pricing for wholesale natural gas trading and origination. He has over 15 years of experience in the energy industry. Ryan has an MBA from the University of Texas in San Antonio where he specialized in Finance.