Major oil and gas companies are increasingly highlighting the alignment of their corporate strategies with climate change goals. They are also pursuing major production growth projects, but the value risk to these investments from the energy transition is limited, according to GlobalData, a leading data and analytics company.

The company’s latest analysis shows that planned and announced projects from the six supermajors of ExxonMobil, Chevron, Royal Dutch Shell, BP, Total and Eni are expected to contribute over 5 million barrels per day (mmbd) of gross oil production by 2025. This comes despite projections of declining oil demand in the 2030s or even the late 2020s in some scenarios.

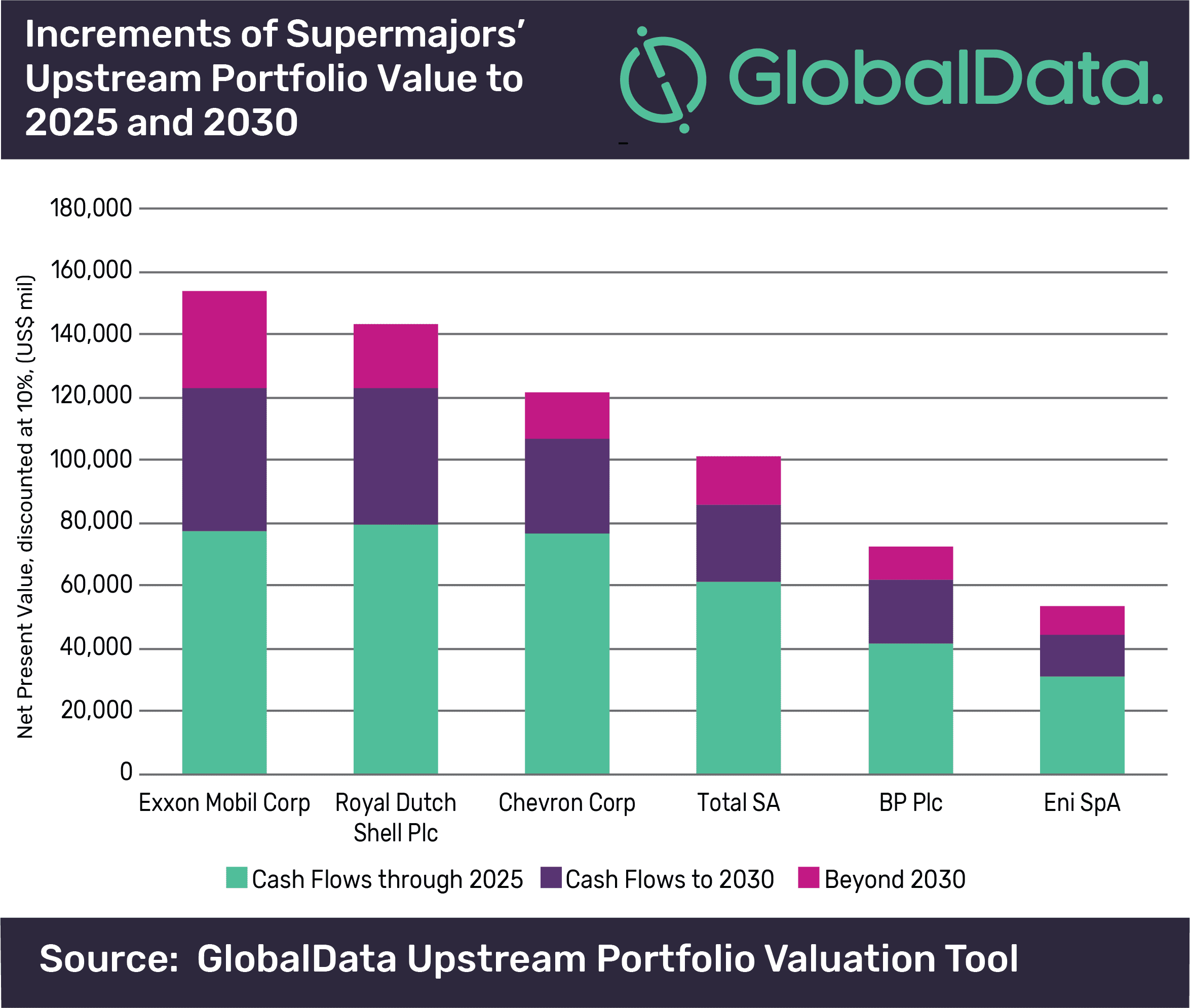

Will Scargill, Senior Oil and Gas Analyst for GlobalData comments: “The risk to majors is mitigated by the fact that the bulk of their portfolio value comes from near-term revenues. Although oil and gas fields generally produce over a long period of 20-30 years, the declining nature of production means that a high proportion of cash flows come in the initial years.

A standard industry discount rate of 10% puts greater emphasis on near-term revenues when assessing value, and the current focus on short-cycle projects compounds this. GlobalData’s analysis shows that across all the supermajors’ portfolio of existing fields and upcoming projects, over 50 percent of the net present value comes from cash flows up to 2025, while 80 percent or more comes from cash flows up to 2030.

Scargill adds: “The design of fiscal regimes also has a significant effect. In order to incentivize new developments, many governments have designed terms that allow companies to rapidly recover their investments through accelerated tax allowances, cost recovery, or other mechanisms that improve cash flows in the first years of production. This combination of factors means that new developments may be subject to the least risk from potential demand reductions.”

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.