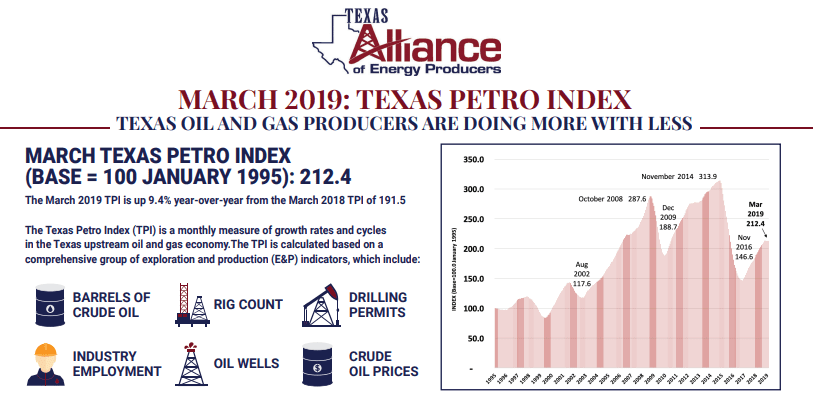

AUSTIN, Texas – Curious trends are happening in the Texas oil and gas industry, according to the Texas Alliance of Energy Producers March Texas Petro Index (TPI). Despite a decline in the March TPI to 212.4 and in the first quarter 2019, prices continue to improve and Texas crude oil production is still breaking records. A monthly measure of growth rates and cycles in the Texas upstream oil and gas economy, the TPI is based on indicators such as rig count, drilling permits, well completions, and employment, which all remained in decline in March.

“Typically, these E&P indicators decline during an observable, sustained contraction in oil and gas activity, but that doesn’t appear to be what we’re seeing now,” Karr Ingham, Petroleum Economist for the Texas Alliance of Energy Producers and creator of the TPI. “I do think these decreases can partly – even largely – be attributed to the sharp and unexpected fourth quarter 2018 crude oil price declines, but clearly there are other forces at work. These have become increasingly evident over the course of the current recovery and expansion from the 2014-2016 industry downturn.”

These forces are the ever-higher efficiencies achieved by Texas oil and gas operators, supported by the numbers. With crude oil production continuing to set milestones, the March monthly average rig count fell below 500, the fourth straight month of decline, compared to a monthly average of 904 in December 2014. The number of drilling permits issued in the first quarter is down by about five percent compared to year-ago levels and is off by nearly 40 percent compared to the 5,367 permits issued in the first quarter 2014.

Direct upstream (exploration and production) industry employment is on the wane as well after reaching a cyclical peak in December 2018. Seasonally adjusted numbers compiled by the Federal Reserve Bank of Dallas, with further adjustments by the Texas Alliance of Energy Producers (to strip out the few “mining” jobs in Texas that are not oil and gas related) suggest the loss of about 3,500 oil and gas E&P jobs from December to March. Further, the March estimate is down by over 70,000 compared to the all-time peak employment total in December 2014.

Industry employment and crude oil production estimates in March suggest that for every one direct upstream oil and gas employee, about 700 barrels of oil are produced, compared to about 170 barrels per employee in 2009.

Crude oil production continued its upward ascent through the first quarter, however, with daily production exceeding five million barrels for the first time according to Alliance estimates (based on data from the U.S. Energy Information Administration (EIA) and the Texas Railroad Commission).

“Given current price levels, which continue to improve, the Texas upstream oil and gas economy remains in expansion mode,” said Ingham. “But the nature of oil and gas economic growth in Texas is different in 2019 largely because it has become perfectly apparent that Texas oil and gas companies can produce more crude oil with fewer resources deployed.”

The March 2019 Texas Petro Index of 212.4 was down from the February TPI of 213.1, and the December (year-end) 2018 index of 212.9 – and more than 100 points (about 32%) below its November 2014 peak. In fact, the Texas Petro Index has generally been in a state of mild decline since its cyclical peak in October 2018.

Crude oil pricing itself is well below the June 2014 cyclical peak in crude oil prices of over $100/bbl, and natural gas pricing in Texas is increasingly wretched in early 2019 thanks to continued deep discounts in Permian gas prices. The Texas Alliance of Energy Producers Texas Petro Index is based at 100.0 in January 1995.

Loading...

Loading...

About Texas Alliance of Energy Producers

The Texas Alliance of Energy Producers, the largest independent statewide oil and gas association in the nation, provides a voice for sound U.S. energy policy for nearly 3,000 members. These individuals and organizations – from small players to publicly traded companies – are the driving force behind the U.S. energy renaissance. Founded in 1930, the Alliance has offices in Wichita Falls and Austin, Texas. For more information, visit https://www.texasalliance.org/.