Find out why the combination of the Saudi/Russian oil price war and the global COVID-19 pandemic has demonstrated a greater need for hedging freight costs.

The COVID-19 pandemic has sent shock waves through the shipping industry. The supply glut of crude oil due to the Saudi/Russian price war and the declining demand due to global “stay at home” advisories sent tanker rates through the roof as oil traders and marketers scrambled to lock down floating storage. On the flip side, the shutdown, in attempts to mitigate further spread of the virus, has hurt supply chains worldwide and dried up the bulk cargo market.

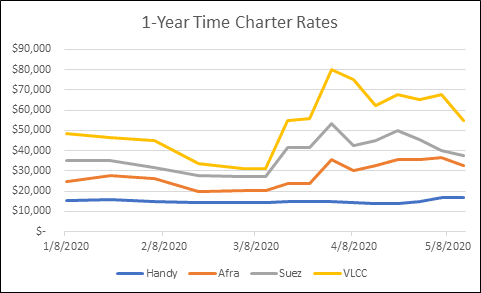

While freight rates are typically cyclical, these world events have caused extreme highs and lows. In the past six weeks, spot tanker rates have been as much as five to 10 times higher than average, while one-year time charter rates nearly tripled for Very Large Crude Carriers (VLCCs).

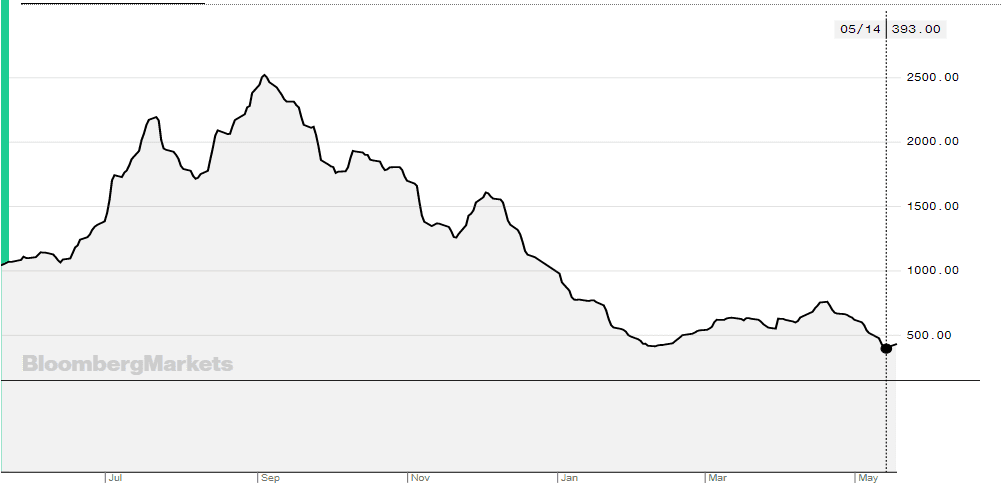

Combining the typical lower seasonal demand with the virus impact, the Baltic Dry Index has dropped to its lowest since 2016 and is over 80% down from its September 2019 high.

In the charter market, these events have demonstrated a greater need for hedging freight costs just as a company would hedge any other energy commodity. Outside of a specific freight book, typical commodity trading companies aren’t looking to make substantial profits on their marine transportation. In today’s volatile commodity market, hedging freight costs should be an important component of a risk department’s overall control policies.

The Baltic Exchange has defined routes for Freight Forward Agreements (FFAs) that can be used as part of a freight book to hedge exposure to freight price changes. For example, a refiner on the U.S. Gulf Coast that regularly brings in Middle Eastern crude would use the TD01 benchmark to hedge themselves against fluctuations in the VLCC market. Depending on the exact route from the Middle East to the U.S. Gulf Coast, this may not be a perfect hedge, but it would likely be closely correlated. Using a combination of available FFAs against a company’s marine routes would provide a more stable freight cost.

Prior to the spike in one-year VLCC rates, the 2020 average had been around $42,000/day. An average voyage from the Middle East to the U.S. Gulf Coast is 30 days, giving an average freight cost of $1.26 million. When the prices spiked to $80,000/day, the voyage cost nearly doubled to $2.4 million. By having an effective hedging program in place, a charterer could have saved over $1 million per voyage.

Opportune LLP has extensive experience working with companies of all sizes in the downstream energy sector to develop and implement effective risk and hedging policies that meet ever-changing business plans. Our professionals offer the unique understanding of the hedging and operational processes that allow us to present alternatives that meet the needs of shipping and trading companies during these volatile times.

James Morgan is a DirectorinOpportune LLP’s Process and Technology practice. James is an experienced consulting executive with over 18 years of experience in project management and solution delivery for the Energy industry. He is experienced in all aspects of a project life cycle from strategy definition and business case development to production support, for both packaged and custom software implementations. Prior to Opportune, James served as the Global Refining Lead for IT at LyondellBasell. James has worked on business process improvement and software implementation projects for natural gas, power, crude, refined products, NGLs, petrochemicals, softsandethanol. James’ scope of experience stretches acrossfront, middle and back-office operations. James has a B.S. in Information Systems and Decision Sciences (MIS) from Louisiana State University.