China and the U.S. and are expected to lead the capacity growth in the global LNG liquefaction and regasification sectors from planned and announced (new-build) projects between 2020 and 2024, says GlobalData, a leading data and analytics company.

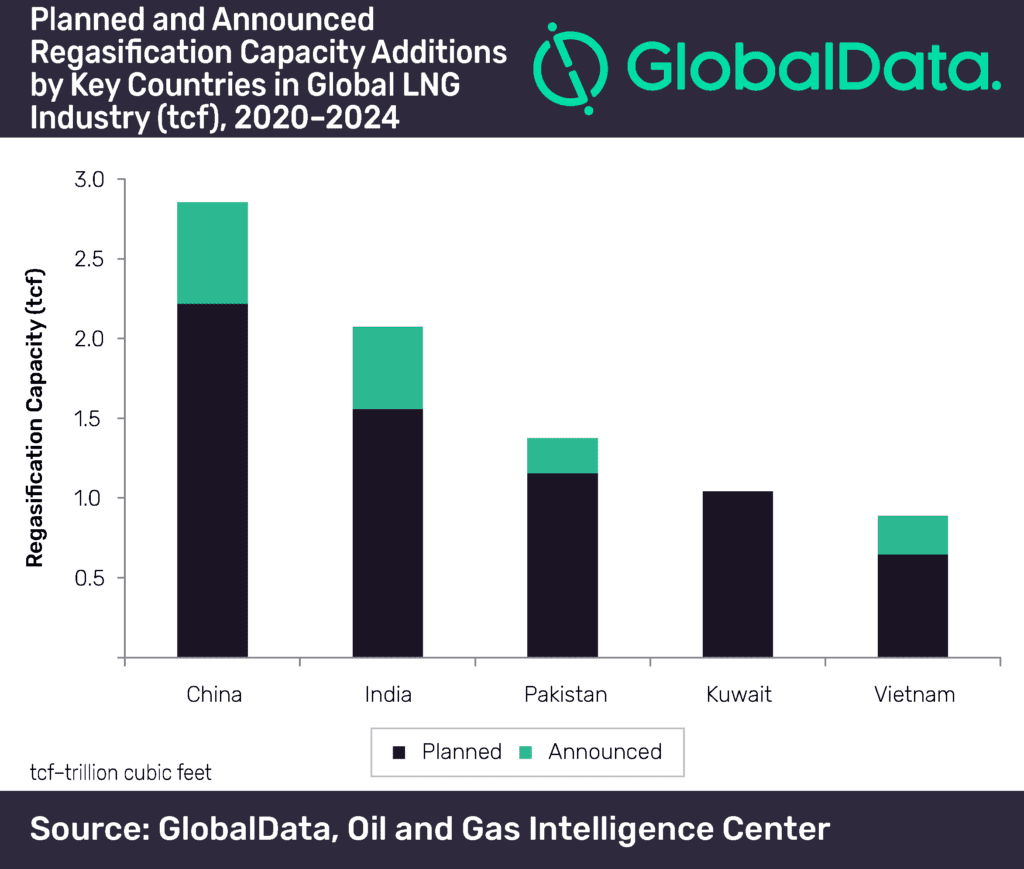

GlobalData’s report,‘Global LNG Industry Outlook to 2024 – Capacity and Capital Expenditure Outlook with Details of All Operating and Planned Terminals’, reveals that China leads globally in terms of regasification capacity growth from planned and announced projects with 2.9 trillion cubic feet (tcf) of capacity expected to come online by 2024.

Adithya Rekha, Oil & Gas Analyst at GlobalData, explains: “Out of the 2.9 tcf of regasification capacity expected to come online in China, planned projects that have received the required approvals for development account for 2.2 tcf while the remaining 0.7 tcf could come from early-stage announced projects that are yet to receive any approvals for development.”

India and Pakistan follow China with regasification capacities of 2.1 tcf and 1.4 tcf, respectively, by 2024.

In terms of liquefaction capacity growth during the outlook period, the U.S. will lead globally with 131 mtpa by 2024.

In terms of liquefaction capacity growth during the outlook period, the U.S. will lead globally with 131 mtpa by 2024.

Rekha continues: “Out of the total capacity of 131 mtpa expected to come online by 2024 in the U.S., 112.7 mtpa is expected to come from planned projects that have received the required approvals for development while the remaining 18.3 mtpa could come from early-stage announced projects that are yet to receive any approvals for development.”

After the U.S., Russia and Mexico rank second and third, with liquefaction capacity additions of 31.2 mtpa and 11.7 mtpa, respectively, from new-build liquefaction projects by 2024.

In terms of the largest upcoming regasification terminals in the outlook period by capacity, the Al-Zour terminal in Kuwait is the top LNG regasification terminal globally with a capacity of 1.2 tcf. The planned terminal is expected to come online by 2021.

As for the liquefaction terminals, Rio Grande leads all the other terminals globally with a capacity of 17.6 mtpa. The terminal is expected to start operations in 2024.