The Orphaned Wells Federal Grant Program, established under the Infrastructure Investment and Jobs Act (IIJA) by the U.S. Department of the Interior (DOI), provides funding and oversight for well-plugging and environmental remediation.

When federal funding initiatives (such as the Orphaned Wells Program) are set in motion, it often leads to more contractor opportunities. Such is the case for many Plugging and Abandonment (P&A) contractors, who may receive their federal or state contracts through the Orphaned Wells Program and need to navigate complex post-award compliance and federal regulations.

Thus, understanding compliance standards is crucial to P&A contractor success. Doing so may not only boost a P&A contractor’s positive influence on the community now and in the future, but it may also lower the possibility of suspension/debarment or clawing funds back, which can have long-term negative consequences.

Understanding the DOI Orphaned Wells Grant Program

The DOI created the Orphaned Wells Program Office (OWPO) to oversee the program’s efforts and administer funding to states and Tribes.

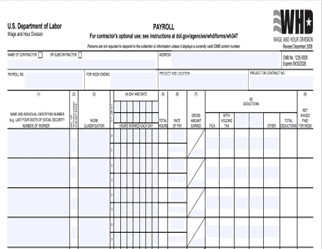

The three types of awards available via the state program include (Table 1):

- Initial Grants of either $5 million or $25 million were provided to eligible states.

- Formula Grants totaling $2 billion have been allocated to states who will be eligible to request funds in six phases, which fall over a six-year period beginning FY 2023. States are allowed to request up to 25% of their allocation each fiscal year.

Table 1: Total and Phase 1 State Formula Grant Eligibility

Source: Data provided by the U.S. DOI

Source: Data provided by the U.S. DOI

- Performance Grants are available totaling $1.5 billion and include two different programs. A matching grant program and a regulatory improvement grant where states can apply for funds based on how they have dealt with orphaned wells in the 10 years before 2020.

For the Tribal Program, $150 million is available for Tribal well plugging, remediation, and restoration. Tribes can use grant funding to establish a well-plugging program themselves in a similar way to how the state programs operate. Tribes also have the option to request “In Lieu of Grant” assistance, wherein the DOI will then oversee plugging wells on Tribal lands.

Permissible Uses of These Grant Funds

Funds from both the state and Tribal programs can be used for the following eligible activities:

- Locating and inventorying orphaned wells

It is expected that the backlog of wells to plug across the country will continue to increase and justify the need for additional funding in the future. Some estimates indicate that IIJA funding is just the beginning, and that existing documented wells will cost between 30% and 80% more than the IIJA-allotted funds[1].

- Plugging and abandoning orphaned wells

Stakeholders should keep in mind that IIJA implemented Build America, Buy America (BABA) requirements for procurement. BABA requires that iron and steel, manufactured products, and construction materials used on federally funded infrastructure projects be produced in the United States[2]. Federal contracting rules also state that contractors on public works projects pay employees at least the applicable Davis-Bacon Act prevailing wage rates.

- Restoring land by remediating surface and groundwater contamination

Stakeholders should consider how this can be accomplished. It may include hiring engineers, geologists, and others to verify that the site has been thoroughly cleaned up and made safe.

How P&A Contractors Can Stay Informed

P&A contractors can familiarize themselves with state allocations and agencies distributing orphaned wells grant funds to potentially access contracting opportunities. The State Orphaned Wells Program on the DOI website[3] is a valuable resource that provides an overview of the grants available for state programs, including Initial Grants, Formula Grants, and Performance Grants.

P&A contractors may also monitor the DOI Orphaned Wells Program News website[4] for funding announcements. In addition, contractors can scan updates, legislation, and additional funding opportunities related to orphaned wells by checking their state environmental or natural resources department websites.

Key Grant Compliance Requirements for P&A Contractors

- Knowledge about the Code of Federal Regulations (CFR)

The Code of Federal Regulations (CFR) is the official compilation of general and permanent rules published in the Federal Register by the departments and agencies of the Federal Government[5]. It serves as a comprehensive reference for understanding federal regulations across various domains, particularly the sections devoted to federal grants and contracts (2 CFR Section 200, also known as Uniform Guidance). The Electronic Code of Federal Regulations (eCFR) is a continuously updated online version of the CFR[6]. Unless regulations unique to the authorizing legislation state otherwise, the CFR applies to federal funding received by a recipient, making it a critical resource for grant management planning.

Even though contractors are not subject to the same regulations as a recipient of federal grants, learning about CFR requirements may help contractors understand various terms and requirements that make for simpler opportunity bids.

- Davis-Bacon Act Requirements

The Davis-Bacon and Related Acts (DBA) applies to grants greater than $2,000 made available under the DOI Orphaned Wells Program for the construction, alteration, or repair (including painting and decorating) of public buildings or public works.[7]

Contractors should be aware of the following DBA requirements:

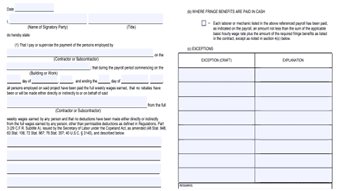

- Locally prevailing wage: The DBA requires contractors to pay laborers and mechanics working on federally funded construction projects the local prevailing wage. The Davis-Bacon “prevailing wage” is the combination of the basic hourly rate, and any fringe benefits listed in a Davis-Bacon wage determination. The contractor’s obligation to pay at least the prevailing wage listed in the applicable wage determination can be met by paying each laborer and mechanic the applicable prevailing wage entirely as cash wages or by a combination of cash wages and employer-provided bona fide fringe benefits. Prevailing wages, including fringe benefits, must be paid for all hours worked on the site of the work.[8]

- Selecting the proper wage determination: While selecting the proper wage determination, contractors need to consider the location, type of construction, and the current wage determination.8 Contractors need to know the minimum wages by location and type of construction while developing cost estimates for an orphaned well plugging contract. The System for Award Management (SAM) website[9] contains all current general wage determinations, as well as previous modifications to the wage determinations (archived wage determinations), and a listing of the wage determinations to be modified in the next publication cycle.

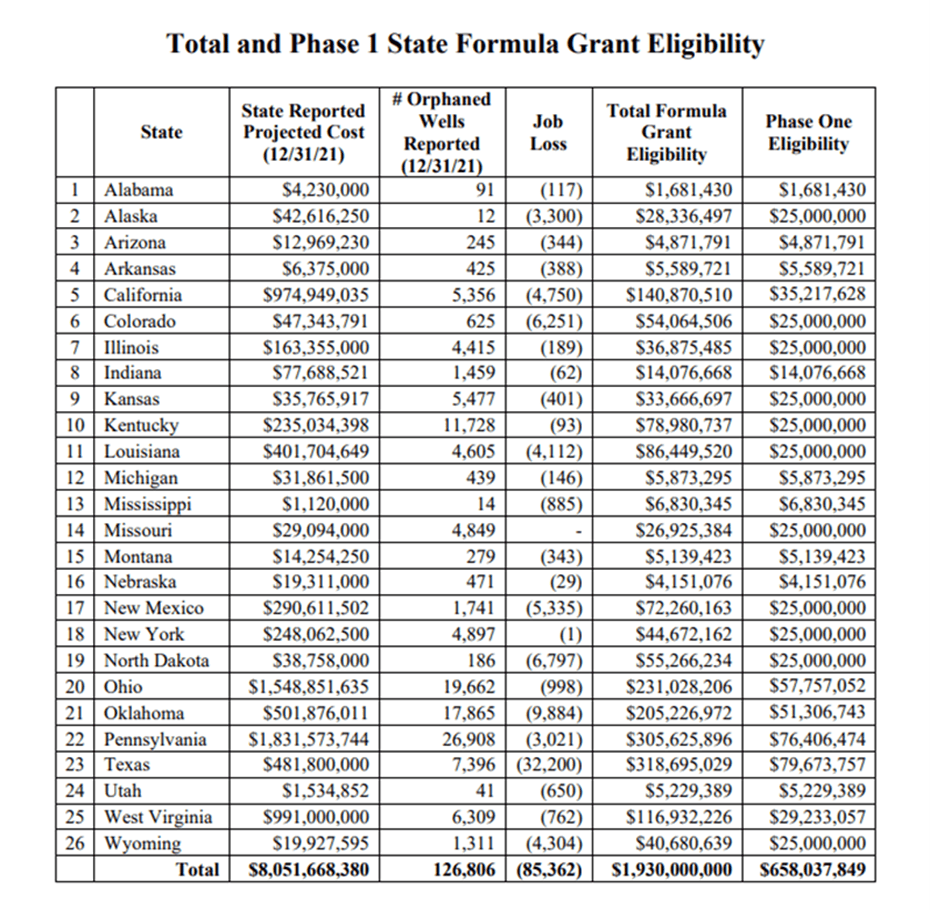

- Weekly certified payroll records: Contractors are required to pay covered workers weekly and submit weekly certified payroll records to the contracting agency. Form WH-347 could be used by contractors to submit certified weekly payrolls for contracts subject to the Davis-Bacon and related Acts. When properly filled out, this form will satisfy the requirements of the Regulations, Parts 3 and 5 (29 C.F.R., Subtitle A), as to payrolls submitted in connection with contracts subject to the Davis-Bacon and related Acts. Instructions on filling out the form can be found on the U.S. Department of Labor’s website.[10]

Image 2: Certified Payroll Template

Source: Template provided by Department of Labor

- Davis-Bacon Poster: Contractors are also required to post the applicable Davis-Bacon wage determination and the Davis-Bacon poster (WH-1321) on the work site in a prominent and accessible place where they can be easily seen by the workers.[12]

When considering database administration (DBA) requirements, it’s essential to consider any state-specific regulations. Following the most stringent guidance ensures compliance and minimizes potential issues for contractors.

- Build America, Buy America Preference (BABA):

Under Section 70914 of the Bipartisan Infrastructure Law (BIL), none of the funds under a federal award (that is part of the federal financial assistance program for infrastructure) may be obligated for a project unless the iron, steel, manufactured products, and construction materials used in the project are produced in the U.S., unless subject to an approved waiver on or after May 14, 2022.

The BABA requirements include:

- All iron and steel used in the project are produced in the U.S.; this means all manufacturing processes, from the initial melting stage through the application of coatings, occurred in the United States.

- All manufactured products used in the project are produced in the U.S.—e., the manufactured product was manufactured in the U.S.; and the cost of the components of the manufactured product that are mined, produced, or manufactured in the U.S. is greater than 55 percent of the total cost of all components of the manufactured product, unless another standard for determining the minimum amount of domestic content of the manufactured product was established under applicable law or regulation; and

- All construction materials are manufactured in the U.S., which means that all manufacturing processes for construction materials occur in the United States.

The BABA Preference only applies to articles, materials, and supplies that are consumed in, incorporated into, or affixed to an infrastructure project. As such, it does not apply to tools, equipment, or supplies such as temporary scaffolding, brought to the construction site and removed at or before the completion of the infrastructure project. Further, BABA does not apply to equipment or furnishings that are used at or within the finished infrastructure project, but are not an integral part of the structure or permanently affixed to the infrastructure project.[13]

When BABA Domestic Sourcing Requirements May Be Waived

By Section 70914 (b), the contractor may work with their contracting agency to apply for a waiver to the BABA domestic content procurement preference requirements, if the agency finds that:

- “applying the domestic content procurement preference would be inconsistent with the public interest (Public Interest Waiver);”

- types of iron, steel, manufactured products, or construction materials are not produced in the U.S. in sufficient and reasonably available quantities or of a satisfactory quality (Non-Availability Waiver); or

- “the inclusion of iron, steel, manufactured products, or construction materials produced in the U.S. will increase the cost of the overall project by more than 25 percent (Unreasonable Cost Waiver)[14].”

DOI has already approved general applicability waivers under this program. The existing general applicability waivers can be found on the DOI website.[15] If the projects or materials do not meet the general applicability waiver criteria, then the contractor can work with the contracting agency to submit a waiver request directly to the financial awarding officer of the orphaned wells grant.

- Methane Measurement Data Collection and Reporting

A major objective of the Orphaned Wells Program is to measure and track emissions of methane and other gases associated with these orphaned wells. These metrics help evaluate the program’s effectiveness and environmental impact.

For consistency across various federal, state, and Tribal orphaned well programs, the DOI provides guidelines and a Data Reporting Template with Definitions[16] to measure and track methane associated with orphaned wells. Contractors should plan to collect this data and report back to the contracting agency.

P&A Contractors & Administrative Assistance

P&A contractors can identify experts to help navigate compliance requirements and reduce the administrative burden on their existing staff. Grants management professionals who have experience with federal grants may provide insights into the application process, compliance requirements, certified weekly payroll submissions, and best practices related to documentation.

In addition, investing in a technology solution to help with certified payroll reports and data collection for methane and other gas emissions may assist with reporting requirements. Seeking guidance from legal experts may ease the burden of compliance and help to provide personalized insight based on the type of grant and project scope a contractor may face.

Conclusion

Navigating grant compliance in the Orphaned Wells Federal Grant Program is essential for contractors. By understanding regulations, planning, and seeking expertise, P&A contractors can contribute to environmental restoration while meeting grant requirements.

Sources:

[1] A New Way Forward for Orphaned Oil and Gas Wells – College of Arts & Sciences at Syracuse University

[2] M-24-02 Buy America (whitehouse.gov)

[3] State Orphaned Wells Program | U.S. Department of the Interior (doi.gov)

[4] Orphaned Wells Program News | U.S. Department of the Interior (doi.gov)

[6] eCFR :: 2 CFR Part 200 — Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards

[7] OWP Phase 1 State Formula Grant Guidance – July 2023 (doi.gov)

[8] Fact Sheet #66: The Davis-Bacon and Related Acts (DBRA) | U.S. Department of Labor (dol.gov)

[10] Instructions For Completing Payroll Form, WH-347 | U.S. Department of Labor (dol.gov)

[12] Fact Sheet #66: The Davis-Bacon and Related Acts (DBRA) | U.S. Department of Labor (dol.gov)

[13] Build America, Buy America Act Domestic Preference Overview (epa.gov)

[14] Made in America: Buy America Waivers for Federal Financial Assistance Awards | U.S. Department of Labor (dol.gov)

[15] Approved DOI General Applicability Waivers | U.S. Department of the Interior

[16] Data Reporting Template with Definitions [xlsx] (doi.gov)