In today’s unpredictable global environment, marked by persistent inflation, volatile interest rates, and shifting trade dynamics, it’s easy to focus on geopolitics as the main driver behind gold’s enduring appeal. But deeper economic fundamentals are the real engine of its long-term strength. Structural deficits, sustained dollar weakness, mounting government budget deficits, and evolving global monetary policy are reshaping reserve strategies. Central banks are responding accordingly – not with knee-jerk reactions, but with a deliberate shift toward the security and value gold provides.

The State of Gold Today

Although gold prices have experienced a recent dip, gold has shown strong resilience over the past year, buoyed by economic pressures rather than short-term market noise. Price fluctuations are expected in any dynamic market, but they don’t diminish gold’s role as a reliable store of value.

Central banks, wary of inflation and weakening currencies, are shifting reserves away from U.S. Treasuries and buying gold at historic levels. In Q1 2025 alone, the U.S. reportedly acquired over 600 tons of gold – a clear indication of growing institutional demand. As CEO of West Point Gold, I emphasize that these monetary policy shifts and economic challenges point to significant upside potential for gold, reinforcing its strategic importance for investors and nations alike.

A Resource Security Lesson from Rare Earths

However, gold’s strategic significance raises a broader, urgent question: Who controls the critical resources that support economic and national security? The rare earth supply struggle offers a cautionary example. China’s near-total control of rare earth processing, accounting for roughly 85 percent of global supply, has exposed serious vulnerabilities in the West’s supply chains, particularly in sectors like electronics and defense.

While gold isn’t a rare earth, it remains strategically vital. Global gold production varies annually, with China producing approximately 380 tons, Russia and Australia about 310 tons each, Canada 200 tons, and the U.S. 170 tons. Just like rare earths, long-term access and control are strategic concerns.

The U.S. Geological Survey’s Mineral Commodity Summaries add to this troubling picture. As of 2019, the U.S. was 100 percent import-reliant for 18 minerals, including 14 deemed critical by U.S. officials. Overall, more than half of the 35 minerals designated as critical have over 50 percent import reliance, even though many exist abundantly within U.S. borders.

This disconnect poses a strategic risk, especially when global supply chains are increasingly fragile. Meanwhile, the economic stakes are high: In 2018 alone, industries that depend on minerals and metals contributed $3.02 trillion to U.S. GDP. Mining is also a powerful job creator, with every mining job creating two additional jobs in the broader economy.

The Case for Domestic Development

Despite abundant mineral wealth, North America has historically underinvested in mining infrastructure, leaving its supply chains vulnerable as global demand rises. Permitting is one of the biggest hurdles, often taking seven to 10 years to complete, making rapid development difficult and reinforcing foreign dependence.

Tackling these challenges requires a multi-faceted approach: streamlining permitting, providing exploration incentives, and encouraging public-private partnerships. These steps are essential to modernize the mining sector and secure domestic control over critical supply.

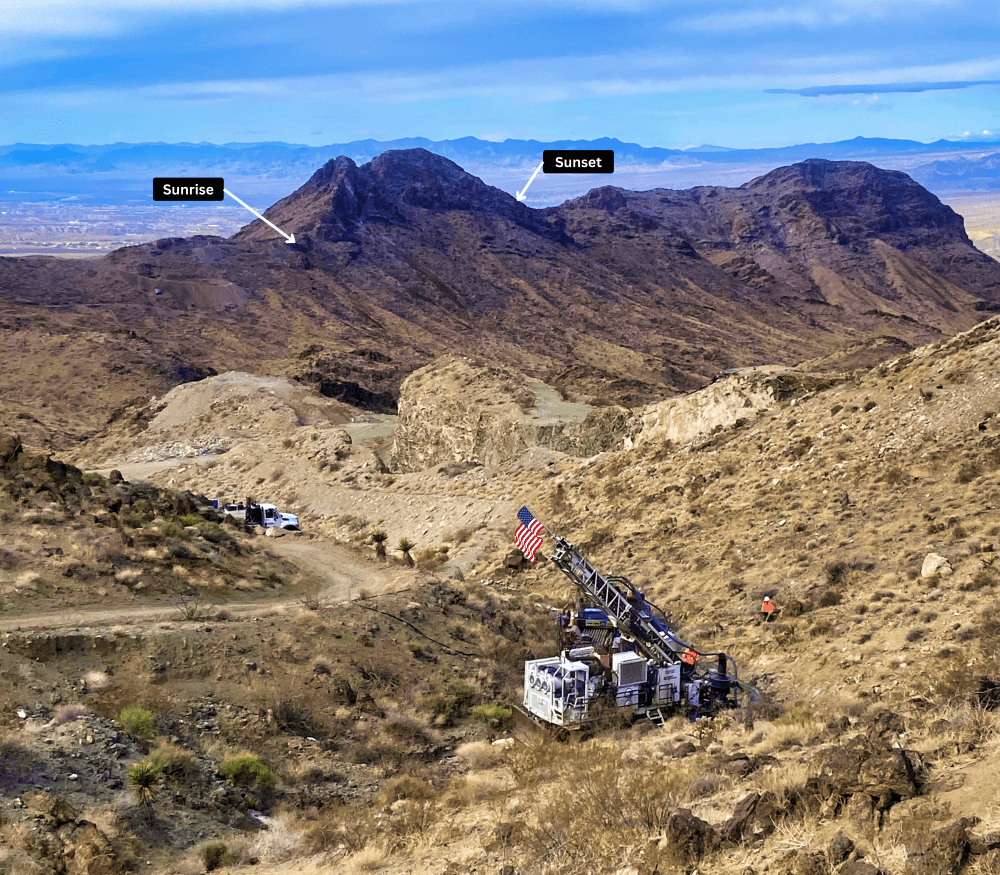

Recent government actions, including an Executive Order invoking “war-time powers” to accelerate domestic mineral production, highlight the urgency of this issue. As inflation erodes currency value, the case for building resilient, domestic supply chains has never been stronger. I emphasize the need for patience and foresight in this effort: You can’t just flip a switch and become resource independent; it takes long-term vision. That’s what we’re building at West Point Gold.

Strategic Imperative of Gold

Ultimately, gold’s importance transcends market cycles and geopolitics. It’s a cornerstone of economic stability and national security, rooted in fundamentals like inflation, monetary shifts, and currency weakness. The lessons from rare earth supply challenges make it clear that domestic control over critical resources like gold is essential to protect supply chains and national sovereignty. Achieving this will require a strategic, patient approach that modernizes regulations, encourages investment, and fosters partnerships to strengthen domestic production. In other words, strengthening domestic gold production is not simply a policy choice; it’s essential for building resilience against future global disruptions, safeguarding financial stability, and preserving critical leverage in an increasingly uncertain world.

Photos courtesy of West Point Gold Corp.