Investment management organizations are stepping up their commitment to the role ESG plays in long-term value creation, but what are the broader implications for the energy industry?

Investment management organizations like Canada Pension Plan Investment Board (“CPP Investments”), which recently announced its updated “Policy on Sustainable Investing”, are actively stepping up their commitment and conviction to the role Environmental, Social and Governance (“ESG”) plays in long-term value creation.

What is CPP Investment’s New Policy?

“As an investor to whom boards are accountable, CPP Investments asks that companies report material ESG risks and opportunities relevant to their industries and business models, with a clear preference for this disclosure to focus on performance and targets,” the organization said in its statement. “When issuers seek input, CPP Investments prefers companies align their ESG reporting with the SASB and TCFD standards.”

Although both organizations are committed to improving the financial disclosures on ESG matters, the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD) each have a slightly different focus. TCFD is focused specifically on climate-related issues (the “E”), while the SASB has promulgated standards that apply to the entire ESG spectrum for every industry, including each individual sector identified therein.

How Should the Policy Be Implemented?

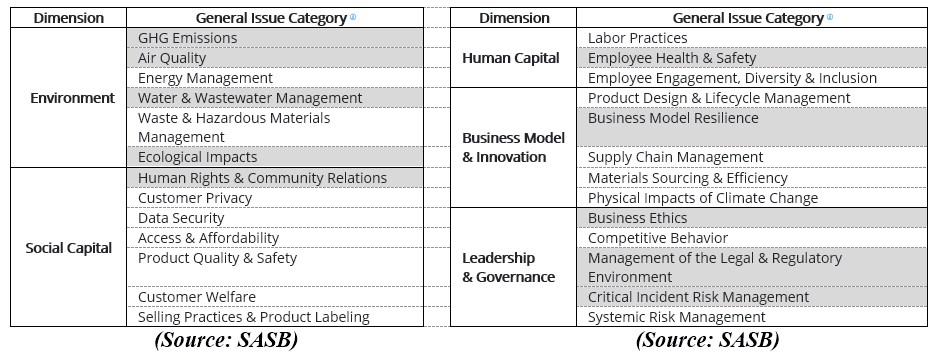

In addition to important environmental considerations, the SASB standards focus on sustainability factors like data security, customer welfare and competitive balance, to name a few. The following table lists the 26 general issues of which the SASB has assessed across five dimensions present within any company. Highlighted issues represent those that the SASB believes will be material for more than 50% of companies within the Oil and Gas E&P sector.

Although many companies, energy included, already discuss (okay, “bury” may be the better word here) many of these factors in their management presentations and SEC filings, the SASB standards are unique in that they suggest specific metrics, by industry sector, for every material general issue noted.

Although many companies, energy included, already discuss (okay, “bury” may be the better word here) many of these factors in their management presentations and SEC filings, the SASB standards are unique in that they suggest specific metrics, by industry sector, for every material general issue noted.

Opportune’s ESG practice will dive into the material issues and related metrics identified by the SASB for each energy sector over the course of our ESG Reporting Series.

Why is CCP Investment’s Policy Important to the Energy Industry?

One could say, the one who holds the gold makes the rules; however, the importance of ESG runs deeper.

The CCP Investments policy and SASB standards are important because they focus on the “whole” company, not just environmental concerns about carbon footprint. This statement isn’t intended to downplay the environmental aspects at all—the point is that carbon footprint can’t be the only metric. Tesla may be the current darling of the renewable sector, but the jury is out on whether the company’s exponential market value is here for the long-term or if it’s being propped up by a bubble of investor bias. In other words, is Tesla’s market value sustainable?

“ESG considerations are inextricably linked to our ability to successfully achieve our investment objectives,” said Richard Manley, Managing Director, Head of Sustainable Investing, CPP Investments. “Our Policy reflects the growing body of evidence showing that companies that integrate consideration of ESG-related business risks and opportunities are more likely to preserve and create long-term value.”

Research and empirical evidence on whether there’s a distinct correlation between managing ESG-related business risks and long-term value will grow quickly over time, but one thing is certain—the long-term value of companies that fail to integrate consideration of material ESG business risks are less likely to be sustainable.

Sustainability is arguably synonymous with governance. With that, a different golden rule is just as applicable—no matter how good the underlying business model may be, any company can be destroyed instantaneously if it doesn’t have strong governance and a great balance sheet.

Investors left the energy industry because of a lack of governance over drilling plans and operating cash flows that resulted in a weak balance sheet and destruction of value. More importantly, investors aren’t coming back until energy companies demonstrate a renewed (or, first-time) grasp of those same factors.

Josh Sherman is the Partner in charge of the Complex Financial Reporting group of Opportune LLP, including oversight of the firm’s Denver and Tulsa offices. Josh has 20 years of experience in providing clients across the energy spectrum with technical research, capital marketsandSEC reporting assistance. Josh and his team of over 30 professionals have led all financial statement and disclosure aspects of the IPO process for over two dozen clients within the E&P, midstream, oilfield service and power sectors. In addition, he assists over 100 clients annually with researching, concluding and reporting for the most complex transactions affecting their businesses. Prior to joining Opportune, Josh worked in the audit and global energy markets department with Deloitte & Touche, where he managed the audits of regulated gas and electric utilities, independent power producers, and energy trading entities.

Josh previously served on the board of directors as Audit Committee Chairman of JP Energy GP II LLC (MLP), Trans Energy, Inc and Voyager Oil & Gas (Emerald Oil). Specifically, as the Lead Independent Director of Trans Energy, Josh initiated and led the company’s successful restructuring and ultimate sale to EQT – a transaction recognized by the M&A Advisor as a winner for the 2017 M&A Deal of the Year ($100MM-$200MM).

Outside of Opportune, Josh has been involved inseveral communityand school activities, including as a past Board Member and Audit Chair of the Literacy Council of Fort Bend County. Josh currently serves as Chairman Emeritus of the American Heart Association’s Paul “Bear” Bryant Award honoring college football’s Coach of the Year. Josh also currently serves on the Dean’s Energy Task Force and Executive Council of the Energy Management Program at The University of Texas at Austin McCombs School of Business.