With limited exit and financing alternatives, oil and gas companies must take steps to address G&A and overhead costs to ensure the financial health of the organization and their stakeholders.

Dealing with market volatility and uncertainty, negative investor sentiment and depressed stock valuations aren’t new to the upstream oil and gas industry. Today is different. The recent oil price rout has surpassed similar downcycles seen in the mid-1980s and 2014-2016 thanks to the one-two punch of coronavirus-related energy demand destruction and the collapse of the OPEC+ supply-management effort that, for more than three years, had propped up crude oil prices. In response, many E&P companies slashed their 2020 capital spending plans and have touted how much of their 2020 production levels are hedged.

The new reality is that most of the industry is in an asset preservation or “blowdown” business model: a focus on cost reduction and maintaining existing profitable production over converting undeveloped locations; reduced rig counts; shutting-in higher cost wells; limited storage capacity; and little to no discretionary spending. Reducing general and administrative (“G&A”) expenses that align with this new reality is now more important than ever.

G&A Costs: In Focus

The days of growth (and debt) at all costs to maximize shareholder returns through an asset sale or public exit (IPO) is now giving way to a focus on free cash flow. Historically, E&P cost structures increased dramatically as companies quickly added people and overhead to match the “scale” of current or expected operations. Companies like EOG and Hilcorp are often lauded for the quality of their assets; however, competing management teams and Boards may have lost sight of the fact that those leaders also operate under a culture of “running lean” – meaning they employ proportionately fewer people, compared to their peers, and align compensation to reward results.

For the year ended December 31, 2019, EOG’s G&A was 3 percent of its annual revenue, compared to the average and median percentage across all exchange-traded upstream companies of 25 percent and 10 percent, respectively.

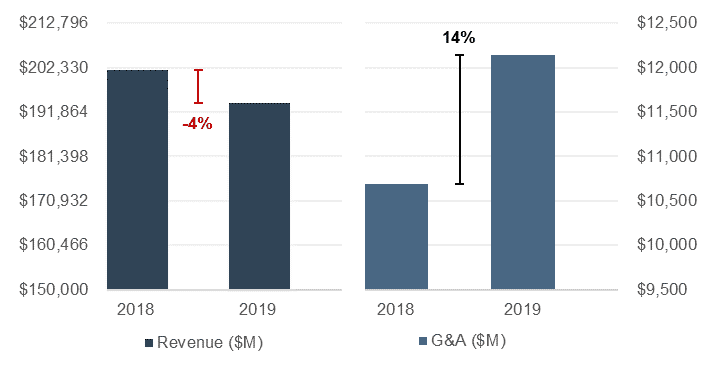

An independent Opportune study identified that G&A expense across all exchange-traded E&P companies increased 14 percent from 2018 to 2019, while their revenue declined 4 percent during the same period. In 2020, the situation is clearly worsening, and many distressed public companies are starting to shed G&A via reductions in headcount and benefits. For example, another recent Opportune study of Form 8-Ks filed through May 2020 identified that about 15 public companies have announced specific cuts in executive compensation ranging from 10 percent to 20 percent.

G&A Costs: In Focus

The days of growth (and debt) at all costs to maximize shareholder returns through an asset sale or public exit (IPO) is now giving way to a focus on free cash flow. Historically, E&P cost structures increased dramatically as companies quickly added people and overhead to match the “scale” of current or expected operations. Companies like EOG and Hilcorp are often lauded for the quality of their assets; however, competing management teams and Boards may have lost sight of the fact that those leaders also operate under a culture of “running lean” – meaning they employ proportionately fewer people, compared to their peers, and align compensation to reward results.

For the year ended December 31, 2019, EOG’s G&A was 3 percent of its annual revenue, compared to the average and median percentage across all exchange-traded upstream companies of 25 percent and 10 percent, respectively.

An independent Opportune study identified that G&A expense across all exchange-traded E&P companies increased 14 percent from 2018 to 2019, while their revenue declined 4 percent during the same period. In 2020, the situation is clearly worsening, and many distressed public companies are starting to shed G&A via reductions in headcount and benefits. For example, another recent Opportune study of Form 8-Ks filed through May 2020 identified that about 15 public companies have announced specific cuts in executive compensation ranging from 10 percent to 20 percent.

In the current environment, E&P companies should be optimizing production, lowering lease operating expenses (LOE) and G&A, and finding sustainable cost savings such as taking out layers of management or closing regional offices. Cuts to back-office accounting, IT, land administration and/or asset development departments are inevitable to better reflect the current environment.

The pertinent questions to current management are two-fold:

- Have they accepted this new reality and are they capable of cutting costs in a meaningful way?

- Are they committed to aligning the company’s goals to that of their current (or new) owners?

Ready, willing and able? Capability versus willingness may be semantics, but we’ve found that a management team’s background (it’s not just the CFO – change takes commitment from the entire C-suite) may determine their ability to succeed in this new environment.

Management teams who grew up in big public companies or transitioned to such entities after careers in banking, public accounting or other sectors outside of “industry” often don’t know any other way than what they’ve historically seen. Even under a blowdown business model, these executives consider large investor relations and human resources departments, maintaining a full back-office to continue managing antiquated accounting systems and keeping geology, drilling, completion and land departments intact a necessity. “We have to be ready for the rebound,” they say.

Conversely, but potentially yielding the same results, are management teams who entered the C-suite by starting private equity portfolio companies during the 2009-2014 boom years. While some of these entities often begin lean, start-up portfolio companies by their nature must be ready for sudden and rapid growth and often elect to preemptively hire a number of people across several functions rather than outsource until they reach a steady state. Fast forward to today, having missed the opportunity to monetize, these companies are now left with a headcount and associated G&A that’s excessive when considering a blowdown business model. “But we don’t need to cut G&A – we’ve always run lean,” they say.

Representative entities may be ready for the rebound, but you (the C-Suite) probably won’t be around to see it, as public companies are filing Chapter 11 and private equity portfolio companies are being smashed together at a record pace. What was considered lean under an asset development model is likely bloated under a blowdown business model aimed at managing existing production to maximize free cash flow and pay down debt.

Committed to Maximizing Free Cash Flow? Whether companies’ performance incentives have historically been aligned to investor needs is debatable, but we’re playing a whole new ballgame today. The field of play and goal posts have changed. Gone are the days of real estate speculation where the primary goal was to acquire acreage (at any price), drill a few wells to prove-up the field and then flip the asset package or company for a pot of gold at the end of the contango rainbow.

Today’s game is about maximizing cash flow to pay down debt and returning cash to investors. The A&D market is almost non-existent, and no value is being given for proved undeveloped reserves (PUDs) or unevaluated acreage. Even Chesapeake Energy, which had skirted bankruptcy for a decade through asset divestitures, finally succumbed to the inevitable on June 28th. Companies emerging from Chapter 11 and those hoping to avoid it must have a viable plan that generates free cash flow. Period.

A recent Kimmeridge[1] whitepaper theorizes that an E&P company trading at 3x EBITDA of $1 billion could generate a 9 percent yield to investors by reducing G&A by ~12 percent and reducing capital expenditure (capex) to ~75 percent of current year EBITDA. The whitepaper further provides examples of two companies in the refining (Valero) and tobacco (Altria) industries that have effectively generated such returns using similar G&A- and capex-reduction initiatives through years of volume, price and social pressures.

Kimmeridge states, “We believe that by making these changes and following the same playbook, the E&P industry could reduce the risk of equity ownership for investors with visibility toward 100 percent of capital returned in a decade with a retained option on the asset base should energy demand continue to grow.”

Right-sizing – A Comprehensive Approach

Right-sizing is a term that was first thrust into the mainstream by manufacturers and businesses of all sizes and industries during the Financial Crisis of 2007-2008. Likewise, this principle applies to the upstream oil and gas industry today. E&Ps should consider implementing a comprehensive approach to right-sizing their organizational structure that better reflects the current market climate and aligns with company goals/objectives.

A comprehensive approach should start with a bottoms-up analysis to identify every department and employee position that’s essential if, based on the current business model and environment, the company were being started today. Positions not deemed essential should be eliminated immediately. For each current employee in an identified essential position, three questions should be considered:

- Would you hire that person again?

- What base salary would you pay them?

- How would you incentivize them?

If the market turns around and expansion is needed in the future, quality employees can always be hired at the right price. Executive compensation packages should be predicated on capital preservation and returning cash to creditors and owners. Plans that tie performance to bonuses and/or incentive awards should also be rationalized and be based on current company goals and objectives. Personnel decisions are probably the hardest activity any leader “gets to” perform and often involves uncomfortable conversations with friends, mentors and mentees; however, good people always find good work and those employees may deserve a fresh start as much as their former employer’s balance sheet.

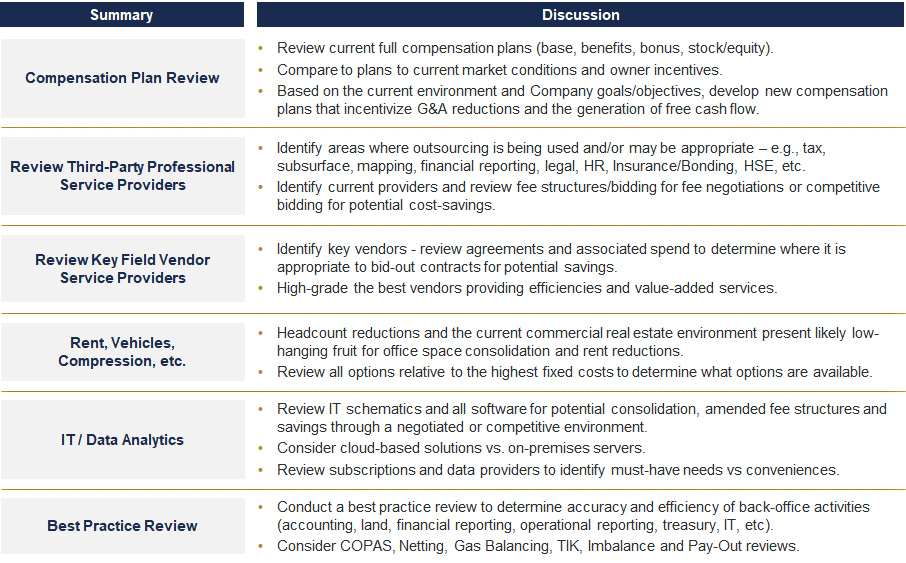

Additionally, a top-down analysis of each G&A category and material contract therein should be performed to identify cost-cutting levers resulting from reduced personnel and business activities. The following table summarizes several key G&A areas and related considerations.

[1] Source: S&P Capital IQ

[2] Revenue and G&A based on total revenue and G&A for major U.S. exchange-traded E&P companies operating in North America as of December 31, 2019, excluding integrated oil and gas companies. and mineral and royalty companies.

Josh Sherman is the Partner in charge of the Complex Financial Reporting group of Opportune LLP, including oversight of the firm’s Denver and Tulsa offices. Josh has 20 years of experience in providing clients across the energy spectrum with technical research, capital marketsandSEC reporting assistance. Josh and his team of over 30 professionals have led all financial statement and disclosure aspects of the IPO process for over two dozen clients within the E&P, midstream, oilfield service and power sectors. In addition, he assists over 100 clients annually with researching, concluding and reporting for the most complex transactions affecting their businesses. Prior to joining Opportune, Josh worked in the audit and global energy markets department with Deloitte & Touche, where he managed the audits of regulated gas and electric utilities, independent power producers, and energy trading entities.

Josh previously served on the board of directors as Audit Committee Chairman of JP Energy GP II LLC (MLP), Trans Energy, Inc and Voyager Oil & Gas (Emerald Oil). Specifically, as the Lead Independent Director of Trans Energy, Josh initiated and led the company’s successful restructuring and ultimate sale to EQT – a transaction recognized by the M&A Advisor as a winner for the 2017 M&A Deal of the Year ($100MM-$200MM).

Outside of Opportune, Josh has been involved inseveral communityand school activities, including as a past Board Member and Audit Chair of the Literacy Council of Fort Bend County. Josh currently serves as Chairman Emeritus of the American Heart Association’s Paul “Bear” Bryant Award honoring college football’s Coach of the Year. Josh also currently serves on the Dean’s Energy Task Force and Executive Council of the Energy Management Program at The University of Texas at Austin McCombs School of Business.

Petar Tomov is a Manager in Opportune LLP’s Valuation practice and is one of the firm’s leading experts on employee and executive compensation matters. Combined with his time as a manager at KPMG, Petar has nearly 10 years of experience focusing on the valuation of stock-based compensation, complex securities and intangible assets for financial and income tax reporting. Petar holds a BS in Mathematics and an MBA from the University of Texas at Dallas.