BREAUX BRIDGE, LA: As an energy consumer, one house you may want to avoid this Halloween is the White House. The current administration’s treats smell and taste like tricks when considering the far-reaching consequences for the country’s economic, energy and national securities.

Scott Angelle, longest-serving Director, U.S. Bureau of Safety and Environmental Enforcement, describes the tricks, “From multiple pleadings with OPEC+ to increase production to bleeding down our own Strategic Petroleum Reserve, these actions appear to help energy consumers with the “pain at the pump.” When viewed more strategically, these actions serve as inherent harms to our efforts to Balance the 3Es™ – Environment, Energy and Economy.”

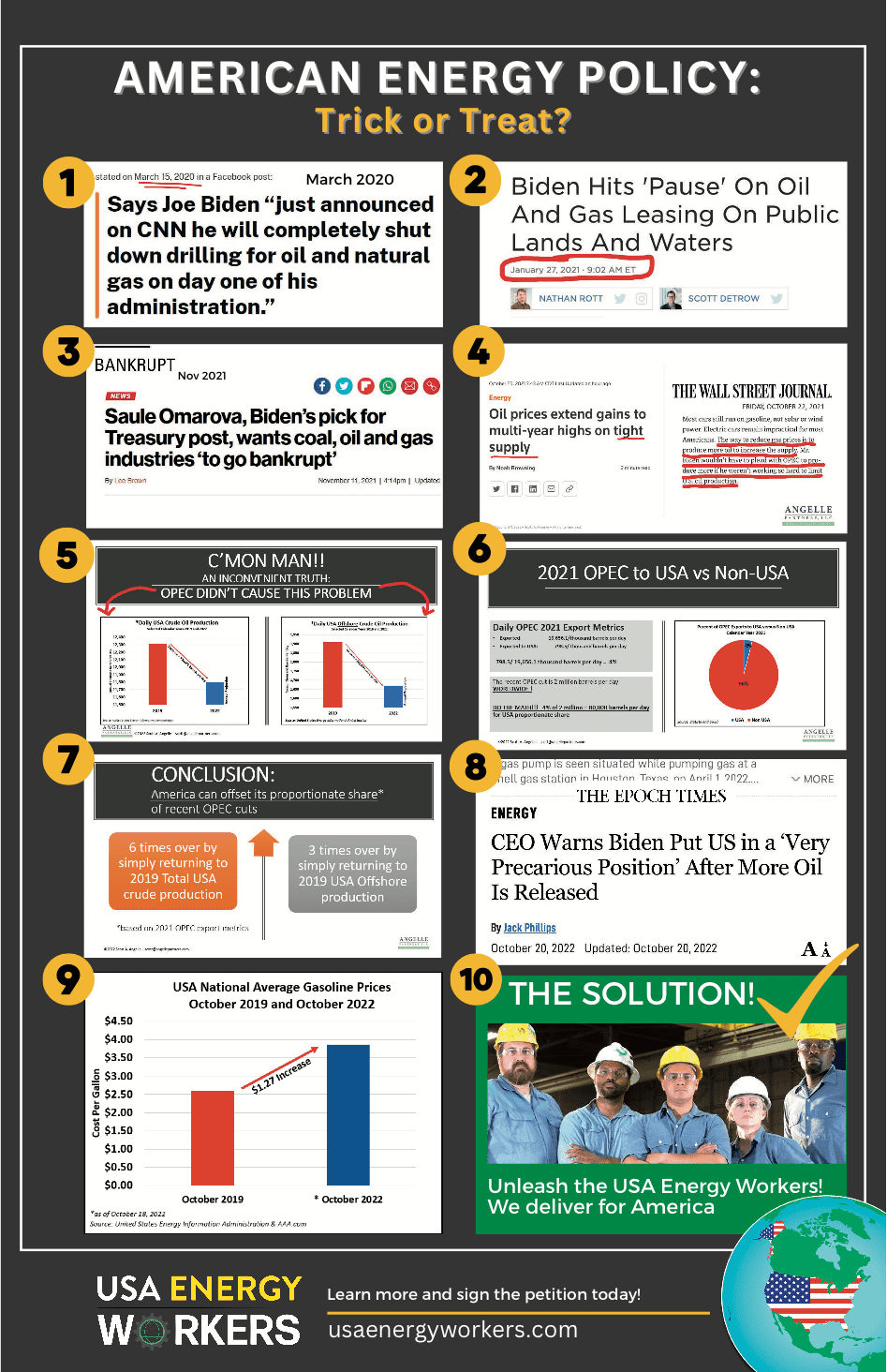

Prior to election day, candidate Biden announced on CNN he would completely shut down drilling for oil and natural gas. Keeping his word upon entering the Oval Office in January 2021, he called for a pause on new oil and natural gas leasing on public lands and offshore waters. Claimed as an action to fight against climate change, it was deemed a certain treat; however, not considered were the environmental advantages that U.S. offshore oil and gas operations provide.

The facts clearly show USA offshore oil and gas is a viable source of energy at lower emissions. Considered one of the most climate advantaged energy-producing provinces in the world, recent research regarding carbon emissions reveals that USA Gulf of Mexico production has approximately half the carbon intensity per barrel of other producing regions worldwide. When it comes to flared or vented methane, the USA offshore industry has consistently been one of the best performing provinces in the world with a ratio of less than 1.25 percent of flared or vented to produced gas.

Furthermore, according to a 2020 Wood Mackenzie report, one can conclude that at least 73.4 percent of the oil imported to the United States had a higher carbon intensity than Gulf of Mexico production. This data bolsters conclusions in a 2016 Bureau of Ocean Energy Management report, produced under the Obama-Biden Administration, that found emissions would increase without new Gulf lease sales because foreign-produced oil would take its place, and “the production and transport of that foreign oil would emit more” greenhouse gases. Contrary to this report, the decision to pause and cancel lease sales was made, nonetheless.

“Pain at the pump” became apparent quickly rising 19 percent in two months following the first treat of pausing Federal leasing. In July 2021, the Administration pulled another perceived treat out of their bag with desperate pleas to OPEC+ to increase production to counter rising energy costs. Not only was the environmental advantage of US offshore energy blatantly ignored, the treat of increased foreign oil production quickly turned into a trick which demoralized an entire industry and only resulted in historic inflation rates caused, in part, by high energy prices.

As energy costs continued to rise with inflation and recession on the horizon, the Administration in August 2021 delivered a treat to energy consumers with a direction to the Federal Trade Commission to “crack down on mergers in the oil and gas industry.” All these efforts directed at the US energy industry only further damaged the economy and had no effect on rising gasoline prices, yet another trick. History is a great teacher. From 1973 to 2019, there were six recessions – all preceded by a hike in energy prices. Most economic experts say we are headed there again.

The latest treat given to energy consumers is yet another oil release from the Strategic Petroleum Reserve. This release treat, a response to the OPEC+ announcement of curtailed production, includes another 10 million barrels of oil depletion from the Reserve. At a closer look, all of these release treats transform into tricks not only based on the non-effect it has on lowering gasoline prices, but also our future readiness for threats to US energy and national security is compromised.

This Halloween, energy consumers need but one treat from the Administration: to unleash USA Energy Workers to 2019 activity levels. When comparing 2019 production to 2022 projected production, total USA production is forecasted to decrease by half million barrels with USA offshore alone forecasted to decrease 240,000 barrels. An increase in USA production to 2019 rates could replace the USA proportionate share (according to 2021 OPEC export metrics) of recent OPEC cuts six times over; USA offshore – three times over.

The men and women of our country who wear steel-toed boots and hard hats have helped each generation of Americans overcome many challenges. Let’s unleash the American spirit to replace these imported barrels, improve the health of our planet, create American jobs, fund infrastructure with the increased government revenue, and lower energy costs. It would be foolish to hold our current course, when the evidence shows we can balance all our nation’s needs. The USA energy workers are ready!

Scott A. Angelle, founder of websites – USAENERGYWORKERS.com and royaltiestorestoration.com, is the longest serving Director of the U.S. Bureau of Safety and Environmental Enforcement. He also held positions in Louisiana as Lieutenant Governor, Secretary of LA Department of Natural Resources, Chairman of Louisiana Public Service Commission and Chairman of Louisiana Water Resources Commission.