Find out why some energy companies are considering potential oil and gas impairments amid low oil and gas pricing, and what key considerations go into conducting these impairments in order to comply with debt covenants and investor reporting requirements.

Public companies are busy preparing their year-end SEC filings and there is no doubt that executives are discussing potential impairments of oil and gas assets due to the current climate in the energy market. Chevron, Shell and Range Resources, among others, have already announced impairments expected in the fourth quarter of 2019. Similarly, privately held companies are facing the same issue in preparing financial statements to comply with debt covenants and investor reporting requirements.

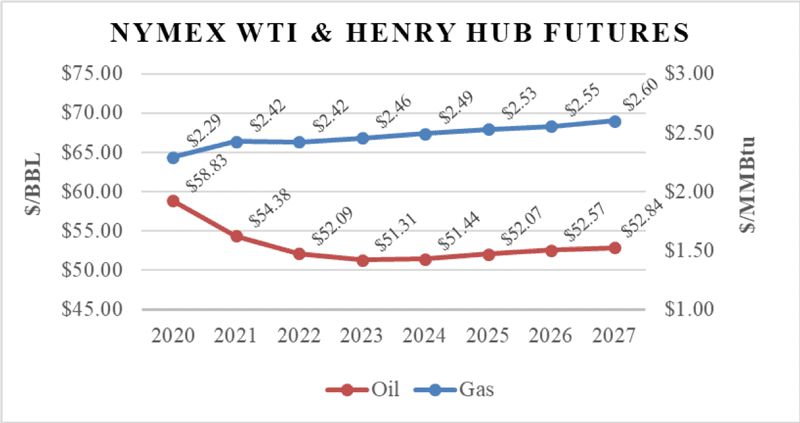

One factor influencing impairments are crude oil and natural gas prices. According to the U.S. Energy Information Administration, WTI (West Texas Intermediate) crude spot prices averaged $56.98/bbl (per barrel) in 2019, down $7.95/bbl, or 12 percent, from 2018’s average spot price of $64.94/bbl. Henry Hub natural gas spot prices averaged $2.57/MMBtu (million British thermal units) in 2019, down $0.59/MMBtu from 2018 levels.

Oil futures indicate more price declines are likely. As shown below, NYMEX WTI crude futures are in an expected decline through 2023 from $58.83/bbl to $52.84/bbl. Meanwhile, NYMEX Henry Hub natural gas futures indicate prices in the range of $2.29/MMBtu to $2.60/MMBtu.

Due to these price declines, some oil and gas reserves are no longer economically viable. Capital to support a drilling program is difficult to come by as investor sentiment for oil and gas continues to wane in both the public and private sectors. Further, many companies are operating with reduced borrowing capacity under their reserve-based bank loans following the fall redeterminations.

As a result, companies have shifted their focus to capital discipline and improved returns, changed their development plans to align with investor demands and eliminated drilling locations and their associated future cash flows from their reserve reports.

Key Considerations in Understanding Oil and Gas Impairments

The media has recently reported that oil and gas impairments are expected. For examples, see these articles from the WSJ, Reuters and Yahoo! Finance. A theme that often gets overlooked driving impairments, however, is the accounting methodology, because, let’s face it, who wants to read about accounting?! Even so, financial statement users should understand the basics of the impairment calculation because the methodology used impacts the results and timing of the impairment.

The WSJ article states: “Significant volatility in the oil price could open a path for producers to argue that big impairments aren’t required this year, but this would be a mistake.” In reality, there are specific requirements regarding when and how to calculate an impairment, so avoiding or postponing impairments is difficult. Attempting to do so would likely result in questions from the SEC for public companies.

It’s important to understand how underlying causes of the impairment will impact a company’s future performance. Impairments are non-cash expenses, but that doesn’t mean they should be dismissed. In fact, the cash was already spent previously when investments in oil and gas properties were made and the related expense is recognized over time as depreciation, depletion and amortization (DD&A). An impairment causes that DD&A expense to be recognized immediately.

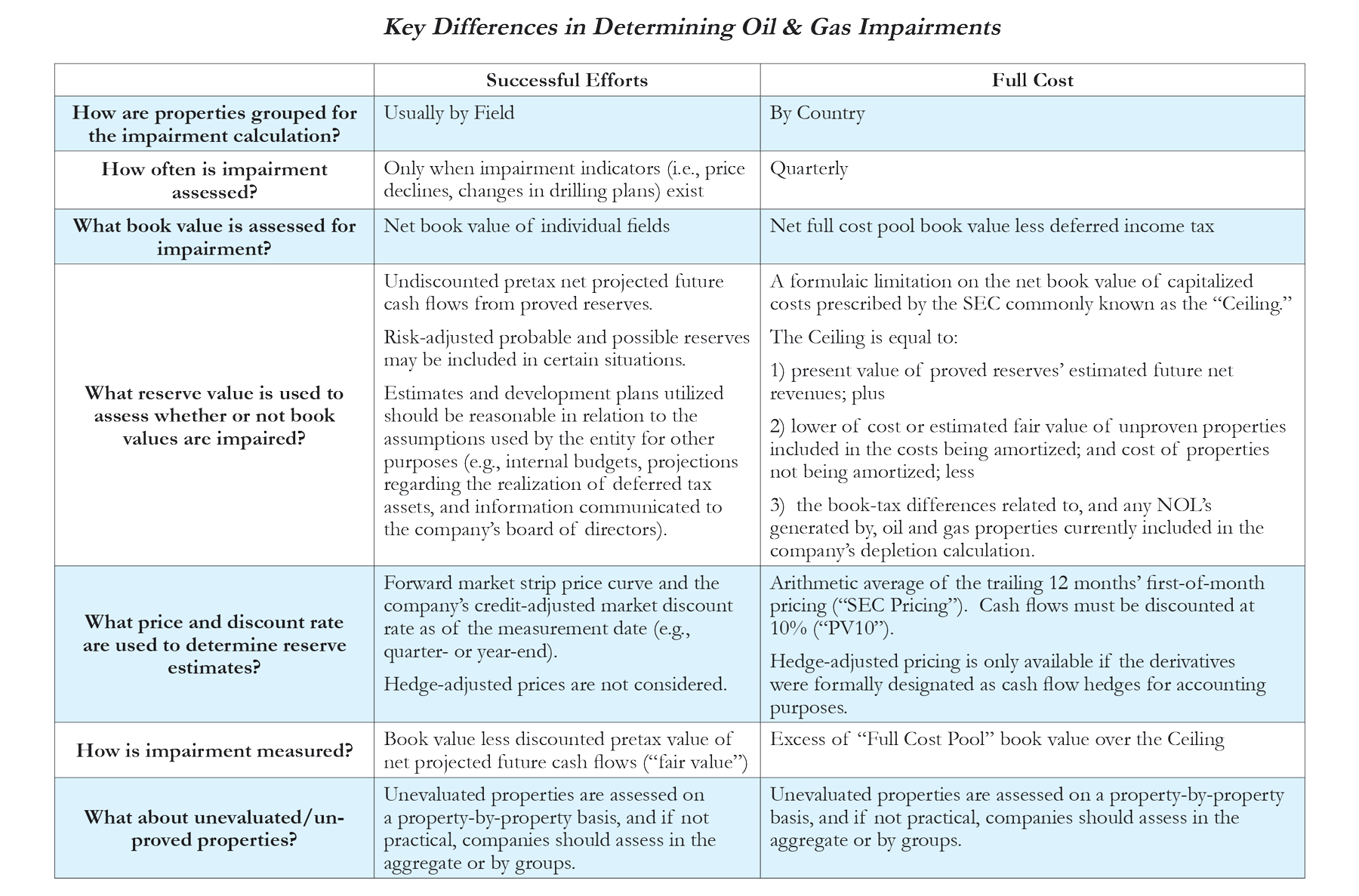

Oil and gas companies use either SE (Successful Efforts) or FC (Full Cost) methodologies to account for oil and gas properties. The chart below summarizes key differences in impairment under the two methodologies. Even variables such as the price, discount rate and the type of reserves that may be included in assessing impairment are different under each methodology.

Income Tax Considerations

Income Tax Considerations

In most cases, income tax law doesn’t follow U.S. GAAP in allowing a current year tax deduction for property impairments due to the presence of more stringent tax rules for recording losses. This results in higher taxable income than pre-tax book income for the period. The corresponding change in the deferred tax liability (or increase in deferred tax asset) from this difference in tax and book income should be recorded using the marginal tax rate and not the estimated annual effective tax rate.

While this in and of itself doesn’t have a direct impact on an entity’s effective tax rate (because the difference is deemed temporary), preparers of financial statements must consider the need to adjust or record a valuation allowance at that time if the impairment causes the (impaired) book carrying value of the properties to exceed their (unimpaired) adjusted tax bases. The SEC staff tend to interpret U.S. GAAP rules rather conservatively in this area, from our experience. The presence of a valuation allowance would reduce the expected tax benefit to record at the time of the impairment.

The main distinction to keep in mind is that FC and SE entities have a different mechanism for recording the gross impairment to properties. SE entities reflect changes in deferred taxes as a part of a U.S. GAAP income tax provision, which is based on changes in carrying value without regard to the effect on income taxes (which is computed separately). FC entities look to SEC guidance to determine if a gross up to the property impairment is required. This latter point is often overlooked by entities and we are aware of cases where the SEC has required restatements of periods with such impairments for this misreporting of pre-tax and tax expense line items.

For a deep dive into the tax effects of oil and gas impairments, please read “Revisiting the Tax Effects of Oil and Gas Property Impairments.”

Amy Stutzman is a Managing Director in Opportune’s Complex Financial Reporting Group with eighteen years of experience in technical accounting and SEC reporting. Amy leads teams that support executive management in understanding the structure and implications of complex transactions such as IPOs and acquisitions. She has strong technical skills and analytical ability and is the firm leader on all U.S. GAAP advisory matters. Prior to joining Opportune, Amy managed the financial reporting group for Apache Corporation in Buenos Aires, Argentina, and was an audit manager in PricewaterhouseCoopers’ energy practice.

W. Lynn Loden, CPA, is a Managing Director at Opportune LLP. Prior to joining Opportune over 10 years ago, he reached the partner level in the Houston, Texas offices of Arthur Andersen LLP and Deloitte Tax, focusing on M&A, structured finance, and energy. He holds active CPA licenses in the States of Texas and Mississippi and currently holds FINRA Series 79 and 63 licenses.