Succeeding with new, post-commodity business models, revenue streams and energy ventures become much more manageable with these four digital elements in place.

Even before this spring’s pandemic-fueled economic contraction and oil price freefall, the energy industry’s transition to a more diverse, lower-carbon mix of products and services was going to be a jolting, sometimes painful process.

Now, as entire industries and individual companies struggle to regain solid footing amid a looming economic downturn, an ongoing health crisis, and an unprecedented level of business uncertainty, that transition has become a survival-of-the-fittest test for companies up and down the energy supply chain. Even some of the sector’s strongest, most progressive and diversified companies are feeling the pain, among them BP, whose net debt increased by $6 billion during the first quarter of 2020 alone.

In June, new BP CEO Bernard Looney announced the company plans to shed some 10,000 employees, most by year’s end. The workforce reductions, he said, are fueled by “the need to reinvent BP in order to stay competitive and realize our ambition. It was always part of the plan to make BP a leaner, faster-moving, and lower carbon company.”

In assuming the CEO role in February, Looney said the company intends by 2050 to become net-zero in terms of greenhouse gas emissions from its operations and carbon in the oil and gas it produces.

Setting aside carbon-reduction goals for a moment, this spring’s oil and gas price collapse alone highlights the merits of diversifying a company’s mix of energy products and services — and the pitfalls of tying a company’s fortunes to volatile commodity markets. Companies that can evolve from commodity suppliers into diversified providers of energy not only make themselves less vulnerable to cratering oil and gas prices, they put themselves in a stronger position to capitalize on opportunities in other energy markets, and in the lower-carbon economy.

This evolution needn’t require companies to dismantle the oil and gas foundation of their business. Rather, it’s a matter of shoring up and building out that foundation by exploring new business models, creating new revenue streams, connecting new supply networks (and adapting existing ones), strengthening relationships with customers, and becoming more intelligent about managing assets with data.

With the right combination of digital tools, all this is eminently possible. Here’s a look at four critical digital capabilities that, when underpinned by a genuine strategic commitment to diversifying, can enable an oil and gas company to efficiently engineer its own evolution — and in doing so, to better position and protect itself for the future, whatever it holds.

1. A digital core. Few energy companies have diversified as aggressively as Portugal’s GALP, whose portfolio of products and services includes outdoor gas grills and other home products, vehicular natural gas filling stations and electric vehicle charging stations, and a substantial renewable energy production portfolio, alongside its more traditional oil and gas exploration, production, and refining operations. Company officials have stated that their goal is remake GALP as the “Amazon of Energy,” and to get there, the company is using an end-to-end digital platform to redesign its business processes essentially from the ground up, to bring a new level of standardization, harmonization, and optimization to all its businesses.

An oil and gas company needn’t have Amazon-like aspirations or GALP-like financial resources to install and benefit from a digital core. Indeed, an intelligent digital core can enable much smaller companies to develop and scale-up new revenue streams and business models that seamlessly integrate with the larger enterprise. That could be a residential solar partnership, for example, or a fueling solution for vehicle fleet operators.

A digital core can benefit existing operations as well as it can enable new ones, allowing a company to intelligently manage (actively or passively) its assets using real-time data from Internet of Things (IoT)-connected sensors in tandem with advanced predictive tools to monitor, assess, forecast, and preserve asset health. A cloud-based, data-powered digital core to which the entire enterprise is connected paves the way for stronger predictive maintenance, remotely monitored and operated field assets, and other efficiencies that an oil and gas company can leverage for its diversification strategy.

2. Workforce management and field logistics tools. To thrive in a business prone to volatile supply-and-demand swings, oil and gas companies need to be agile and responsive, not only with their assets but also with their workforces. Having the ability to quickly scale a workforce, as dictated by strategic priorities and market conditions, has long been a must for oil and gas companies. Digital tools that seamlessly connect operations and contingent worker supplier companies to deploy field crews most efficiently (and in the era of coronavirus, safely), including core as well as contract employees, are more valuable than ever.

Companies can use these same digital workforce management tools to support their diversification efforts. A digital, end-to-end ERP system enables companies to hire, onboard and train new employees, and/or shift and train existing employees, to support a new initiative, enterprise or partnership in which the company is involved.

3. Experience management (XM) capabilities. As energy companies diversify with more outcome-oriented offerings (packaging a commodity, natural gas, with turnkey installation of an end-use appliance like a gas grill, for example) and their focus on the customer intensifies, experience management, or XM, enables them to shape the experience around those offerings. In this experience-focused approach, embodied in the equation X+O=XM, a company uses XM software to gather “X” data from current and target customers, synthesizes it with operational (O) data, then analyzes the findings to shape the new products and services it offers as well as how those new products and services are marketed, delivered, and supported. The goal is to consistently create superior outcomes around the new product or service the company is offering.

For oil and gas companies, XM tools also can prove valuable on the employee side, helping a company measure — through surveys and other means — worker engagement, workplace safety, quality of training and other key factors, and to take appropriate steps in those areas based on analytic insight.

By touching key points along the entire customer and employee journeys, XM’s potential value to oil and gas companies goes far beyond what traditional customer experience (CX) initiatives can deliver. For companies to successfully diversify with new business models and revenue streams, XM can be a catalyst to building and sustaining engagement with customers, employees, suppliers, and business partners.

4. A digitally connected supply/partner network. Standing up a new business or a new line of products and services could well require an oil and gas company to create entirely new supply networks to support that new venture, particularly if it lies outside the company’s traditional commodity business. With a flexible digital platform in place, the company has the framework within which to create those supply networks, as well as entire ecosystems, around a new enterprise. When members of that network are connected in real time, they can share critical data on inventory, logistics, etc., and collaboratively address issues to avoid disruptions.

As resource-intensive and risky as entering an unfamiliar segment of the energy business can be, the best route to diversification for some oil and gas companies could be via partnerships, alliances, and joint ventures. In that context, the connected supply network becomes a full-blown ecosystem in which business partners, suppliers, and even customers are engaged with one another, sharing operational and experiential data, information and insight, and collaborating in real time. Data becomes a resource that a company and its partners can use to model various scenarios around a new venture or solution, from marketing to pricing to customer service and support, so the venture or solution ultimately stands a better chance of succeeding in the marketplace.

Once viewed as merely a distraction or dalliance, diversification — whether it contains a carbon-reduction element or not — is increasingly becoming a strategic imperative, if not a matter of survival, for oil and gas companies. GALP, BP, and many others are embracing it as an opportunity. Other companies have arrived at a tipping point and are seemingly poised to follow suit. Some traditionalists still have yet to reach that point. But when they do, they’ll find a range of digital tools ready to help them reinvent themselves.

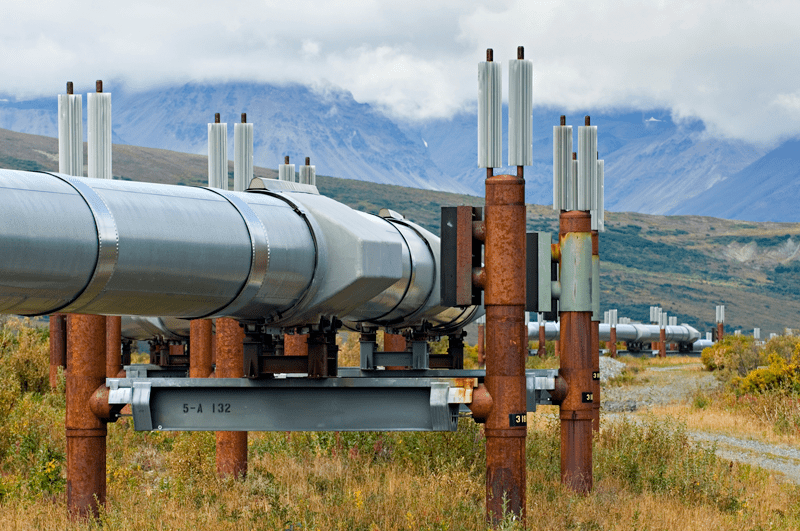

Headline photo courtesy of SAP

Benjamin Beberness is global vice president for the oil & gas industry at SAP, where he’s responsible for leading the company’s solution strategy and global marketing within the oil and gas industry.