Following the financial crisis of 2008, Satoshi Nakamoto came up with a revolutionary concept of decentralized money or cryptocurrency, bitcoin with the underlying technology of Blockchain. Since then, Blockchain is continuously improving and is striving to find a better application experience.

Blockchain, the foundation of cryptocurrency Bitcoin, is a distributed network where records are secured by encryption algorithms and the consensus protocols while enabling full end to end visibility in the systems. When this technology emerged over a decade ago, the leaders across the industry were uncertain about if it’s practical to use. Now in 2019, executives across the board agree that “Blockchain is in the disruptive stage of growth potential and will create new markets or upend existing markets for poised growth.”

With an overall market size of around US$2.3 billion by 2021, Blockchain is gaining traction and finding more use cases in the oil and gas industry. Several blockchain pilot projects are analyzing configurations and assessing value across the energy enterprise, from gas field to end customer.

Considering the complexity and risks of oil and gas operations, along with the scale of investment, capitalizing on cost takeout and associated transformation opportunities are the key to profitability. Besides connecting through M&A, restructuring, restructuring initiatives, mergers, and acquisitions regulatory actions, the oil companies collaborate across broader business networks to achieve global standards of success.

The oil and gas supply chain network is extensive, as it includes participants from different global locations and under different jurisdictions. As multiple parties participate in a complex supply chain, various linkages in the supply chain become a source of risks.

Due to multiple suppliers in the oil and gas industry, each supplier maintains its ledger in compliance with their policies and procedures leading to duplication of the contracts, which slows down the recording and reconciliation of the transactions. As a result, capital flow and revenue recognition slow down throughout the supply chain. The duplication of effort and third-party validation amplify the administration cost of doing business. The intermediaries deployed to resolve disputed transactions also drive the transaction cost high, delaying the reconciliation process with other participants in the network.

In such an entwined supply chain network, the risk of a security compromise is inevitable and can lead to a butterfly effect sending shockwaves throughout the supply chain. Incidents can stem from simple mistakes and may trigger cyberattacks or fraud. As a result, trust declines and deals are often delayed or lost.

In the emerging “trust economy” in which companies’ assets and reputation are vulnerable, Blockchain based solutions ensure efficient, immutable, transparent, and secured transactions. Blockchain is becoming the revolutionary technology assuring a high level of efficiency, privacy, and security.

Blockchains fall under two categories: Permissionless and permissioned chains. Permissionless blockchains allow any party without screening to participate in the network, while permissioned blockchains require consortiums or an administrator to evaluate the participation of an entity on the blockchain framework. Regardless of the type of Blockchain, business logic is encoded using smart contracts. Smart contracts are an encoded agreement on the blockchain framework and are self-executed, which means that no human intervention is required to execute transactions. Smart contracts enable accurate, cost-effective and fast transactions, with enhanced transparency and security.

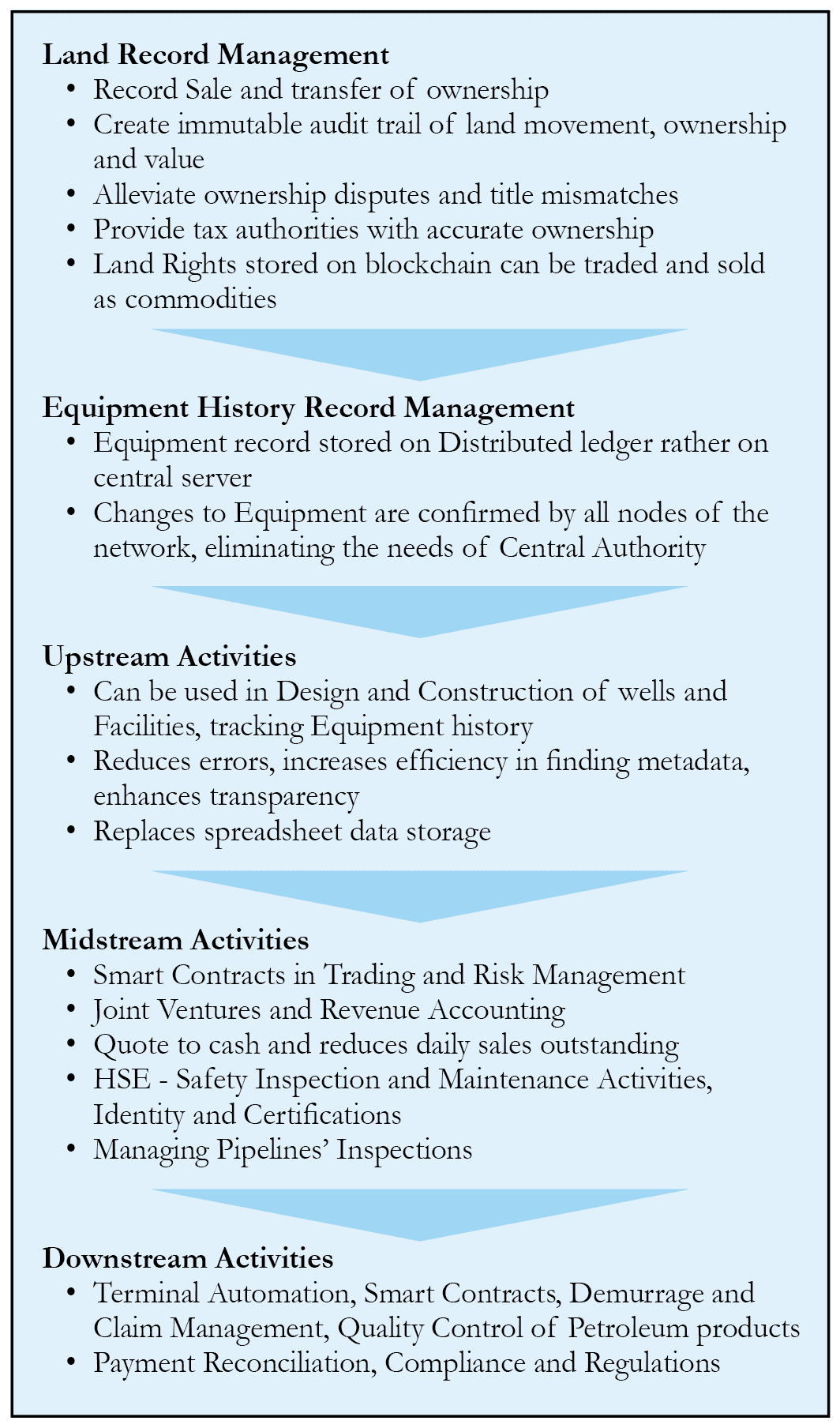

The following use cases illustrate Blockchain’s potential to disrupt the oil and gas industry and meet the industry’s regulatory, operational and market needs (see chart).

Several blockchain projects have started and are building momentum in the oil and gas sector. Natixis and Trafigura have developed the first blockchain solution in commodity trade finance to digitize U.S. crude oil transactions. The distributed ledger platform, backed by Hyperledger Fabric hosted by Linux Foundation, let digitization of major steps in a crude oil transaction on the Blockchain, enabling improved transparency, enhanced security, and optimized efficiency.

Blockchain with IBM and SAP can streamline joint billing operations, Authority for Expenditure (AFE) approval tracking, and other oil and gas processes. AFE operators can now extend existing joint venture accounting and AFE tracking communications with Blockchain to create a single shared truth distributed ledger that secure immutability and provides permission-based visibility to operators and non-operators ensuring compliance, avoiding delays as well as the tedious and time-consuming prior period adjustments.

Backed by Quorum, Vaqt a trading platform is being used by Shell, BP, Norwegian Equinor, Mercuria Energy Group, Koch Supply and Trading, and Gunvor. The largest shareholders of VAKT Global are such banks as ABN Amro, ING, and Societe Generale. Other companies are expected to join in 2019. VAKT has the potential to provide a cost reduction of 40 percent by getting rid of paper documents and replacing them with smart contracts. In May 2019, over 20 European energy trading firms announced peer-to-peer Blockchain based trading framework.

While Blockchain has the potential to bring the biggest impact on the oil and gas industry, the technology is in its nascent phase, leaving enormous opportunities for investment and growth. As the oil and gas transactions involve multiple intermediaries, the early adoption of Blockchain provides an incentive for the company’s profitability and performance. The early adopters are capitalizing on this innovative technology and saving time, but the blockchain adoption by oil and gas companies is not ahead of the curve. The biggest barrier impeding blockchain adoption is the trust issues. According to Pricewater Survey, the barriers to blockchain adoption are regulatory uncertainty, lack of trust among users, ability to bring networks together, separate blockchains not working together, inability to scale, intellectual property concerns and audit/compliance concerns.

The current operating system has many drawbacks that may pose risks such as data and identity theft, high costs of transactions in public Blockchain, lack of recipients and users, technical problems due to initial applications and lack of standardized mode of operation. Implementing and standardizing Blockchain requires significant investment, including legacy system integration as well as reskilling and retraining of the workforce. Cyberattacks may ensue from insufficient security design flaws and deficiency management systems. Due to data inputs at various nodes, there is a risk of tampering at each node. Jurisdictional problems may arise as decentralized ledger span multiple locations, and blockchain companies are unclear about the jurisdictions, and regulatory regimes to which their products and services are being subjected. Regulatory and legal environments for Blockchain are still under development. The users must understand the evolution of regulatory guidelines and its ramifications.

Blockchain technology brings many opportunities, application to business processes, but is not free of challenges and risks. It is imperative that the users mitigate the risks and deploy safeguard measures to harness maximum benefits of this technology.

Amandeep Kaur works as a Financial Accounting professional at ScanOleum an oil and gas startup company focused on Oil and Gas trading, Drilling Services and Marketing Oil and Gas equipment. She dedicates a significant time in monitoring Oil and Gas markets, identifying opportunities as well as managing risks and compliance. She has a keen interest in writing about Oil Markets, M&A activities in the Oil Industry, and Advanced Technologies to help oil and gas businesses. She has an MBA in Finance and Marketing from the University of Delaware.