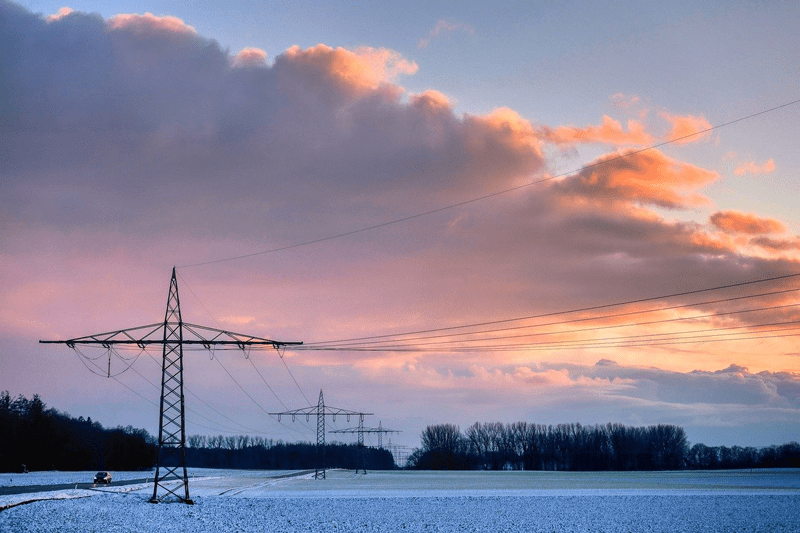

How we derive energy and from what sources we find power have evolved into a variety of options. While fossil fuels command the energy sector as the premier power source, alternative forms of energy continue to evolve and grow each year as solution providers. Many call it the energy transition, while others continue to dismiss any progress made. Others try to find a happy medium and recognize each energy source as an additional solution to a problem: How to provide enough energy to satisfy the growing appetite for power generation.

DNV, an assurance and risk management firm, has been following the energy transition and recently released its Energy Transition Outlook 2024 report, which provides insight into the state of alternate energy sources. While demand, electricity, fossil fuels, finance, policy and emissions are analyzed within the report, renewables are a prime focus, with inferences made. At the same time, the company looks at the global and regional forecast for 2050.

“Last year, in the forward to our 2023 Energy Transition Outlook, I wrote that the global energy transition had not truly started,” writes Remi Eriksen, DNV group president and CEO, in the current report. “Clean energy had not started replacing fossil energy in absolute terms. Now, one year later, we have reached that point.”

He adds, “2024 is the year that the global energy transition has begun; it is also the year that emissions are likely to peak.”

If this is the case and emissions promise to peak, the global energy transition should be prompted not only to stay the course, but additionally to benefit from inspiration and momentum. This year’s DNV report takes a peak into forecast expansions made in the renewable sector, focusing on biomass, hydro, solar and wind power.

Bioenergy

According to the DNV report, bioenergy is society’s most significant renewable primary energy source. It encompasses organic waste, agriculture and livestock residues, forest woods, and energy crops. While growth is expected to see limited gains overall, DNV projects bioenergy will represent a 12% share of primary energy in 2050. These numbers surpass coal. Solar, however, is expected to outplay bioenergy sometime between 2040 and 2045 because of its naturally limited energy potential.

Still, leaps and gains are expected in biomass technology between now and 2050. While its use will decline for traditional uses such as cooking, DNV suspects bioenergy demand in transport and manufacturing will nearly double in growth. Decarbonization policies and limited availability are expected to be primary influences.

By 2050, the demand for bioenergy used in road transport is predicted to fall by 58%, largely due to electrification efforts and advancements. However, other transport sectors will benefit from this reduction. In fact, aviation is on track to claim 48% of the bioenergy share by the turn of the century.

Hydropower

“Hydropower generation is poised for growth,” states the DNV report. “In fact, we forecast that it will expand by close to 50% by 2050. While important, this growth is dwarfed by the massive expansion of solar PV and wind over the same period. So much so, that the share of hydropower in global grid electricity generation reduces from 14% now to below 11% in 2050.”

The DNV report indicates hydropower has benefited from substantial growth, with its share doubling over the last 20 years. Topographical restraints, however, hinder its overall potential. As a result, growth will gradually decline.

The modest increase projected by 2050 will claim only 600 TW and will vary depending on the region of focus. Hydropower also could solidify its importance in dispatchable power needs. Being a zero-emissions power source, which is easily turned on and off, hydropower could serve as a viable solution for managing daily and seasonal power variations while propping up grid flexibility.

Solar

When discussing alternative energy sources, solar typically prevails as the solution with the most capability. As a result, its use has grown in popularity each year, and it survived the crushing pandemic of 2020.

“Solar PV has experienced remarkable growth over the past two decades,” states the DNV report. “While annual solar installations comprised a modest 1 GW in 2004, by 2019, this figure had surged to 100 GW. Even amidst disruptions in 2021 caused by the COVID-19 pandemic and geopolitical tensions in North Eurasia, solar PV added 150GW. In 2023, installations reached nearly 400 GW.”

DNV projects that 20% of new PV installations will include dedicated storage, which will increase to 57% by 2050. By the middle of the century, solar PV should reach 11TW, with an added 5.4 TW of solar co-located with storage facilities. This would bring the total PV capacity to 16.4 TW by 2050 and boast a critical increase from 2023.

With solar becoming a more prevalent solution in the future of energy supply, the industry’s economic framework should change accordingly. An increase in market penetration will allow solar to meet or surpass the power demand and drive electricity prices to almost zero or even into negative price values. This potential marks the significance of storage systems, specifically those that are co-located solar and storage systems.

Wind

For purposes of reporting, DNV focuses on three types of wind power, which accounted for 7% of power generation in 2023. Onshore, fixed-offshore, and wind turbines all contributed. As with solar, DNV expects the demand from these wind power sources to be driven by new demand growth to meet electricity needs.

According to the DNV report, 2050 will mark all regions of the globe being touched by wind electricity generation in the power grid. North America is expected to carry a 46% share of wind power in its electricity supply, while Europe takes a 38% account of its own. However, Northeast Eurasia is projected to continue relying on its domestic fossil-fuel sources and depend on only about 10% of wind-supplied power.

Predictions Made True

The argument over fossil fuel sustainability and alternative energy’s potential as a complete replacement energy production source will continue to partner with any progress made. Various situations and developments promise to surface, with 2050 goals being 25 years away. The one undeniable factor is that alternative energy does claim a piece of the energy production territory on a global scale. The debate should not be about whether alternative energy has the momentum to meet power demands; it has already accomplished those goals.

Instead, the focal point should concentrate on how each power source benefits society. DNV’s Energy Transition Outlook 2024 certainly makes tangible predictions, offering a clean energy future. With 25 years ahead to meet 2050 goals, the energy industry promises a good show on how the story develops and ends.

Nick Vaccaro is a freelance writer and photographer. In addition to providing technical writing services, he is an HSE consultant in the oil and gas industry with twelve years of experience. Vaccaro also contributes to SHALE Oil and Gas Business Magazine, American Oil and Gas Investor, Oil and Gas Investor, Energies Magazine and Louisiana Sportsman Magazine. He has a BA in photojournalism from Loyola University and resides in the New Orleans area. Vaccaro can be reached at 985-966-0957 or nav@vaccarogroupllc.com.