The energy sector receives glorifying reviews for its efforts in alternative energy but, according to a recent New York Times’ article, fossil fuels continue to remain strong when contemplating how to meet the globe’s increasing energy demands. Despite expecting to see stifled growth through governmental regulation and a predicted decrease in overall spending on growth, oil and gas companies have been displaying significant activity throughout the year.

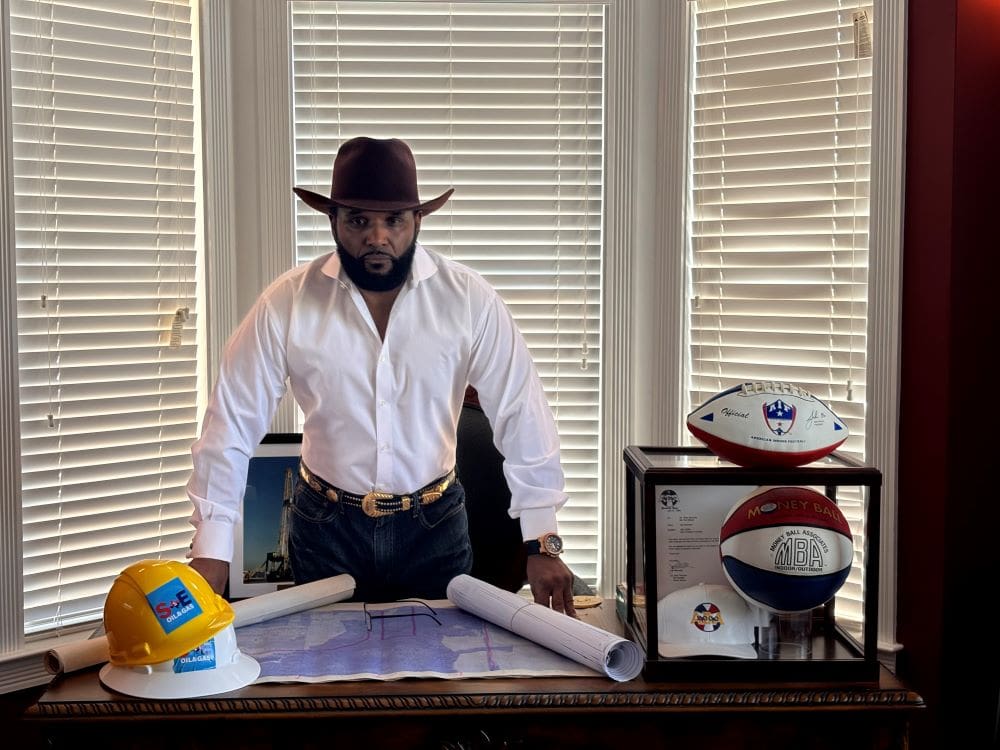

Considering current trends and the future of what is to come in American politics, Erick Moore of EM Holdings Corporations says we are sitting on the cusp of an explosion of activity that yields incredible investment opportunities for businesses and private individuals.

As managing principal of EM Holdings, Moore brings a robust history of oil and gas experience to assess the market, analyze data, and make specific direction predictions. This practice guides the firm during the investment process, where it performs a complete due diligence process on all its prospective investments. Its group of equity investors includes investment groups, pension funds, endowments, bank affiliates, and high-net-worth individuals known as angel investors.

When analyzing an investment opportunity, Moore and EM Holdings address infrastructure, ensuring it is in place but stable and experienced. Business models must be clearly defined with a focus on one primary business sector. Revenue must reside in the $10 to $100 million range and earnings before interest, taxes, depreciation and amortization (EBITDA) somewhere between $3 and $10 million.

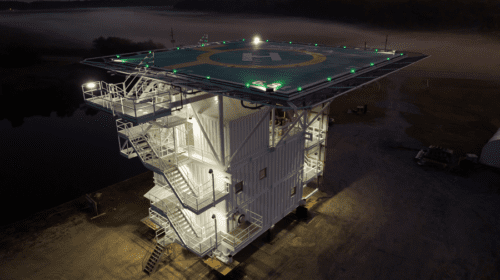

Meeting these standards, SE Oil and Gas Producers, LTD, has recently been added to EM Holdings’ portfolio of investment opportunities. The company offers essential services in demand and will continue to see demand grow in the areas of products and services, trucking, logistics management, proppants, drilling services, oil field services and geological services.

According to Moore, energy demand is a growing and that insatiable appetite that must be fed. As a result, the time for investing in fossil fuels is now, regardless of the overall public opinion that defames oil and gas daily.

“I think primarily right now we’re in an election year,” says Moore. “With potential change with how our government is handling things, the demand for energy is strong but will get stronger daily.”

Moore points to potential opportunities associated with all forms of energy. While subsidies and tax incentives have stimulated attention to alternative energy investment, fossil fuel opportunities will not just die off into the night.

“There are a lot of regulatory variables that increase subsidization, but it will be a while before all things could be alternative energy,” says Moore. “Even if car companies made good on their pledges to produce only electric vehicles by 2035, it will take decades to transition away from fossil fuels. The world will still require a significant amount of oil and gas for the foreseeable future.”

Factors of Influence

According to Moore, the energy demand is high and continues to soar mainly because the current administration has depleted federal reserves. To stifle rising prices at the pump, the Biden administration introduced products from the federal reserves into the market for the sole purpose of cutting off those price increases. This practice has been a common directive by the federal government, and just recently, it restricted gas leasing on thirteen million acres of a federal petroleum reserve in Alaska.

In addition to cutting leasing opportunities in the offshore oil and gas sector, these restrictions have only intensified the need to increase supply to meet demand. Moore points this out as an indicator that investment opportunities will flourish in bringing ideas and solutions to fruition to meet energy demands.

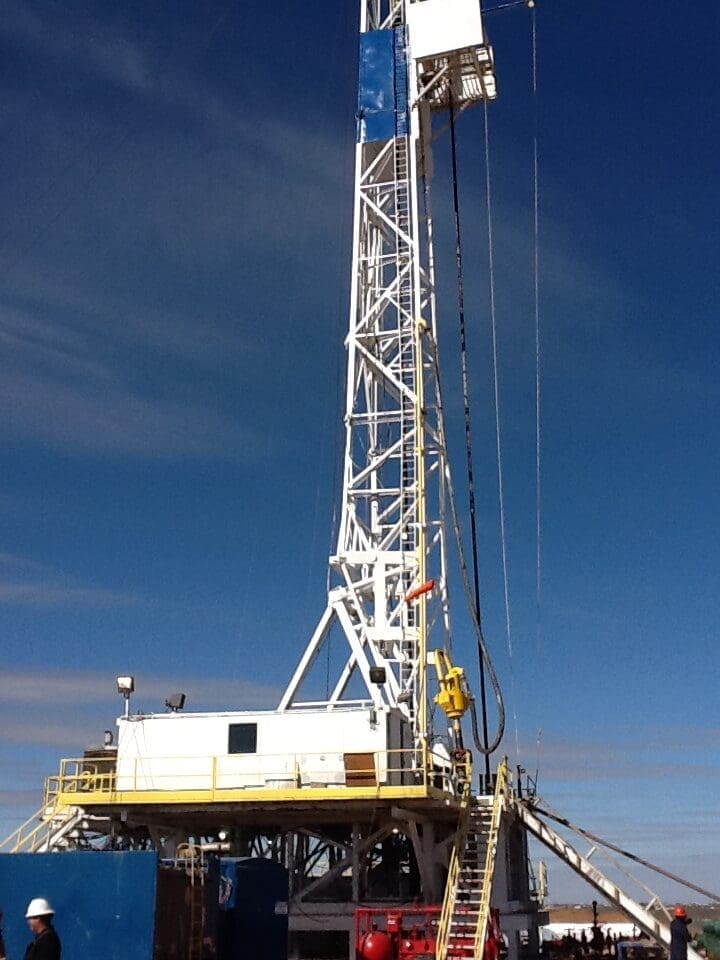

Moore identifies current movements as precursors to explosive activity that he and his firm expect in the North American shale. Not only has drilling activity increased, while multiple financial institutions predicted 2024 spending to remain flat, interest is also growing with exploration activities moments from being initiated.

“The rig count alone is up 65 percent,” Moore points out.

The Eagle Ford Shale extends across 26 counties in central and south Texas and has a rich oil and gas history with its first well being drilled in 2008. The formation did not see an uptick in drilling until 2010, but when the boom struck the industry, it benefited from a significant run until 2015. The area began to recover in 2019 and has considerable production, with drilling rigs still seen in numerous counties.

While the Eagle Ford boomed with activity and remains productive, Moore says the new potential is fueling investment opportunities in oil and gas. The Buda Limestone formation spans the High Plains and Trans-Pecos regions of West Texas and continues eastward, finding itself overlaid by the Eagle Ford Shale. Moore points to additional infrastructure and support services needed in the Eagle Ford area to help bring the Buda online.

“This next layer should be even more profitable than the Eagles Ford,” Moore predicts.

With LNG activity remaining a staple in the energy supply quest, Moore maintains that West Texas and Haynesville activity will continue to grow, fueling investment opportunities throughout.

Moore targets what many have thought to have played out in southern Louisiana as an opportunity. According to data studied and science applied, the Interstate 10 corridor through Calcasieu Parish promises to see a resurgence in oil and gas activity. Its proximity to Lake Charles and Cameron, Louisiana, certainly influences probability.

“We foresee significant activity and opportunity in that area of Louisiana in two to three years,” says Moore.

Moore and his firm have directed attention to Oklahoma due to additional discoveries in what is already a bustling area. While many companies seek growth through increasing and enhancing existing production, the boom of investment opportunities will rely on drilling. The wells must be drilled for the other support services to enter the picture and, for that to occur, Moore warns that a change must be made.

“I think the White House is realizing now that they have to make a change,” says Moore. “To thrive, they are going to have to loosen and pave the way for domestic drilling programs.”

Identifying Key Investment Opportunities

Support services for drilling campaigns will offer many investment opportunities, but Moore foresees additional outlets. Great opportunities will populate the areas of water supply and condensate disposal. With all sectors of oil and gas requiring water, it will be in high demand for drilling and hydraulic fracturing needs. That water must be sourced from somewhere; opportunity will surface with trucking, supply and treatment.

A critical component of oil and gas operations is that whatever is sent downhole must return to the surface. Injecting water downhole returns to the surface as condensate, which will need to be properly removed from the location and sites.

That support structure provides endless opportunities. Saltwater disposal facilities will need to be constructed to service the growing supply, additional trucking will need to be in place, and related services will increase.

Moore feels the drilling fluid market will foster further investment opportunities in the oil and gas industry. If activity increases, the supply of drilling fluids must grow proportionately. A significant increase in fluid supply could create an environment for the formation of new companies to assist in meeting that new demand.

Moore feels the drilling fluid market will foster further investment opportunities in the oil and gas industry. If activity increases, the supply of drilling fluids must grow proportionately. A significant increase in fluid supply could create an environment for the formation of new companies to assist in meeting that new demand.

Startup companies focusing on these various areas can offer further opportunities. Moore says that new companies entering the industry can capitalize on an upward market and, if established early enough, can see significant increases in profitability as demand increases. Getting in early allows investors to capitalize on big profits down the road with minimal investments made in the present.

Introducing the SE Energy Fund II

Moore and his firm currently have $227 million under management for alternative energy investments. New opportunities are available through the SE Energy Fund II, which encompasses several components of the fund’s makeup. It includes active drilling opportunities in south Louisiana, and additional drilling opportunities also span the Texas Gulf Coast.

SE Energy Fund II includes interest in saltwater disposal facilities, hydraulic fracking, along with active drilling opportunities in Oklahoma, Louisiana, Wyoming and West Texas. The fund continues to honor its robust design, concentrating on the acquisition of active and profitable energy services companies both domestically and overseas.

Moore’s SE Energy Fund II reigns as an investment solution rooted in entertaining those multiple areas of investment interest. Having analyzed the data and potential, Moore feels the SE Energy Fund II offers a diverse opportunity in investment returns, catering to multiple areas of oil and gas that are expected to grow in proportion to the response in meeting energy demands. Given the current opposition to the oil and gas industry, yet the anticipated increase in activity through a new presidency, Moore and his firm reason oil and gas will remain a necessity and, therefore, a staple in investment portfolios.

Moore believes, “Whatever may be true of the death of fossil fuels in America, and in the world for that matter, our short-term, immediate future as a society is linked to the continual availability of oil and gas.”

Nick Vaccaro is a freelance writer and photographer. In addition to providing technical writing services, he is an HSE consultant in the oil and gas industry with twelve years of experience. Vaccaro also contributes to SHALE Oil and Gas Business Magazine, American Oil and Gas Investor, Oil and Gas Investor, Energies Magazine and Louisiana Sportsman Magazine. He has a BA in photojournalism from Loyola University and resides in the New Orleans area. Vaccaro can be reached at 985-966-0957 or nav@vaccarogroupllc.com.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.