Mineral buyers want to be special. Unfortunately, most know that aside from the strength of their network there isn’t a lot to differentiate one group from the next. That, of course, doesn’t stop them from trying.

Nearly every mineral buyer has an obligatory website offering “fast and fair offers” telling potential sellers that they will give them more for their minerals than the other guy. They battle for inbound leads, focus on creating sleeker websites, tweak keywords to perfection and spend on geo-targeted digital advertising. In the end, there is no definable special sauce separating one from the next.

The more ambitious and well-funded invest heavily in hiring the most talented negotiators and researchers in an attempt to drum up leads in targeted AOI (areas of interest). Others focus on developing proprietary software solutions. Although very intelligent land professionals help create these, land professionals are not developers and the solutions are usually customized Excel spreadsheets.

So, while mineral buyers want to be unique, most of them act on very similar principles – “fast, fair offers with a focus on integrity.” Are they better negotiators and researchers? Maybe. Does this provide a substantial advantage? Most likely not. Do they have access to public data that no one else does? Obviously no, most often leads come from tax rolls, lease records, forced pooling agreements, company reports or other similar publicly available data.

In a market where everyone is selling themselves the same way and using the same data, the only way to gain a meaningful advantage is to innovate in ways others are not. Those who fail to adopt new technologies and reimagine processes will tread water and eventually fall behind. The mineral buyers that uncover and implement solutions to quickly and accurately process reams of mineral ownership data will win by a landslide.

How Can a Mineral Buyer Truly Gain an Edge?

A good option is “buying in front of the bit,” or attempting to buy in front of operators. E&Ps do this all the time to improve NRI (net revenue interest), diversify their portfolio and become more resilient to market swings. If a mineral buyer wants to buy in front of a drill bit they don’t own they have four options:

- Partner with an operator and agree on cost + fee per acre

- Predict the future

- Get lucky

- Leverage inside information

Partnering is the only option proven to work consistently enough to bank on, while the others can be considered gambling, illegal or both. Getting lucky is only a plan for fools and we’ll leave inside information to the sharks. In order to partner, a mineral buyer must first find a company willing to trust them with their sensitive information. If they do, partnering is a safe, risk-averse bet for those who are content with small wins and limited upside. But the oil and gas industry, with its rich history of wildcatters and tycoons, has never been a place for those looking to win small. This leaves mineral buyers with a single option – predicting the future which, if you squint, looks very similar to getting lucky.

Blanket Title as a Mineral Buying Strategy

Over the last decade, data companies have started offering tools that make it possible to predict future production with impressive accuracy. For example, DrillingInfo gives clients access to leasing trends and rig movements to determine where an operator will drill next. When this data first became easily accessible it gave users an edge, but today nearly everyone uses DrillingInfo and, as a result, everyone can make the same predictions. When everyone uses the same data services, custom spreadsheets, and CRMs, it is no longer an advantage, it is the minimum requirement to stay competitive. Predicting the future only has value if a company is able to execute on it before someone else. Answers make you smart, actions get things done, but neither hold much value without the other.

The Need For “Actionable Intelligence”

Prices can soar overnight when an operator takes a lease, beginning a rush to gain position. The rush forces buyers to cut corners by sacrificing speed and accuracy to close transactions. In the end, success in this environment relies heavily on luck and brute force. Mineral buyers must find a way to accurately value a mineral owner’s assets fast enough to take action while competition is limited.

Running out title conventionally can cost thousands of dollars for a single owner. Current economics dictate that in order to invest capital into confirming ownership mineral owners first must commit to selling by signing a LOI (letter of intent). Without a commitment, it is cost prohibitive to prerun title. When capital is deployed to research a single lead, a company is essentially placing a binary bet with limited upside.

The Agrarian Age for Mineral Buyers

The approach to date resembles a hunter/gatherer mentality. To survive requires being opportunistic, adaptable and expertly skilled. The best have been able to survive and even thrive, but even then, outdated tools and a resource intensive approach limit the size and stability of the opportunities. Just as early humans transitioned from “hunter/gatherers” to farmers in the Agrarian Age, mineral buyers need to evolve and begin “farming” opportunities. Systematically running blanket title is the way to accomplish this.

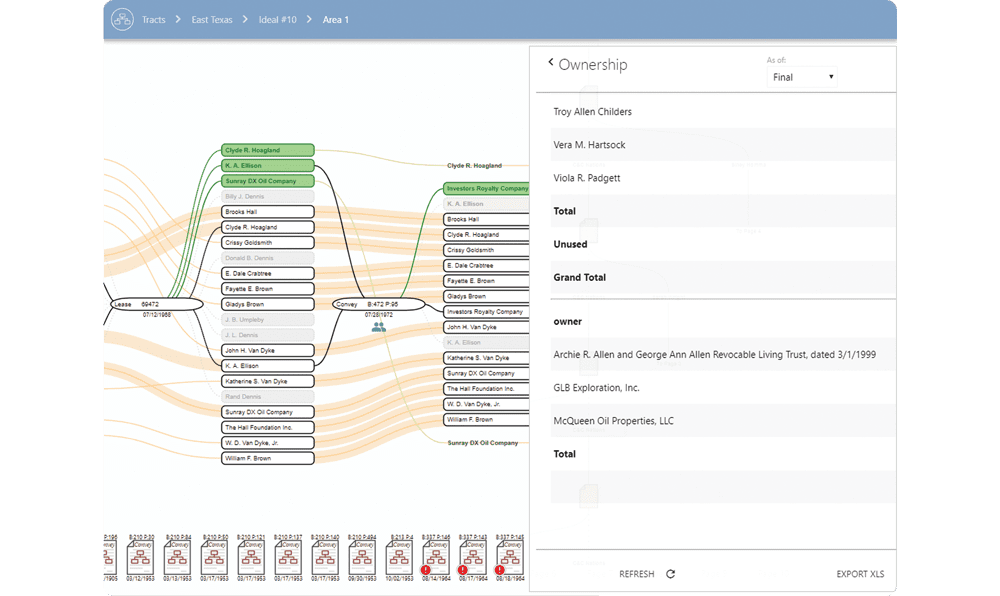

Blanket title generates a list of all current mineral owners for an AOI with pre-confirmed interest calculations. Mineral buyers taking this approach acquire actionable intelligence that allows them to bypass the step of signing an LOI. Offers can be sent out en masse and close rates skyrocket when an owner is approached with a deed and a check they can sign and cash on the spot. There are two ways to run blanket title. The first is reactively by waiting for a potential seller, getting an LOI signed and then running out all of the names and owners in the same tract, section, or AOI, rather than just the single signed owner. The second is to proactively run an area of interest (AOI) to identify all owners before having a potential seller.

Using Title Management Platforms to Win

Today, successful mineral buyers know “where” they want to buy, the winners of the next half decade will be the fastest to find the “who.” Title Management Platforms (TMP) like Tracts, use common title to identify all leads surrounding the initial target. Features like automatic interest calculation eliminate math while document interpretation libraries store deed interpretations for repeated use. Hungry, young, PE backed mineral buyers are entering the space and building their processes using a technology first strategy. By removing the most time-consuming steps involved in title research they are able to run entire sections for what it used to cost to run out a single name. As these companies continue to adjust, auto calculation of interest and interpretation libraries are turning one lead into 20 and cutting required investment into a fraction of what they have been historically. Leveraging TMPs is providing immediate returns, exponentially increasing upside while vastly reducing the opportunity for a complete loss. Today TMPs offer a massive competitive advantage for those early to adopt, soon they will be a requirement just to stay competitive. We’ve seen this story before.

Matt Chamberlain is VP of Growth at Tracts having lead efforts in business development, client relations and strategic planning. He has a breadth of experience bringing new technology and processes to the energy sector and environmental industries. Chamberlain earned a Bachelor’s Degree with honors in business and marketing from St. Edward's University. He is a member of the American Association of Petroleum Landmen (AAPL).

Ashley Gilmore is CEO and co-founder of Tracts where he applies an extensive background in launching and managing startup companies. Drawing on knowledge of land & title law and information technology, Gilmore helped pioneer a new approach to title processing in the oil & gas industry. Gilmore has been awarded a patent for title processing and visualization technology. He holds a Juris Doctor from Willamette University College of Law and a Bachelor of Science in business management from Central Washington University.