In recent months, there has been a dawning realization that the barriers to a clean energy transition are more formidable than previously understood. Higher interest rates have made capital investment more difficult. Deficiencies in the infrastructure required to deploy renewable resources are increasingly apparent. Geopolitical instability has brought the issue of energy security to the fore. Today, more than 760 million people, largely located in sub-Saharan Africa, lack access to energy and, according to the United Nations Department of Economic and Social Affairs (UN DESA), half of the estimated 28 percent growth in the world’s population between today and 2050 will be concentrated in nine countries, seven of which are classified as low or lower-middle income by the World Bank. Security of affordable energy supply is critical for the economic advancement of all, not just those who have the economic means to pay a premium for green.

The International Energy Agency (IEA), in its November 2023 report, The Oil and Gas Industry in Net Zero Transitions, states that with existing policies, global oil and gas demand will not peak until 2030, while conceding that even in a Paris Accord 1.5oC scenario, oil and gas is unlikely to disappear from our energy mix. Absent broad acceptance of nuclear energy (which would take years to plan, build and deploy), a sudden breakthrough in nuclear fusion technology, or other unforeseen technological advancements, hydrocarbons are not going away.

In a world that still requires oil and gas, there are three ways to curb greenhouse gas (GHG) emissions: 1) reducing energy consumption, 2) switching to alternative clean energy resources, and 3) mitigating GHG emissions generated by fossil fuels. Much effort has and will continue to be placed on lowering consumption and developing new energy resources. But when it comes to reducing GHG emissions, carbon capture and sequestration (CCS), however nascent, is one of the principal technologies available and should play a key role in our efforts to move closer to Net Zero.

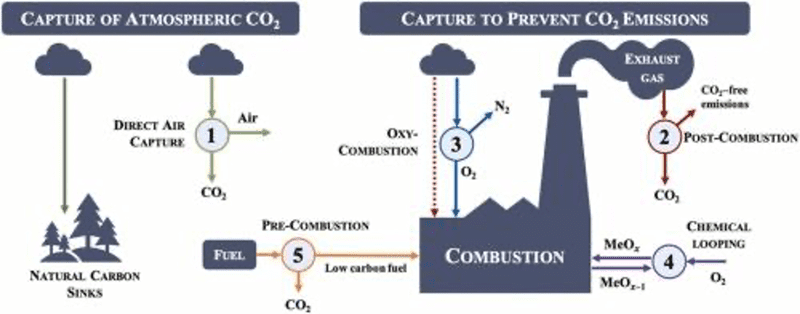

Figure 1: Direct Air Versus Point Source Capture

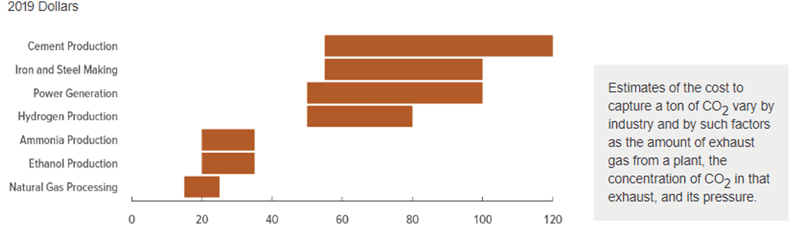

Capturing carbon from a point source (i.e., industrial facility, power plant) is an ambitious endeavor. Facilities are expensive to build and to operate, and their construction often delayed and subject to cost-overruns. The process itself can consume a significant amount of energy. Geography and geology are limiting factors. Carbon dioxide must be stored beneath impenetrable rock and if the point of capture is not near the required geology, it must be transported. While some CCS plants have exceeded 95 percent efficiency, that efficiency and, by association, cost varies across technologies and sources (Figure 2).

Figure 2: Estimated Range of Costs for Capturing a Metric Ton of CO2 in the US in 2019

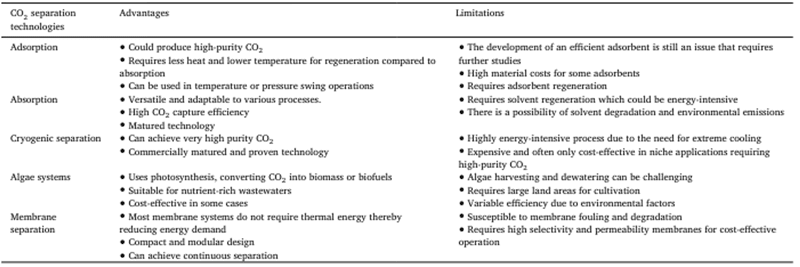

Point source CCS methodologies include adsorption, membrane capture, cryogenic separation, and algae systems. Each has its benefits, in terms of cost-effectiveness and efficiency, as well as disadvantages, in terms of being relatively cost-prohibitive, inefficient, energy intensive or environmentally-unfriendly (Figure 3).

Figure 3: Advantages and Limitations of CO2 Separation Technologies

Direct air capture (DAC) extracts carbon from ambient air. DAC plants need not be specific to any location apart from proximity to a CO2 source and storage (or re-use) opportunity. At present, DAC processes are more inefficient than point capture, are energy intensive, and are the most expensive means of CCS. However, multiple new technologies are in development and DAC is attracting investment from both private and strategic investors, while receiving government funding and policy support in the U.S., the EU, U.K., Canada and Japan.

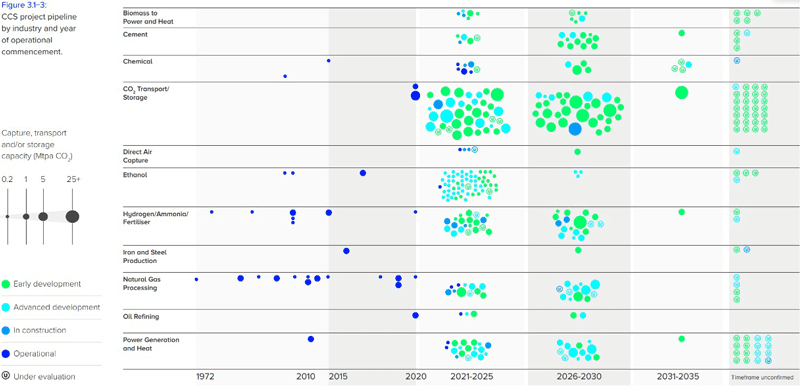

Figure 4 shows how CCS has been leveraged in the past and provides indications of future deployment. Prior to 2020, investment was focused on ethanol, natural gas processing, and industrial applications. Today, we are seeing evidence of the intention to employ CCS on a much larger scale, in the form of advanced development of transport and storage projects. Figure 4 suggests that broad application of CCS across industries is relatively recent. Today, CCS captures 0.1 percent of global emissions. While that statistic is unimpressive, this graphic illustrates we are in the early days of CCS development and deployment. Despite skepti. cism concerning viability, scalability and affordability of CCS, as well as the concern that carbon capture is simply a way of “kicking the can down the road” to Net Zero, investment and innovation continues.

Figure 4: CCS Project Pipeline by Industry and Year of Operational Commencement

In the U.S., the Infrastructure Investment and Jobs Act of 2021 provided for $6.5 billion of carbon management funding. The Inflation Reduction Act of 2022 provided $3.2 billion in extended credits for CCS. Multiple energy companies, prompted by the need to decarbonize, and encouraged by public funding, have begun to implement advanced CCS capabilities. The U.S. DOE recently awarded $1.2 billion to Occidental Petroleum and Climeworks for DAC hubs to remove two million metric tons of CO2 per year.

Significant private investments continue. For example, Schlumberger (SLB) recently announced a $400 million investment in Aker Carbon Capture which provides solutions for industrial, biofuels, and hydrogen market segments. According to Pitchbook, the median value of carbon capture-related non-strategic investment deals rose 142 percent from 2022 to 2023 and has risen 105 percent in 2024 to date. This investment interest is indicative of commitment to continued innovation in CCS.

However, the CCS market remains relatively nascent. Artificial intelligence (AI) can help. In January, the University of Surrey published a study suggesting AI could improve carbon capture energy consumption by 36 percent. Researchers at Argonne National Laboratory have leveraged AI to design, on an atomic level, metal-organic frameworks that selectively absorb carbon. Digital twinning is being used to optimize the CO2 storage process. Ultimately, the enhanced simulation capability of digital twins could optimize the CO2 capture in production or emission pathways, driving emissions lower.

Academia has a significant role to play in the further development of CCS. While government support has been a catalyst for investment in renewable energy and decarbonization technologies, energy-focused initiatives similar to the bi-partisan passage and ongoing renewal of the Bayh Dole Act, which grants patent rights to inventors developing government-funded technologies, is an example of legislation that puts taxpayer dollars to work driving innovation, entrepreneurial activity, and sustained economic growth. Other countries can follow this model as well. Strengthening an innovation economy should facilitate breakthroughs and increase our competitiveness against countries where government is the primary driver of innovation and economic growth.

The energy trilemma refers to the challenge of creating an energy system that is economically, environmentally and socially balanced. This poses difficulties for low and lower-middle economies such as India, Nigeria, the Congo, Pakistan, Ethiopia, Tanzania and Uganda from which the bulk of population growth will come over the next 25 years. For these countries, affordability is a prerequisite to survival.

Even as we continue to develop renewable energy solutions, oil and gas will be a part of the solution for some time. Continued investment in CCS – from the private as well as the public sectors and academia – should be a strategic priority. However challenged the CCS technologies are today, the promise of more efficient and cost-effective solutions can support a transition to greener energy while providing an upward pathway and bridge to prosperity for all.

Jeff Whittle is head of Womble Bond Dickinson’s Global Energy and Natural Resources Industry Sector. He has nearly 30 years of legal experience with clients in the energy and high-tech industries and serves as the Managing Partner of the firm’s Houston office.

Christé Spiers is the Global Energy & Natural Resources Sector Strategist at Womble Bond Dickinson.