The oil and gas industry is based on the marketing of hydrocarbons. Since the early stages, the use of this raw material has made a difference in the way societies live. Oil has changed its meaning over time, from being known as a source of light and heat for the cities in the past, to what it has become today, an economic indicator for countries’ economies around the globe. For that reason, it is also known as black gold.

The fundamental basis for exploration and subsequent drilling and production is the price of the crude in the market at the moment. Over time, difficulties finding hydrocarbons and their subsequent activities in order to be extracted have changed, becoming more difficult each time. Because of this, factors such as technology, specialized personnel, procedures and structures, have evolved to adapt to new challenges. In turn, costs have skyrocketed.

As an example, we have the hydraulic fracturing works that used to be performed in the past, reaching costs of $100,000. Sand was used as a proppant and water or gasoil was used for fracture pressure without limits of stages. Today, fractures are calculated by stages, the fluids to be used are specialized, and the proppants range from rubber to diamond-like ceramics, reaching prices of over $500,000 in some cases.

It is also the case with drilling works. In the past, oil wells reached depths of 5,000 feet; today, they reach depths of 20,000 feet. This has caused the implementation of new drilling rigs, specialized equipment and techniques, that lead to a greater trend of borehole problems; therefore, operational costs increase exponentially.

This indicates that the oil and gas business has changed. More and more operators are in charge of the production of crude oil in the form of third parties. The number of companies that are in charge of offering services of field operations, or hydrocarbon distribution, among others, has also grown; therefore, strategies for crude oil marketing are of utmost importance.

To understand the business of crude oil marketing, certain concepts would have to be understood:

The type of crude oil to be negotiated is one of the first points. As a main reference in terms of price, we have Brent crude oil. Considered as acid crude, it has 0.37 percent sulfur. This is produced in the North Sea, quoted in London, and traded in Europe. Close to 60 percent of the contracts in the world are agreed upon with this type of crude oil. In second place, we have West Texas Intermediary (WTI) crude oil, containing 0.24 percent sulfur; thus considered to be sweet, this type of oil is easier to refine. This crude oil comes from Texas, is quoted in Chicago, and is used by countries such as the USA, Canada, and countries in the Caribbean and South America as a reference price.

In terms of supply and demand, supply symbolizes the amount of crude oil that is present in the market. If it exceeds demand, the cost of the barrel (either Brent or WTI) tends to fall. Other factors such as news, natural disasters, or tensions in the Middle East, which affect the supply network, directly influence the cost of the hydrocarbon. This is due to the imbalance that it can cause in the market, superimposing demand over supply. This type of scenario causes the price to rise.

As an example, we have the impact that the COVID-19 virus generated in the oil market. Despite greatly decreasing oil producing activities and thus affecting the supply network, the price of the barrel went down, due to the law of supply and demand. Although the supply was diminished across the world, the demand was significantly more affected because countries applied social restrictive measures, such as quarantine. Besides, countries with high consumption of hydrocarbons for heat generation are currently in the summer season, avoiding the expenditure of hydrocarbon derivatives. At the same time, fuel is not being used as much as before due to the home office becoming the new trend.

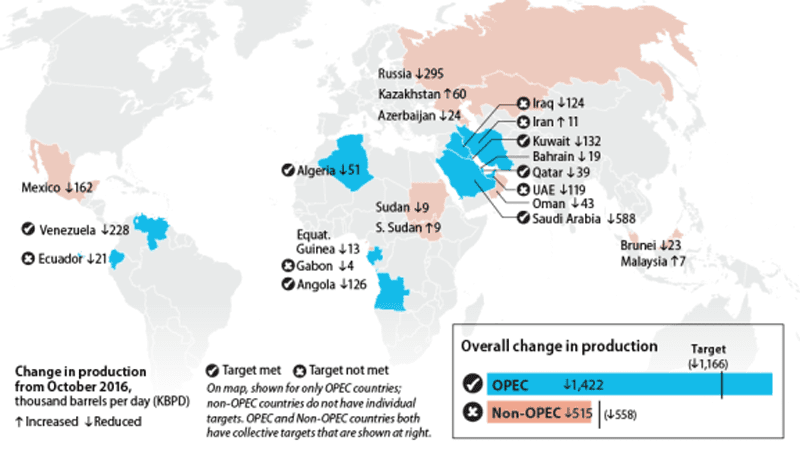

The oil business is limited by two markets, OPEC-aligned countries (Organization of Petroleum Exporting Countries) and non-OPEC-aligned countries (non-OPEC). The operations of these entities are closely linked to the price of crude oil.

OPEC acts as a regulator of the amount of oil that the countries aligned to its organization produce or, in some cases, the amount that is at its disposal for the market, directly influencing the supply. The non-OPEC-aligned countries are engaged in the production and sale of crude oil under their own discretion. In the past, these organizations operated separately; today many of the decisions are taken together.

Since black gold is a regulatory element for economies, countries that present themselves as a global power use mechanisms and strategies to alter the market in their favor. There are different market strategies to move this balance to one side or the other.

The service companies that handle the extraction of the oil play a fundamental role, since they are the ones that assure the production in its first stages, and on the other side, there are those that detail the economic feasibility that new projects may have (proven reserves).

The price of crude oil is impacted if oil fields with significant reserves begin to be exploited; therefore, one of the market strategies is the economic feasibility that service companies provide to the development of new projects. In view of the rise in crude oil prices from 2003 onwards, companies in the United States began fracking practices, this process being sustainable due to the constant rise in the price of the crude oil barrel. At the same time, with the implementation of these processes, more efficient and economical [methods] were developed, thus achieving lower costs of shale oil and gas production.

This injection into the production of the United States placed the country first on the list of world producers, and gradually caused the price of crude oil to decline to a desired point for the economy of the aforementioned country, being the country that consumes the most hydrocarbons.

Therefore, market economic strategies go hand in hand with the technical factor provided by service companies, in this case.

Another strategy for the marketing of oil is strategic transport. Nations such as the USA or Russia do not produce all the oil they sell on their territory. Their economic alliances with producing countries make part of the generation of hydrocarbons carry their signature abroad, but these countries are far from their borders.

In the case of the USA, 69 percent of the crude that is generated in the nation is divided as follows: Texas (41%), North Dakota (11%), New Mexico (8%), Oklahoma (5%), and Colorado (4%). Another 15 percent is produced in the Gulf of Mexico, classifying the remaining 16 percent from countries in the Middle East.

Sixteen percent of crude oil produced in the Middle East is equivalent to 1,956 MMbbl/d. The article “Oil tanker rates double as demand for storage and transport resurfaces,” published by Reuters in March, explains that cargo ships have a daily cost of approximately $170,000 in trips from the Middle East to China, taking not more than 10 days in extreme cases.

In the case of traveling to the USA, the cargo ships can take from 35 to 50 days, as explained by the diplomat John Burgess in the article, “How long does it take for oil to be shipped from the Middle East to the Gulf Coast?” In these cases, the price per cubic meter varies from $5 to $8; that is to say, from $0.0.2 to $0.03 per gallon. This associated cost to transport makes the oil produced abroad to be traded in the same market network where it is produced. In this way, countries like the USA can negotiate a part of their production either in crude or in derivatives with European or Asian countries, and what is generated in revenue can replace the amount of crude oil necessary for the country with shopping on the American continent.

The oil business has more than 150 years of history. Nowadays, it is the world’s economic thermometer, taking into account the principle of Newton, which explains that work is energy. It is indicated that the world’s movement is thanks to the production of crude oil. It is the factor that moves the world; therefore, the interest of countries is to dominate the market. To understand the scope of the market is a necessity as it is a business. The world will not stop.

Headline photo courtesy of Energy Infra Post

Raul Palencia is an engineer and researcher with more than 10 years of experience as a geologist. He graduated from the prestigious University of Andes (ULA), later he received a master’s degree in reservoir engineering at the Venezuela Hydrocarbons University. During his career development, he worked for oil companies in positions such as: field geologist, reservoir engineer and reservoir simulation. He has worked in Argentina, Ecuador, Mexico and Venezuela. He currently resides in Texas.