The low price of oil coupled with the pandemic has resulted in budget cuts and significant shifts in how companies are operating. Forward looking energy companies are using this time to refresh their aging technology roadmap and introduce a modern and reliable digital blueprint for their enterprise.

Analysts indicate that these early adopters will become the winners with access to the information they need to make strategic moves, operate more efficiently, and take on acquisitions that they wouldn’t have otherwise had the bandwidth to embrace. More than ever, a foundation of trusted data combined with proven technology is essential for survival.

Based on a recent survey published by Quorum Software, 96 percent of IT decision makers (ITDMs) across all industries agree that the use of technology can transform a laggard industry. But, when oil prices were in the $100s during the early 2010s, it masked the need to modernize technology and innovate the energy business.

Fast forward to 2014 and now 2020, operators are adjusting and adapting to falling prices and restructuring to drive down costs and operate more efficiently. Companies can no longer rely on external investment and maintain the status quo. They are being forced to live within free cash flow by optimizing their business processes.

Meanwhile, other industries, such as the financial, retail, and manufacturing sectors, have been adopting and investing in modern technology over the past decade to remain competitive, manage market threats, and improve their day to day operations. Research on the successes and failures of other industries is being applied by innovative oil and gas executives to ensure a successful digital transition and build an effective roadmap for the future.

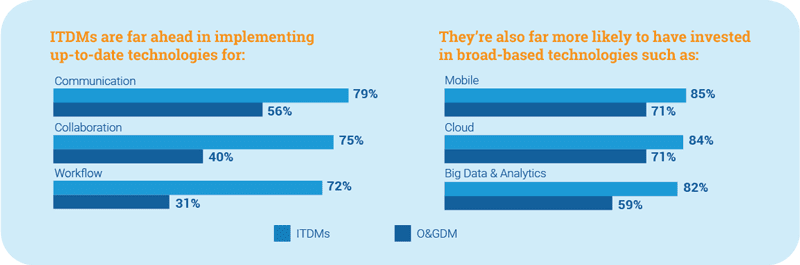

Quorum’s survey indicates that only 13 percent of oil and gas decision makers (O&GDMs) say that their companies are adopting new technologies fast enough to be competitive, compared to 51 percent of ITDMs from other industries. Experts say that not only is it important to adopt technology based on critical market disruptions, but it requires a timely transformation. Examples point to failed businesses like Kodak, Blockbuster or Blackberry and successful businesses like Lyft, Air BnB or Apple to show the difference between well-timed and poorly-timed tech adoption. The key message to be learned from successful companies in other industries is that they treat data (market, consumer or financial) as a critical asset and apply the same level of rules, processes, and governance that they would over any physical asset.

The oil and gas industry has been much slower to adapt compared to its peers since most companies take a bottoms up approach, where investment is driven at a business unit level with a focus on analytics or field automation or geological and geophysical (G&G). Very few companies have embraced a true enterprise-wide digital transformation.

Does the Size of Business Matter?

As for company size, a common impression has been that smaller companies are nimbler and more willing to innovate than larger ones, but larger companies have bigger budgets to devote to transformations.

In the survey, ITDMs ranked large companies as having a huge edge in automation, with better technologies and a focus on innovation. Meanwhile, OGDMs respected large companies for their skill in these same tactics, but also give small companies much higher marks for agility in adopting new technology and hiring better talent. The door is open for smaller players to catch up.

Where Are Technology Investments Happening?

While the oil and gas industry has invested heavily in technologies used in the field to acquire, transform, and transport products, it lags behind its counterparts in the delivery of technologies to the back office. That is changing with the current economic landscape. Companies are starting to dedicate resources and funding to streamline back office operations to drive business agility and efficiency, while they look forward for signs of improvement in the market.

Four areas emerge in the report as key priorities for the oil and gas industry: cloud, mobile, IoT, and analytics. Each has varying degrees of importance depending on a company’s maturity, organizational makeup, or business goals, but they all help operators gather, manage, and analyze data in a more intelligent way.

When looking at lessons learned from other industries, the oil and gas industry needs to avoid the temptation to jump straight into the analytics space and rely upon machine learning and artificial intelligence to make sense of the data. According to Kang Chen, CIO at Concho Resources, a strong digital journey starts with a solid foundation of trusted master data and an evaluation of technology areas that can be deployed for specific business advantages.

Mastering Data to Drive Operational Efficiency

IT leaders agree that having access to consistent, trusted data at all stages of the business lifecycle, across all platforms, is critically important. In the oil and gas industry, it is even more imperative given the proliferation of different data silos within distinct functional units and limited common governance across them.

“No matter the industry or maturity of the [different] industries we researched, data quality was an ongoing challenge and organizations were spending 95 to 97 percent of their time cleaning up the data, and only 3 to 5 percent of time analyzing the data,” says Chen. “The key is to figure out how to make the data usable and useful and complement the technology that we were implementing.”

Establishing a strong foundation of master data management and business knowledge integration provides the platform for visualization, analytics, and workflow automation. This enables experienced personnel to spend the majority of their time using the data, rather than cleaning it up, which results in the creation of innovative solutions to drive operational efficiency.

Other industries have undergone their own digital transformation where they recognized the importance of data and digital technology to support their growth plans. Oil and gas companies can learn from these successes and failures to develop their own digital roadmaps. The primary message is to treat data as a critical asset and to avoid the temptation to shortcut the process. A platform of trusted master data is key to any successful digital transformation.

As energy companies continue to navigate these uncharted waters, those who have adopted technology with trusted, quality data will be in the best position to skillfully invest in strategic acquisitions, significantly reduce capital and operating costs, and operate with greater confidence in this disruptive time.

Quorum Software offers an industry-leading portfolio of finance, operations, and accounting solutions that empowers customers to streamline operations that drive growth and profitability across the energy value chain. From supermajors to startups, from the wellhead to the city gate, energy businesses rely on Quorum. Designed for digital transformation, the myQuorum software platform delivers open standards, mobile-first design, and cloud technologies to drive innovation. We’re helping visionary leaders transform their companies into modern energy workplaces. For more information, visit www.quorumsoftware.com.

Headline photo courtesy of Bigstock

Steve Cooper is Vice President of EnergyIQ by Quorum Software, a recognized leader in the oil & gas data management arena. As part of EnergyIQ, he has developed a sophisticated Well Master Data Management platform that supports critical decision-making at many oil and gas companies today. He started EnergyIQ in early 2008 after 14 years at Petroleum Information (later IHS) with 5 years spent as the CIO. He is a past Chief Communications Officer and Board Member with the PPDM Association. Additionally, he has served on the Board of Directors for two publicly-traded gold mining companies.

Steve holds a Ph.D. in Automated Mine Surveying & Planning, Nottingham University, England and Bachelor’s Degree in Mining Engineering from Nottingham University, England. He worked in several soft and hard rock mines upon graduating, but switched to the petroleum industry shortly thereafter, taking a number of classes at the Colorado School of Mines.

Steve has been published in numerous journals and has presented at industry conferences on subjects including data quality, governance, master data management, analytics and visualization. Recently, Steve joined the Data Analytics advisory board at Denver University and is an occasional contributor at the Colorado School of Mines.