“Earn more, spend less,” the most basic business adage, is the holy grail for profitability in any organization across all industries. For small to mid-sized companies that are largely static throughout the year, planning to achieve this goal may be a relatively consistent exercise, with known variables reported and forecasted through simple bookkeeping and accounting functions.

In large cyclical businesses such as those in the oil and gas industry, planning for profitability is not so simple. These organizations, which are often international, are subject to vast swings in factors beyond their control, from global, environmental and political events, to supply and demand and commodity pricing. Proactively – as opposed to reactively – managing assets, production and sales in companies that may have literally hundreds of thousands of moving parts requires agility, fueled by the ability to forecast for and quickly adapt to dynamic markets, ideally within two financial quarters or less. Today, that capacity to rapidly pivot is enhanced by robust enterprise resource planning (ERP), with sophisticated tools that capture real-time data across all departments and integrate it into meaningful analytics, driving strategic commercial decisions that are aligned with market forces and the energy industry’s changing cycles.

In the current oil and gas landscape, when revenue generation is constrained by the time and expense of exploration and resource development versus maintaining operations in challenging markets, process and economic efficiency matter more than ever. Gone are the days when a business’s financial function was handled by a few individuals crunching numbers in a corner, basing purchasing and pricing on after-the-fact historic data alone. Now, while it’s safe to say that all big oil and gas companies are using some type of enterprise accounting (EA) system to support their ERP, we can likely assume that another common adage, the 80/20 rule, is also true: 80 percent of these businesses are using only 20 percent of their EA systems to maximum advantage.

The problem lies not in the software or equipment, but in the human change management required to optimize any new process. As author Drew Troyer noted in “Human Factors Engineering: The Next Frontier in Reliability” (Machinery Lubrication, March 2010), “Based upon the general failure cause categories outlined in the U.S. Department of Energy’s root cause analysis standard … nearly 80 percent of what goes wrong can be attributed to people issues. Problems with procedures and training (combined) are responsible for nearly 40 percent. Management oversight represented about nine percent.” In my experience, even in the accounting department or finance center effective process improvement starts not with a new tool, but with a mindset that requires buy-in from all personnel at every stage.

Within the last decade, the evolution of new technologies in digitization, cloud computing, artificial intelligence (AI) and big data analytics have revolutionized accounting and financial management, demanding that those who work in these fields, particularly at large organizations, embrace innovation and think differently about these traditional business functions. In our fast-paced business environment, time is the most precious commodity. EA systems with integrated accounting processes offer solutions that can help us to understand our situations in real time, by redistributing each process to capture a broad range of critical information at the source and making it visible to all, so the whole organization is responsible for the numbers and the results.

The Enterprise Accounting Equation

I like to define the overarching benefit of effective enterprise accounting as an equation:

Real-time Analytics =

Real-time Data + Right Process

Enterprise Accounting

To better understand this equation, let’s start with data. Chief financial officers (CFOs) and finance leaders use diverse data and intelligence to identify patterns and business behaviors that inform strategic decisions and help their teams plan for the future. This process of collecting, modeling and analyzing raw data to derive answers and drive decisions is commonly referred to as data analytics.

External data is used to examine competitors and market trends, whereas internal data reveals an organization’s stand in the marketplace and how it can enhance its position. Data might be historical or current (in real-time, or “live”); the best analysis considers the past and present, as well as possible futures. In our competitive environment, quality data analytics are key, providing the invaluable insight a company needs to reduce cost and enhance profitability.

Assuming you have a good EA program that provides cost-effective cloud computing and related services, you can obtain required data faster, but it must be clean and timely. Data management must cross all business functions, integrating ERP information from all departments and divisions into your data analytics to power your comprehensive business intelligence (BI). By unifying data points from multiple internal and external sources, you can create actionable dashboards that provide business insight for senior management and executive leadership. However, a third adage – “garbage in, garbage out” – applies here, as the business decisions gleaned from these insights will only be as good as the data on which they are based. Data accuracy is critical to achieving powerful BI.

Building the Right Process

That brings us back to the human element of data analytics, which is the most critical factor in building any successful analytical program. Ensuring accuracy in BI depends on building the right processes within your EA system and populating each process with correct data.

Process is defined as “a series of actions or steps taken in order to achieve a particular end.” In any organization, there are various processes which help the business run right, from generating revenue to managing costs to achieving the bottom line (or “profit”). EA tools created by SAP, Oracle and other tech industry leaders enable us to establish and automate data collection in end-to-end processes such as:

- Order to Cash (O2C/OTC): integrating finance, sales, and distribution (revenue cost)

- Hire to Retire (H2R): identifying the human resources cost of an entity’s employees over the course of their careers (people cost)

- Procure to Pay (P2P): managing procurement and settling bills (purchasing costs)

- Record to Report (R2R) = collecting and presenting timely and accurate information to support financial, operational and strategic analysis (BI).

To achieve the optimum goal for any process, it is critical to invoke a fourth adage: “Do it right the first time.” Each business process referenced above typically involves multiple people who may each be involved in only one small aspect of the total process. EA corrects this “tunnel vision” by offering complete process visibility to everyone who has a functional role, offering all stakeholders the ability to easily determine where they are in a step or timeline, as well as the impact in quantity or dollar value. Yet again, in defining the right process and collecting the data points, accuracy is key.

To understand how human error can be the proverbial “ghost in the machine,” it’s important to note that even in EA systems, all transactional data is at some point manually created or keyed. While the system may require half the number of personnel as more traditional accounting methods, even one error by one individual can disrupt the value of the data analytics by generating incorrect information down the line. And although it is possible to correct an error with a rectification journal entry, that correction will not reflect additional information such as vendor details. Thus, to do it right the first time, we must ensure that every individual understands what data to capture and where it belongs in the process to optimize the analytics, and that every individual is committed to making accurate data entries.

The parameters of a right process for an oil and gas company should consider global factors, as these organizations generally have a global presence, and should have the ability to weed out variables that might impede process implementation. Any process should also be able to project for future growth and allow for cost-effective modifications. Programs that require too much time or expense to adjust defeat the overall objective, which is to integrate technology into accounting, reporting and live analytics for better business decisions.

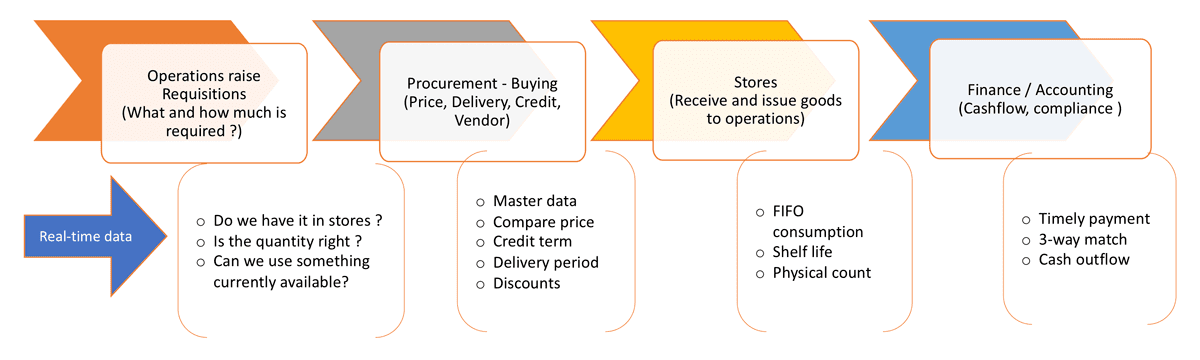

As stated earlier, oil and gas market factors limiting gains in revenue require that we focus on reducing costs in both downturns and upturns. Figure 1 illustrates how an effective EA process integrates buying for material and supplies with inventory control and financial management to optimize procurement and cash flow.

In this process, we are able to analyze various aspects even before we raise requisitions and, with the ability to see the availability of products across the entire entity, we can see that we might not need to request a purchase of new materials, enabling this process to stop at the requisition level. Furthermore, if we see that our supplies are short at the next level, the procurement team can start reviewing the best price and the company’s last discount to negotiate a good price and credit term and an even better delivery period. The customized right process also allows the inventory team to issue goods on a first-in, first-out (FIFO) basis, avoiding materials obsolescence or the need to write off material that has not moved off the shelves. Finally, the accounting department can pay the vendor when the invoice is due to maximize cash flow, ensure compliance and support fiscal filings and auditing.

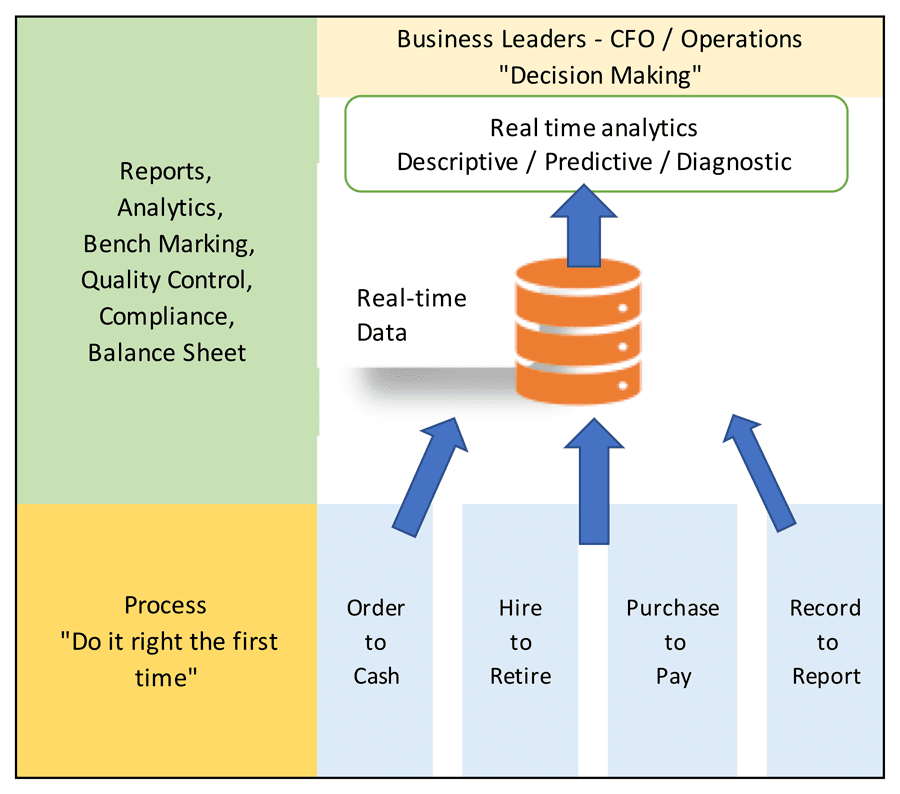

Elevating Your EA to Real-time Analytics

While most oil and gas companies are paying for ERP tools, I suspect that far too many are using them as upgraded spreadsheets, relying on traditional methods of data interpretation instead of optimizing the real-time data analytics that these advanced systems provide. Figure 2 shows how the EA equation can work, using real-time data input into the right process to produce descriptive, predictive and diagnostic live analytics that can then support good decision-making. We can also use the information to review our monthly tax liability and ease reconciliation of data more accurately and efficiently, with clean data that better facilitates managing tax payables and fiscal filings.

Using EA optimally means planning for “just in time,” having a cost sheet for every job we do and including multiple factors such as pricing and location, plus variables that could substantially impact our outcomes and subsequent decisions. Maximizing EA will make us more agile and adaptable to fluctuating market conditions, but individuals and teams are often resistant to the kind of change management required to effectuate continuous process improvement.

Training and changing existing mindsets are generally the bigger challenges for any organization that has traditionally relied on Microsoft Excel or other modes of data interpretation. To overcome resistance, financial leaders must be able to identify the problems and provide solutions that can be accepted and implemented across the organization, domestically and abroad. This could be achieved by coaching, mentoring, face-to-face workshops and providing digital learning opportunities to the lowest level of executives, who can then be change ambassadors to the employees on their teams.

Once an EA system is adopted, I encourage teams to embrace the change as opposed to enforcing it among unwilling participants. Change is hard, but we can make it easier by training all personnel to understand the advantages in time efficiency and productivity that the new system provides, as well as the significant analytical benefits (and possibly financial, in terms of bonuses) that can lead to more profitable commercial decisions. Obtaining broad buy-in will be easiest when the new process is simple, effective and compliant. I tell my teams that the process should work as well as the people.

Upper management can facilitate smooth transitions by demonstrating how EA enables the company to align key performance indicators and ethical industry practices with processes that generate profitability. Adapting to EA technology solutions will drive efficiency and good data-based decisions, but to use 100 percent of your EA system effectively, organizational leaders must lead by example and be the torchbearers of the change they envision.

Vishal Chaturvedi, MBA, is head of process-general accounting for North America and the Caribbean at one of the world’s largest oil field services companies. For nearly two decades, Chaturvedi has worked to increase profitability, mitigate risk and enhance process efficiency by integrating technological solutions in accounting, reporting and live analytics, resulting in significant time and cost savings.