Kicking off a New Year, a new decade and in Oil and Gas – an exciting time of making deals happen! Of course, I work in the off-market acquisitions space, and there are a lot of plans that will take shape in 2020 over the entire industry. At Beachwood, we are seeing a significant amount of assets shift from “not for sale” to “for sale” for a number of reasons.

The main reason, as expected in this market, is to capitalize on assets that are not core to the company’s position in the field. Eliminating overhead, in every aspect of the word, is going to be a common theme throughout the year. With sellers eliminating overhead of operational assets, there will be more cashflow to increase the production of current assets, or to purchase additional assets that fit better into the current portfolio.

The current oil and gas operators are looking at this market with opportunistic eyes. Emotional attachment to wells, lands, leases, capital investment, etc. has gone by the wayside. Everyone is excited to move forward. To get out of the current stall, and to shift into the next gear. This industry has always been focused on one primary target, and that is to make money.

With service costs finally dropping, the midstream deferential costs slowly eroding away, the focus is finally back on the core belief of the actual operators in the business, to make money. The companies feeding on oil and gas are realizing the hard facts, that you can’t overcharge on a commodity driven entity. The stock market won’t continue to pull the strings, especially when the entire industry falls out of favor with the investment community. There is oil and gas in the United States that can be produced, and money can be made. As obvious as that statement is, it has taken literally seven years for the industry to realize it.

Now that private equity has lived through a downturn, they are savvier with investment dollars. They are asking tougher questions of their teams; and demanding result-driven success. With this new direction, we will see merger after merger in 2020. We will see companies that will collapse on one another, and asset divestitures that will primarily help fund internal cashflow commitments.

The great news is that everyone in the industry is excited about this development. The stalled collective business model needed to be shaken. It needed to be reduced to a simple formula of the creation of positive cashflow and the elimination of unnecessary debt. There needed to be a restructure, and now that everyone can see the light, excitement is starting to rise.

We can expect a huge turnout at this year’s NAPE in February, and although the deals on the ten by ten tables may not reflect the actual assets available, the off-market deals will be flying around. I’m expecting a fantastic 2020, and an even better decade. Everyone is ready to make it happen!

Here’s to a very Happy New Year!

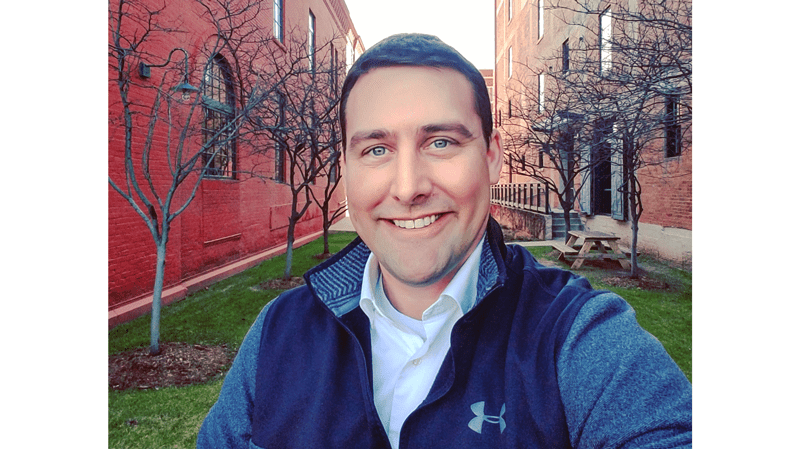

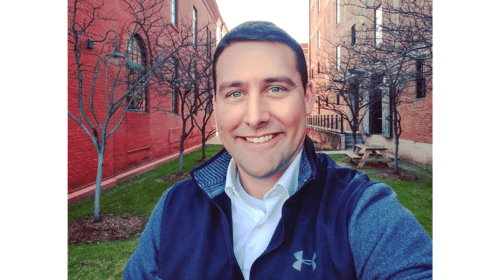

Josh Robbins is currently the Chief Executive Officer of Beachwood Marketing. He has consulted and provided solutions for several industries, however, the majority of his consulting solutions have been in manufacturing, energy and oil and gas. Mr. Robbins has over 15 years of excellent project leadership in business development and is experienced in all aspects of oil and gas acquisitions and divestitures. He has extensive business relationships with a demonstrated ability to conduct executive level negotiations. He has developed sustainable solutions, successfully marketing oil and natural gas properties cost-effectively and efficiently. Beachwood strives to partner with top tier oil and gas firms to find off-market deals that provide maximum benefit to their corporate acquisition strategy. At Beachwood, Mr. Robbins manages the corporate branding, senior staff, and the Beachwood Strategic Consulting Group, including sales strategy development for all of the Beachwood clients. Josh has been featured in numerous trade magazines as he is an accomplished writer and speaker on the acquisition and divestment market. He writes a bi-monthly acquisition and divestiture column for Oilman Magazine that has a social reach of an estimated 145,200 views per issue. The best way to reach Mr. Robbins is through email.