Consumer sentiment is a powerful force in driving climate action. Inspired by this thesis, Sapphire Technologies sponsored a survey of over 1,000 U.S. adults aged 18-plus weighted to be demographically representative of the U.S. population. The findings shed light on opportunities for oil and gas companies (O&G) to educate consumers on the efforts they are taking to mitigate climate change – and the impact those efforts will have on consumers, and their pocketbooks.

Majority Positive Perception

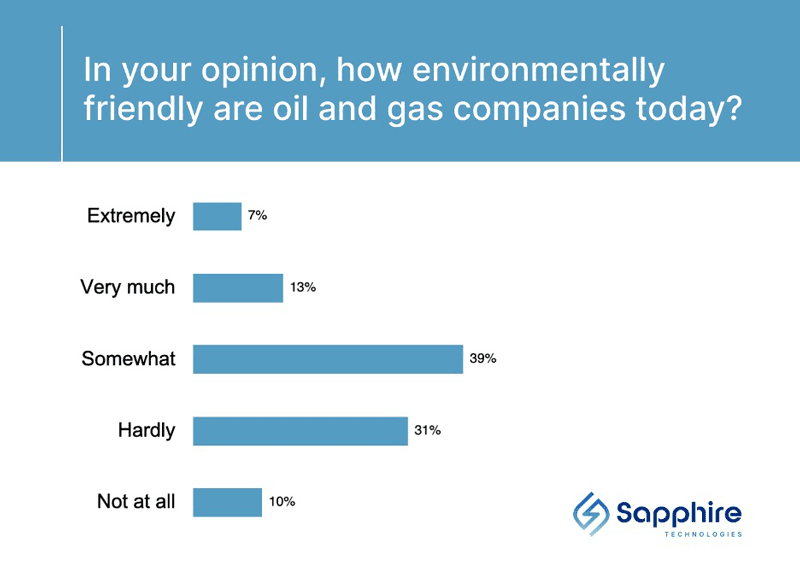

The majority of respondents surveyed believe oil and gas companies are at least somewhat environmentally friendly (59 percent), with 20 percent of respondents believing O&G companies are “very” or “extremely” environmentally friendly. Interestingly, Millennials and Gen Z respondents indexed slightly higher than older generations in indicating O&G companies are “very” or “extremely” environmentally friendly.

These findings are in line with a recent American Gas Association survey, which found that 63 percent of Americans agree natural gas is a clean source of energy and 70 percent believe the natural gas industry should play a role in reducing overall emissions.

Of course, oil and gas companies have made and continue to make substantial investments in reducing emissions, but consumers are not necessarily aware of these investments.

Consumers Lack Information on Specific Environmental Efforts

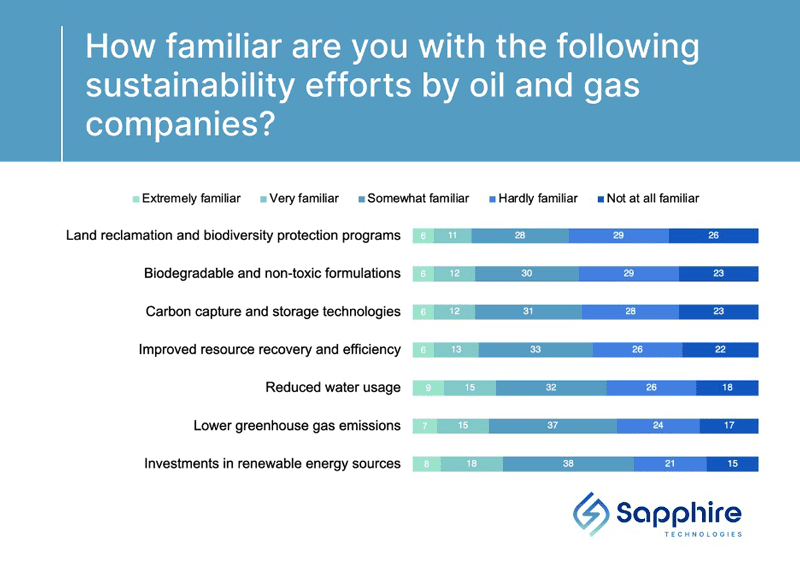

The survey asked consumers how aware they are of specific sustainability efforts by oil and natural gas companies. Perhaps unsurprisingly, given the prevalence of the topic in news media, consumers are most familiar with oil and gas companies’ investment in renewable energy sources – 64 percent of survey respondents were at least “somewhat aware” of these efforts. However, the amount of investment made in a specific area of environmental sustainability did not necessarily correlate with consumer awareness of those efforts.

Indeed, according to research firm Rystad Energy, cumulative global spending on carbon capture, storage, and utilization technologies could exceed $240 billion by 2030; yet, 51 percent of survey respondents were “not at all familiar” or “hardly familiar” with efforts O&G companies are making to expand carbon capture. Leading O&G companies are making substantial investments in scaling carbon capture. According to CNBC, Chevron plans to invest $10 billion in CCS and Exxon has pledged $20 billion to this emissions-reducing technology. In March of this year, SLB and TotalEnergies both announced acquisitions of carbon capture companies to expand their portfolios.

What Messages are Important for O&G Companies to Deliver to Consumers?

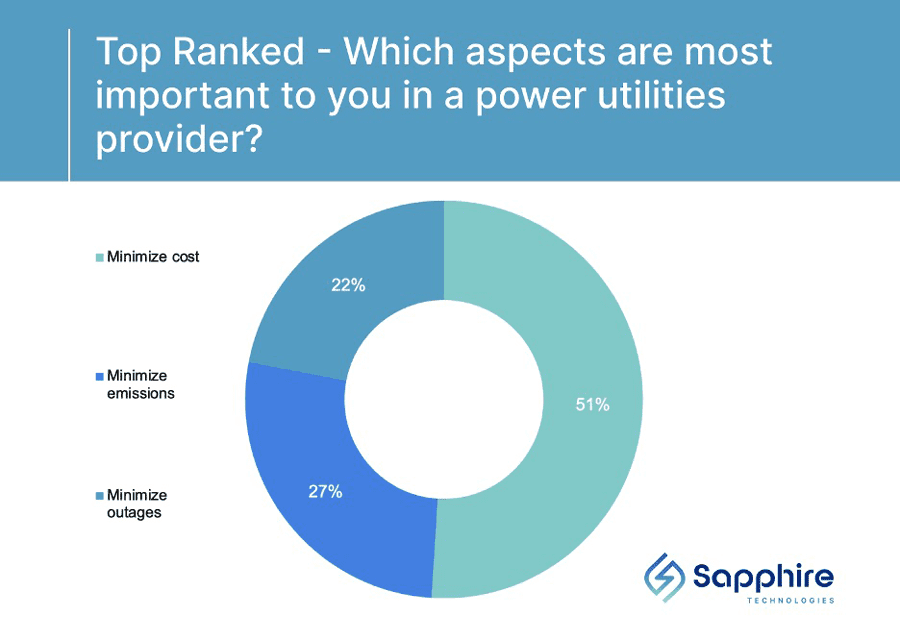

It is important for O&G companies to educate consumers on the environmental impact of their supply chains and on mitigation efforts. However, to do so effectively, it is also important for O&G companies to understand consumer priorities when it comes to energy consumption. The survey asked respondents to rank in importance their top priorities as consumers of energy products. The majority of respondents (51 percent) ranked “minimize cost” as their top priority, “minimize emissions” was the second top-ranked priority (27 percent), followed closely by “minimize outages” (22 percent).

With rising energy costs and both climate-related and geopolitical disruptions to energy security, it’s important to understand consumers care about minimizing emissions; however, they also care about affordability and energy security. As a February 2024 EY study bluntly stated, “Sixty-five percent of energy consumers know how to start making sustainable energy choices, but 70 percent say they will not spend more time or money doing so.” While this may or may not be true, the opportunity exists for O&G companies to educate consumers on environmental efforts while also addressing concerns about the impact of those efforts on energy affordability and energy security.

Let’s return to CCS efforts as an example. Carbon capture projects are underway throughout the oil and natural gas supply chains as a way of reducing emissions. However, these efforts can also yield revenue generating or cost-reducing opportunities for O&G companies which help to offset the cost of investing in these decarbonization technologies. Carbon capture can help reduce venting emissions, and captured CO2 can be injected into oil reservoirs to increase recovery through enhanced oil recovery. Investments by O&G companies in carbon capture and storage technology can also generate new revenue streams through applications in hard to abate sectors. Indeed, according to CNBC, SLB projects carbon capture and storage will account for $10 billion in revenue within its overall energy portfolio by 2040, and Baker Hughes is targeting a market of six to seven times that amount for its new energy business.

Upstream electrification is another area where environmental and economic sustainability go hand-in-hand. Drilling rigs and production infrastructure traditionally use diesel or natural gas turbines. According to SLB, 66 – 75 percent of energy produced is lost in this process. However, low-carbon electricity can provide a solution that both reduces emissions and saves on energy costs for operators.

For example, CNX is partnering with Sapphire Technologies to install Sapphire’s FreeSpin® In-line Turboexpander (FIT) Generators at wellheads. These systems use advanced magnetic technologies to convert kinetic energy from pressure reduction processes to create clean electricity. This clean electricity, generated from otherwise wasted energy in the upstream process, can be used to further reduce emissions by replacing alternative carbon-heavy energy sources.

A profitable business model translates to scalability for energy transition investments. This not only means success against emissions reduction goals, but also it means these investments won’t impact reliability or affordability of downstream energy products for consumers. This is the tactical messaging that it would be prudent for O&G companies to deliver.

How O&G Companies Can Reach Consumers

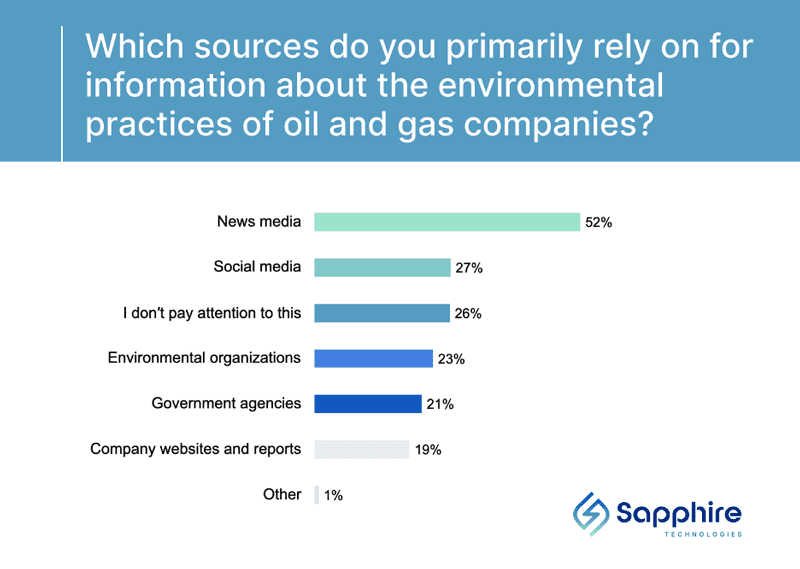

The survey also sheds light on how consumers are getting their information on the environmental practices of oil and natural gas companies today. The majority of respondents (52 percent) turn to the news media to learn about the environmental practices of O&G companies. The news media was the most widely consumed source of information for every generation of respondent except Gen Z. For these younger consumers, social media was the most widely relied upon channel for information (45 percent).

This insight provides both challenges and opportunities for oil and gas companies. While the news media is still the most important information channel for consumers when it comes to education on the environmental practices of O&G companies, social media is of rising importance to younger consumers. Social media tends to support simplified, short-form, and sometimes sensationalized messaging which can pose a challenge when educating on a nuanced topic. However, the companies can look at alternative forms of communication (for example, video and animation) to distill complicated topics into social media-friendly formats.

This insight provides both challenges and opportunities for oil and gas companies. While the news media is still the most important information channel for consumers when it comes to education on the environmental practices of O&G companies, social media is of rising importance to younger consumers. Social media tends to support simplified, short-form, and sometimes sensationalized messaging which can pose a challenge when educating on a nuanced topic. However, the companies can look at alternative forms of communication (for example, video and animation) to distill complicated topics into social media-friendly formats.

Conclusions

While consumers’ overall perception of O&G companies skews positive, O&G companies can benefit from educating consumers around specific initiatives they are taking to reduce environmental impact. However, for consumers, the importance of environmental sustainability must also be weighed against the importance of affordable and reliable energy. O&G companies might find that the best way to talk to consumers about environmental impact actually involves talking to consumers about the full picture – that is, one that takes into account affordability, energy security and environmental impact.

For full survey results, visit our website.