It has become extremely difficult to optimize product movements across an increasingly complex petrochemical supply chain. Chokepoints at shale oil fields are complicated by capacity problems further down the logistical stream that are stimulating the construction and expansion of oil export terminals. Today’s challenges are slowing down product transports, increasing costs, and threatening to prevent oil companies from realizing the full benefits of increased capacity.

To solve these challenges, companies are turning to Industry 4.0 solutions for liquid storage terminals that aggregate sensor and planning/forecasting data into a single shared view while also delivering valuable analytics and real-time alerting capabilities. These tools enable operators to squeeze the highest possible product volumes through their supply chain and transportation infrastructure.

A Tough Problem Gets More Challenging

A 2017 report by the ACC (American Chemistry Council) and PwC (PricewaterhouseCoopers) predicted that, in the larger U.S. chemical industry, excess inventories could soon cost $22 billion in working capital, and capital expenditures (CAPEX) could increase by $23 billion for the equipment and infrastructure required to handle increased congestion and delays. The report also predicted that logistical inefficiencies could result in up to $29 billion in increased operating costs over a ten-year period.

Today’s terminal optimization tools offer a solution, delivering accurate real-time data so operators can make the best possible decisions at all stages of the supply chain – from upstream exploration and petroleum production through midstream transportation to refineries for conversion and storage, and on through downstream processing and the transportation, marketing, and distribution of refined products by pipeline, vessels, rail, and trucks.

Terminal optimization platforms have already played a key role in helping liquid storage terminals absorb massive growth in crude oil transportation traffic from onshore shale finds, over the past few years. Initially deployed at the dock, these web-based and collaborative process optimization tools have enabled users to reduce dock delay times an average of 35 percent within the first few months of their adoption, and to complete approximately 15 percent more vessel calls within the first year. More recently, these tools have evolved to provide planning, reporting, forecasting, analytics, and alerting capabilities across all terminal logistics operations, thus setting the stage for new ways to manage multi-modal product movements.

A New Approach

At the core of today’s terminal-optimization platforms is a combination of real-time and historical AIS (Automatic Identification System) data that enables users to improve visibility into vessel operations and to cut liquid-cargo transportation costs while enhancing safety and security. This enhanced visibility vastly improves processes like demurrage calculation, ensuring that all parties have the same information about demurrage costs and who is responsible for penalties. Everyone can discuss and dispute issues by using the same information about real-time and historical vessel movements, and can collaborate to identify and correct root causes of delays.

In addition to improving visibility, today’s tools also facilitate collaborative real-time operational planning and reporting across all terminal product movements from the dock to tanks, trucks, rail, and pipelines. Stakeholders can work together on an extensive range of logistics operations – from pipeline transfer scheduling, tasking, and line management functions to historical reporting for performance tracking, optimization, and trending analysis. They can also troubleshoot together, solving scheduling and other problems while understanding how actions in one part of the operation affect what is going on elsewhere.

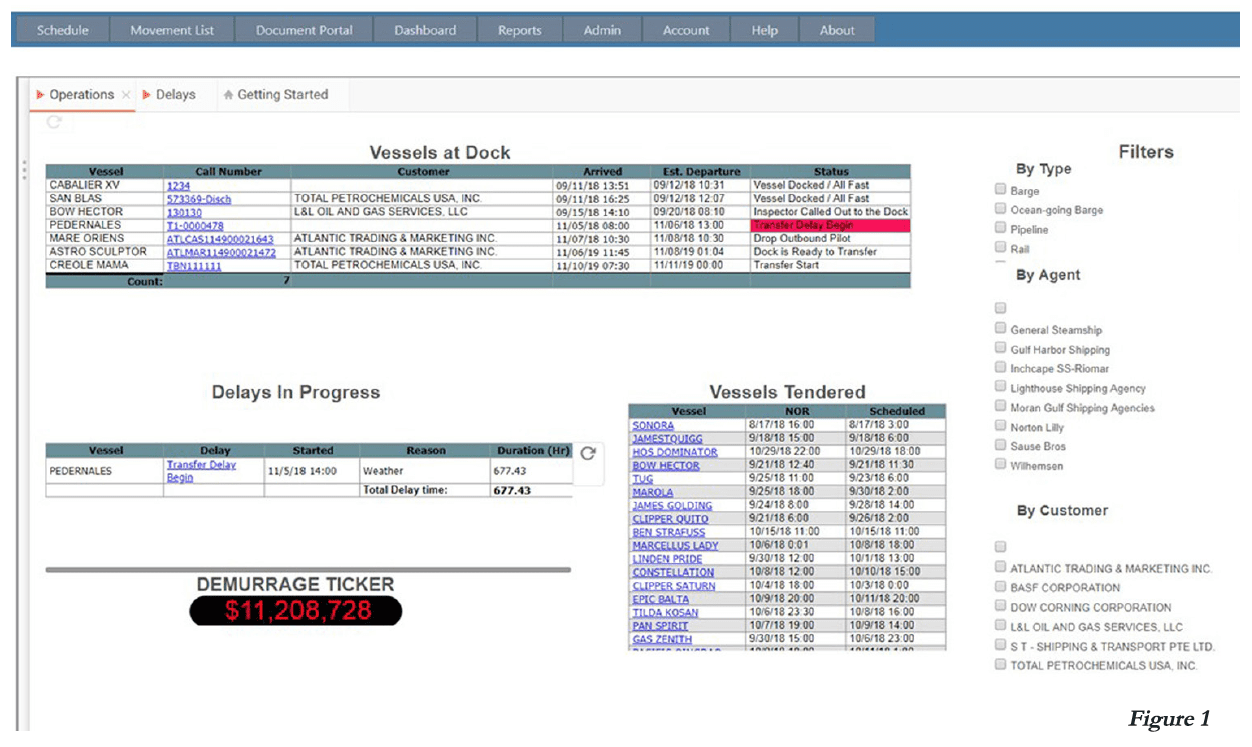

Another benefit of today’s tools is more consistent asset allocation, along with asset-utilization reporting. The most common problem that operators report is when multiple products must go through the same pump and there is an incoming product that requires special handling or that needs more time to transport than other products. Planners can now preempt these problems, oversights, and associated scheduling conflicts by giving teams the necessary logistics information about delays and other issues in order to collectively make complex asset-utilization decisions (Figure 1).

Figure 1: One of the purposes of delay dashboards and reports is to correlate information about inbound pipeline moves and the availability of docks. Dock delay reports improve how users schedule vessel arrival times and manage through any disruptions, while also enabling them to assess how delays impact productivity and demurrage expenses.

All event logging activities are automated, and diverse stakeholders can collaborate anywhere, anytime. Users can build tank-to-tank lineups on the fly and keep them for future use, and do this in a consistent fashion to ensure that everyone can understand throughput for every line and route, identify bottlenecks, and build business cases for additional infrastructure. They can also implement proactive alerting to prevent overfill and underfill situations and other scheduling conflicts.

Additionally, today’s tools deliver valuable forecasting and planning capabilities across all transportation modes and serve as the most consistently accurate source of information – thus enabling all available information to be obtained from a single shared source. Operators can validate capital and outsourcing investments, while also comparing the effectiveness of third-party resources, analyzing investments in additional owned assets, and evaluating a combination of both approaches.

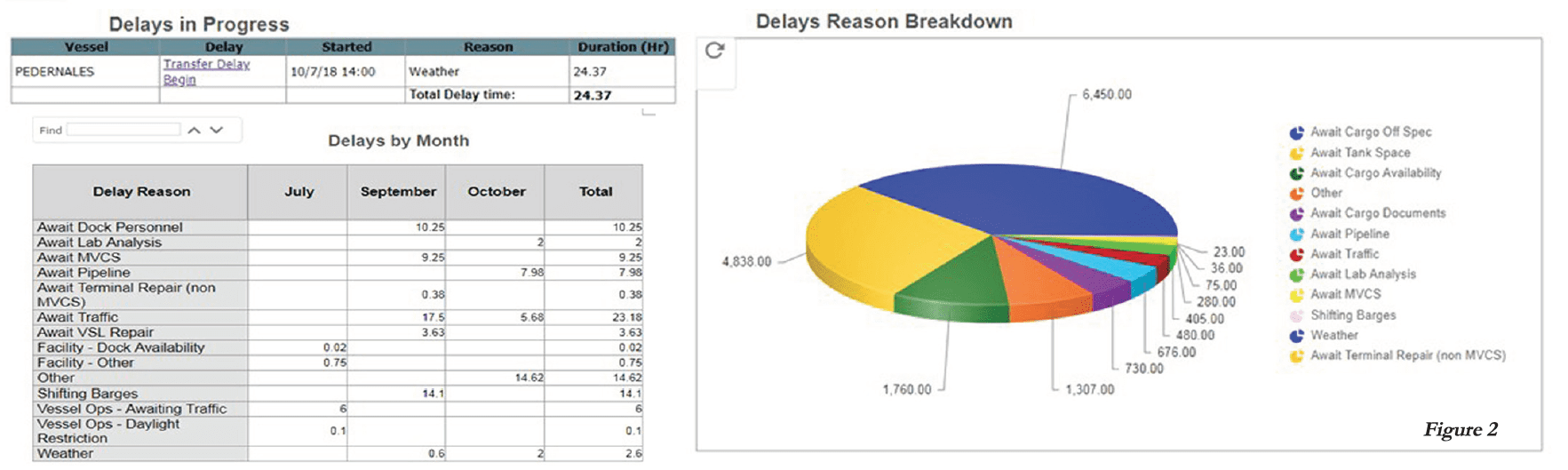

Leveraging Key Performance Indicators

One of the most transformational capabilities of today’s terminal-optimization tools is that they deliver the real-time and historical operational data that operators need to set and manage measurable KPIs (Key Performance Indicators). This capability enables operators to improve and standardize productivity, alert users when corrective actions are needed, and keep operations within desired efficiency envelopes. KPIs help mitigate supply chain risks by enabling all stakeholders to understand root causes of delays, and they facilitate the creation of benchmarks for improving and standardizing best practices (see Fig. 2). KPIs can also be used to trigger alerts before deviations from the target KPI benchmarks exceed accepted thresholds, so users can collaborate on the best courses of action.

Figure 2: Users can also create delay dashboards that drill deeper into the root causes of delays, which facilitates the development and tracking of KPIs for improving and standardizing best practices.

KPIs have traditionally been used to plan capital expenditures on maritime dock expansion projects, and to validate that existing dock capacities were being fully utilized. Now, operators are also using these tools to more effectively plan investments in new tanks and in other storage and transportation infrastructure. With these tools, operators can generate reports on a variety of terminal-wide task metrics and track measurable KPIs ranging from how long it takes to complete one task and launch another, to compliance reports on emissions regulations.

Today’s collaborative terminal process optimization tools are quickly becoming logistics hubs for all product movements – whether they are tank-to-tank transfers or a variety of inbound and outbound pipeline, railcar, and truck movements. These tools are changing how terminals operate by automating significantly more of the supply chain management process. They are also introducing real-time KPIs and trending analytics into capital investment decision making and into the increasingly critical process of improving and standardizing efficiency best practices and benchmarking.

Aaron has over 15 years of business development and project management experience and has interfaced with several ports and terminals along the Gulf Coast to optimize delivery of project cargo and facilitate marine logistics projects. After serving in the U.S. Navy as a submarine officer, Aaron began his career at FMC Technologies and then joined Chevron as an Operational Excellence Engineer working with the onshore drilling and completions team. He then joined FTO Services as a business development manager for a subsea riserless light well intervention service, before joining Signet Maritime, a marine logistics company specializing in tug and barge operations in the Gulf of Mexico. Aaron has also completed over 20 years in the U.S. Navy Reserves as a submarine officer. He graduated from the United States Naval Academy and is also a distinguished graduate of the University of Houston with an Executive Masters of Business Administration degree.