Everywhere you look, the news is sobering, but industry experts remain confident that the oilfield can lower its cost structure and weather the downturn. We hear the same from our clients and see some companies making smart decisions to remain on top. The following strategies are being used successfully to expand revenue, reduce costs and improve cash flow. You may find at least one of these strategies to be new, relevant and impactful to your business now, and you may emerge stronger when the market improves.

Revenue Strategies

During periods of decreased activity, protecting key customer relationships becomes even more critical to maintaining revenue than during an upswing. Expanding revenue into ancillary services can also produce positive results. Recently, one of our clients credited his good reputation to keeping his company operational and continuously selected over the major providers. He defined his reputation as delivering “good quality work, every day, all the time.” With sufficient revenue, his company capitalized on low valuations and purchased another service company. Those outcomes resulted in a new type of revenue stream, presence in a desirable geographic area, and additional sales staff.

Also consider expanding revenue horizontally into industries less affected by the downturn, or into those experiencing increased demand due to lower fuel costs, such as transportation. Evaluate not only the potential financial and diversification benefits, but also the requirements for training, certifications and insurance, and the impact on your safety record.

Be willing to negotiate lower prices, but tie those prices to commitment levels and an expiry date or automatic escalation clause based on the price of oil, so you are not stuck when prices improve. Bundling services can allow more room for margins since operators will often pay more to deal with less suppliers.

Consider mergers and acquisition right now. Company valuations are low, so it’s not the best time to sell, but it is a great time to buy. Mergers reduce fixed costs and can improve chances of surviving. This merge-now-sell-later strategy can lead to a higher valuation in the future both from higher prices and being a part of a larger entity.

As reported in my article from the Texas Annual Energy Symposium, Jason Wilcox, an experienced O&G investment banker, said, “Back office sophistication is often more lacking in technology compared to the technology in the field. What buyers are looking for is assurance that they are getting what they are being told.” He explained that when the technological and geographic advantages of two firms are relatively equal, a business with an auditable accounting system is far more attractive than one run with editable spreadsheets and off-the-shelf bookkeeping software.

We all know maximizing asset utilization increases revenue and profitability. Thus service and rental companies should know the utilization of each equipment type and be able to quickly identify and fill excess capacity. Accurately recording equipment deployment, movement and returns keeps asset locations current and minimizes asset loss. Mobile apps on wireless devices, including iPads, Androids, Windows tablets and phones, can make any information readily available in the field, eliminate the problem of lost revenue from missing field tickets, and help assure a job’s full equipment, consumables, and service usage is invoiced. Lost field tickets and errors deciphering them can disappear like the days of $140 oil.

Cost Reduction Strategies

Some of the easiest areas to cut costs include discretionary items like travel and entertainment; however, to lower costs more significantly, take a closer look at each line item in your financial statements and require its existence to be re-justified given the current environment.

Recognize that the decision to cut a line item should not be based solely on its relative net cost or profitability. For example, deciding whether to shut down a remote site would also involve weighing the strategic impact of having a presence in the area; the likelihood of being able to reclaim such presence when the market recovers; the affect on key personnel and customer relationships; and the possibility of subleasing excess space or relocating to a smaller space.

Vertically integrate, where feasible. Consider building your own customized equipment for a job, versus buying or renting. That strategy can both lower cost and lessen the need to layoff some otherwise idle workers.

For some companies, reducing headcount is the largest cost-cutting move. Evaluate whether a temporary, across-the-board salary reduction is sufficient. Some worry that letting people go will result in a manpower shortage when activity rebounds. We have found that improved systems can reduce costs and increase efficiencies to the point where even higher activity levels can be supported with a fraction of the manpower, thus rendering the need to re-hire these roles a moot point.

A single, integrated system can eliminate duplicate software licensing and support fees and redundant data entry labor costs and errors, and it can provide immediate visibility into the profitability of all segments of the business for timely decision making. In tandem with layoffs, it may also make sense to consider outsourcing some back office and accounting and functions, or hosting IT.

We have seen variable incentive pay compensation motivate drivers to self-optimize routes and schedules, thereby reducing fuel costs. This concept can be used in other aspects of a business, and is especially effective if performance feedback is timely with real-time or weekly numbers.

Cash Flow Strategies

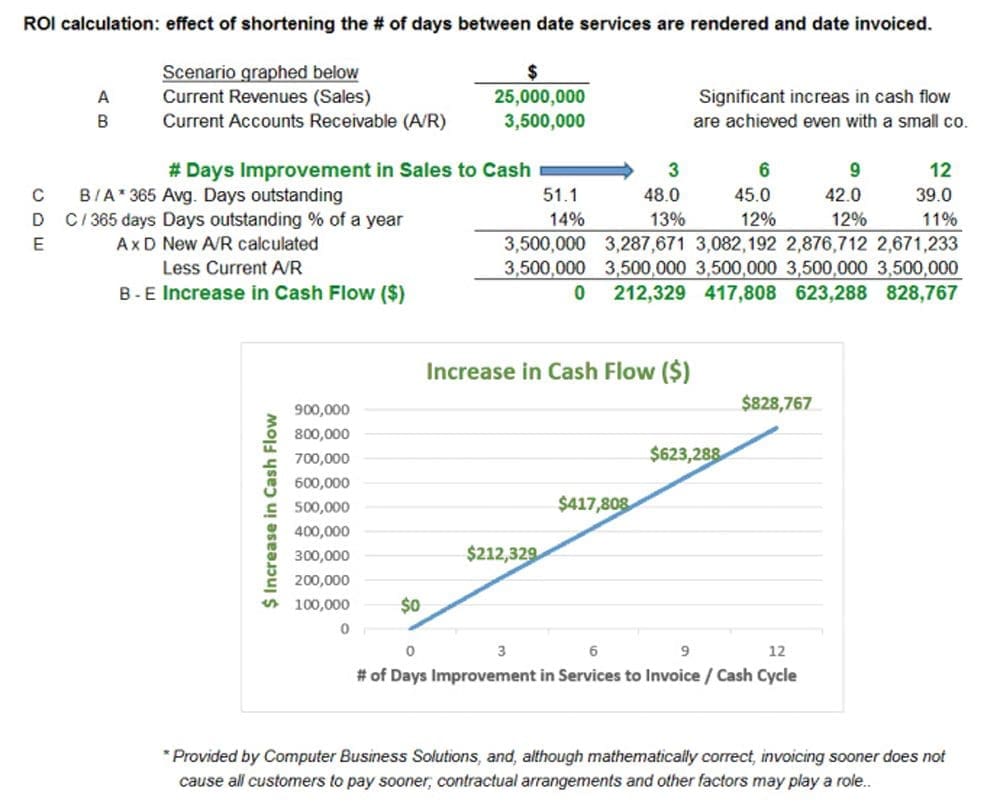

One of the easiest methods to improve cash flow is to shorten the number of days between the date a service is performed and the date it is invoiced. Wireless devices with mobile apps that enable equipment usage and other field ticket information to be entered in the field and electronically billed can shave days off that process. The impact of reducing average days between services performed – or goods delivered – and invoice payment can be significant, as illustrated in Figure 1.

You may even consider factoring your receivables. That process involves selling your accounts receivables to a third party – a factor – at a discount. It is often an expensive proposition; however, cash is received sooner from the factor, rather than waiting on the customer. Factoring is easier to set up and qualify than a bank loan since it is based more on your clients’ financial strength and their ability to pay, than yours. But don’t be caught by surprise; forecast your cash flow – always a good idea – and keep a keen eye on your liquidity.

Emerge Stronger

All of us know that the oil and gas business is cyclical, and like other businesses, the good times have led to bloated processes, systems, and payroll. This is the time to reexamine processes and costs, and to ensure technology is able to support the business during lean times. Oilfield companies executing on wise decisions will emerge stronger, reminiscing how $45 oil prices provided the catalyst to their long-term success.

Dennis R. Smith is the founder and president of Computer Business Solutions Inc. – CBSi-Corp.com. He graduated from Southern Methodist University with a BBA in Finance/Economics, and earned his MBA from Pepperdine University. At CBSi, his team has designed and created a suite of OGFSTM software modules based on Microsoft Dynamics specifically for the industry.