There was talk when the COVID-19 crisis hit that it would sidetrack, at least temporarily, the oil and gas industry’s “beyond the barrel” diversification into new, more sustainable lines of business and, in doing so, set back global efforts to decarbonize the energy mix in order to address climate change.

Instead, the opposite has happened, at least for the dozen or so super-majors whose CEOs comprise the Oil and Gas Climate Initiative (OGCI).

“The reality,” states a May 26, 2020, letter signed by the 13 CEO members of the consortium, “is that rather than shifting our priorities, the COVID-19 crisis is further crystallizing our focus on what is essential: health, safety and protection of the environment while providing the energy and vital products that society needs to support economic recovery.”

A significant portion of those CEOs — including top execs from Repsol, Total, BP, Equinor, Shell and ENI — have committed their organizations to a specific target: net-zero emissions by 2050 or sooner. And others around the globe are following suit, if not with net-zero commitments then with other emission-reduction programs. During a September 2020 meeting of the United Nations General Assembly, Chinese President Xi Jinping pledged that his country, the world’s largest producer of greenhouse gas emissions, would achieve carbon neutrality before 2060.

Moving from a heavily hydrocarbon-leaning energy portfolio to one that is more diverse and carbon-neutral won’t happen overnight. But even fossil fuel-focused oil and gas organizations are acknowledging it’s time to get serious about carbon-reduction.

“Meaningful action toward climate progress is rooted in investment and innovation, and no one is investing more in clean tech than the U.S. oil and natural gas industry,” Todd Staples, president of the Texas Oil & Gas Association, writes in a recent column published in the San Antonio Express-News.

The kind of meaningful action to which Staples refers is largely predicated on a company’s ability to diversify its business portfolio and manage emissions across that portfolio in a digitally intelligent way. Doing so will require oil and gas companies to focus on three key areas:

Mindset. An August 2020 study from Oxford Economics identifies a class of high-achieving oil and gas companies that share a business approach and mindset known as systems thinking. Systems thinking, the study explains, is “a way of seeing the entire web of relationships within and beyond the organizational firewall as a unified entity that operates smoothly, dynamically and as part of a cohesive strategy.”

According to the study, whose findings come from a survey of 3,000 senior executives across ten industries, including 300 from the oil and gas business, there’s a clear link between systems thinking and overall results. “Leaders are far more likely than other respondents to say they have integrated communication and data-sharing processes across the business, increased transparency into operations, broken down organizational silos and invested in collaborative technologies.”

Another common thread among this elite class of oil and gas companies is its embrace of a purpose beyond short-term profitability. The Oxford Economics study finds that those companies “have created and taken meaningful action on a clear and consistent purpose-driven vision.”

What does systems thinking look like when it’s applied to a purpose such as carbon emission-reduction? At the organizational level, it means every part of the company is connected and accountable toward meeting that goal. It means extending that interconnectivity to the company’s partners and suppliers, with uniform data standards and transparent information-sharing along the entire value chain. And particularly with regard to sustainability and emission-reduction programs, it’s about linking employees explicitly to a purpose like net-zero carbon emissions. “Providing employees with a clear and consistent purpose-driven vision that is backed by substantive action is key” to thriving in an uncertain future, asserts the Oxford Economics report.

Agility. Rather than neglecting their oil and gas origins, companies like ENI are diversifying around them with that net-zero 2050 target in mind. Amid a flurry of announcements about partnering on a new laboratory that’s investigating ways to turn the power of ocean waves into electricity and investing in solar and wind ventures in the United States, the Italian company also was touting a new natural gas play off the coast of Egypt.

Likewise, another OGCI member, Spain’s Repsol, was opening an offshore windfarm along the Portuguese coast, launching an electric vehicle charging venture with the automaker Kia, and closing a renewable energy acquisition in Chile at about the same time it was announcing a new deepwater oil discovery in Mexican waters.

Successfully developing new renewables-focused ventures alongside traditional oil and gas lines of business requires a company to have a strong, flexible digital infrastructure, one that provides a platform on which a company and its business partners can connect, share information and collaborate. That digital platform also should enable data and real-time insight to flow unimpeded, so these new lines of business seamlessly integrate into the broader enterprise. With advanced modeling and predictive capabilities as part of that platform, a company (and its partners) can model various pricing, billing, consumption and customer preference scenarios to gain valuable strategic insight into how to position a new venture.

Molecule management. To ensure their beyond-the-barrel ventures run efficiently and profitably alongside their traditional oil and gas lines of business, while producing the desired emissions reductions, it’s vitally important that energy companies be able to measure the energy molecule’s entire journey downstream, however it was produced. Using data and analytics, companies can begin to make direct correlations between specific asset-management tactics and emission reductions.

They also need to be able to measure and accurately report every particle of emissions, from exploration to extraction, processing and transportation, through to product use and end-of-life treatment. This data is valuable on multiple levels — for regulatory compliance, for measuring progress toward carbon-reduction goals, and for public relations purposes, to differentiate a company as sustainably minded in the eyes of consumers and the workforce. As the Oxford Economics study points out, “Efforts toward sustainable operations, net-zero carbon footprints, and green energy production are a strength in the talent marketplace for companies in the [oil and gas] sector.”

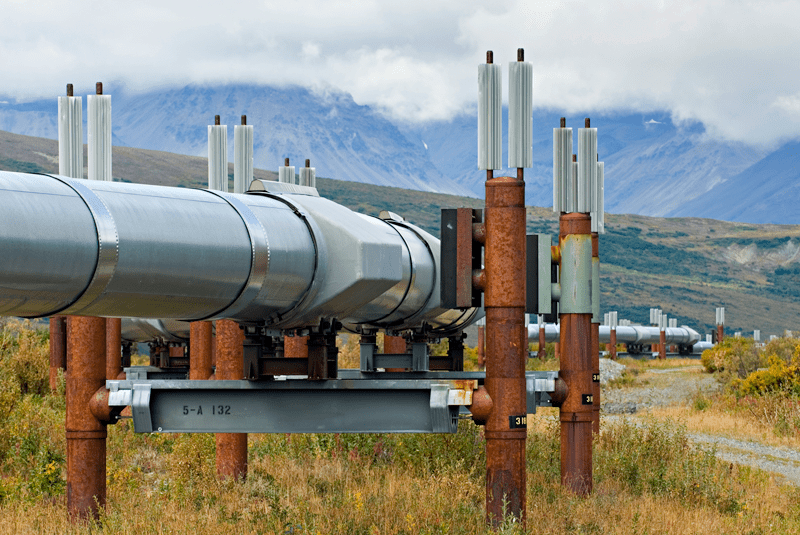

Headline photo: A significant portion of oil and gas CEOs have committed their organizations to a specific target: net-zero emissions by 2050 or sooner. It’s going to take a shift in mindset to achieve this goal.

Photo courtesy of Feed Media

Brent Potts is senior director of global marketing, oilandgas, at SAP.