Obtaining robust market intelligence for a complete view of the oil and gas industry across the supply chain comes with its fair share of challenges. The rise of web search engines made access to publicly available information easier for companies to tap into disparate competitive resources that were hard to access previously. For modern researchers and analysts, the burden now rests on distilling disparate public and proprietary resources to identify consensus and track long-term impact of emerging trends.

One of the biggest benefits of AI is the ability to distill large amounts of information quickly and efficiently, giving researchers a new way to streamline insight discovery and focus on more strategic initiatives. NLP (Natural Language Processing), an AI technique that focuses on the understanding of human language, works to add a contextual layer, with the ability to distinguish nuances and tonality in differentiated verbiage – uniting different sources that share similar themes under a shared context or sentiment, regardless of variations in terminology.

Understanding Macro Trends

Developing a full understanding of the long-term impact of current macroeconomic trends is a balancing act of collecting information en masse, while maintaining a razor-sharp edge on the most important insights to inform strategy. Complexity deepens when the market landscape takes the global stage, with different entities using different verbiage to discuss similar themes. How are different stakeholders responding? What is the tonality of companies that face potential impact? What is the consensus of Wall Street analysts, and how does it vary from other global perspectives?

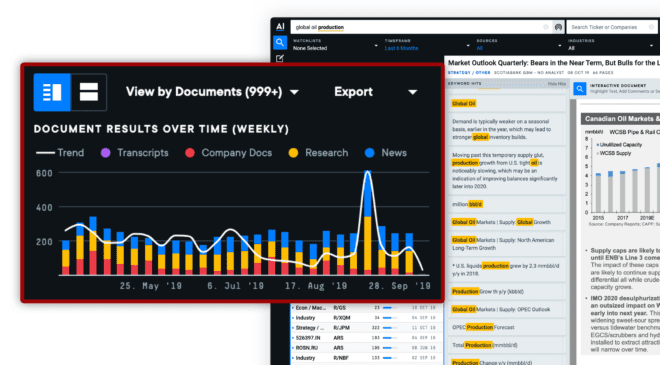

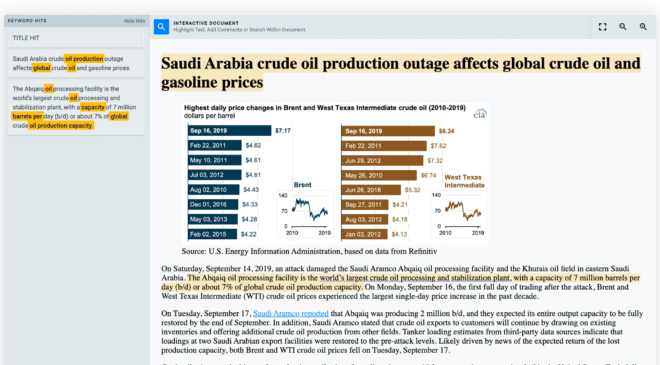

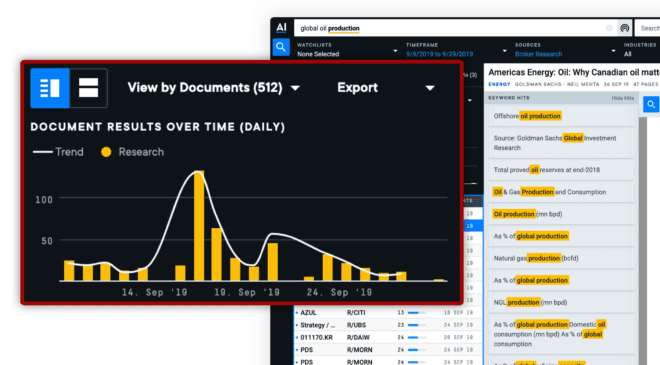

For example, in September 2019, an unexpected drone attack on Saudi Aramco facilities raised a flurry of questions on the impact on the price and supply of crude oil. According to AlphaSense data, contextual mentions of “global oil production” spiked throughout the week of the attack across a range of document types – especially within broker research, news and company presentations.

Dissection of these different content sets together in real-time can lead to a greater understanding of both the short-term and long-term implications of the event as a whole.

First, let’s look at regulatory data, which is notoriously difficult to mine when searching through agency repositories. Further investigation immediately reveals a highly relevant EIA regulatory report released on September 23 detailing an immediate production drop at Saudi Aramco facilities to 2 million b/d in wake of the attack – down from estimates of 6.7-9.9 million b/d of crude oil production in August.

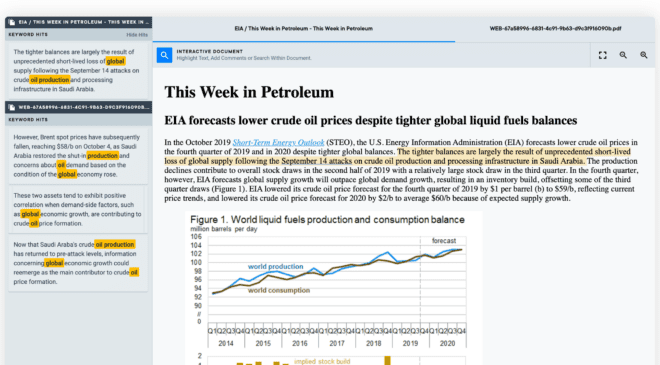

A later report filed by the EIA at the start of October forecasts lower crude oil prices through the duration of Q4 and into 2020, despite tighter global balances in wake of short-term loss of supply, stating; “The tighter balances are largely the result of unprecedented short-lived loss of global supply following the September 14 attacks on crude oil production and processing infrastructure in Saudi Arabia.”

The report also states that supply will outpace demand into Q4, posing questions over inventory. Understanding and tracking these larger regulatory forecasts can be useful when assessing your own planning and forecasting in light of shifting oil prices and demand.

Analyzing broker research alongside other content resources can help affirm strategy in alignment with forecasts from the Street. Broker research is also especially valuable when extracting data tables to build out your own reporting. According to AlphaSense trends data, more than 400 broker reports discussing global oil production were released within the two weeks following the attack, with a spike on September 18. Of those reports, 217 of them mentioned Saudi Arabia. Sorting and filtering these reports by relevance, broker tag, and report type can give you a more robust, qualitative view of the issue.

Drilling in deeper, analysts can leverage sentiment analysis to immediately understand how other market leaders are discussing industry issues to help affirm their own consensus. Sentiment analysis leverages deep learning AI models to identify tonality of language. When those AI models are applied to company documents like earnings transcripts, analysts can quickly identify how companies are discussing specific trends and how that language may have changed over time.

When looking at all earnings transcript mentions of “global oil production” through 2019 (63 at the time of the study) we found that overall sentiment skewed negative (38 percent overall positive, 62 percent negative). Total SA explicitly addressed the Saudi Aramco attack at their Investor’s Day conference on September 30, saying: “It’s also a shock for the oil markets because obviously, it increased somewhat the risk premium in the oil price, and it might also force the market to reconsider what are the acceptable levels of inventories and spare capacities in the world.”

This is an interesting insight from Total SA, and could also be worth noting when considering planning and forecasting for changes in demand and inventory in the event of short-term shifts in global supply.

Using AI for Planning and Forecasting in Oil and Gas

The future of AI within the Oil and Gas space is promising, with companies already investing heavily in AI to improve processes, increase production, and reduce waste (research shows oil and gas investment in AI is projected to reach $4.1 Billion by 2025). When it comes to corporate planning and forecasting, AI tools can help elevate market intelligence by consolidating and streamlining insight discovery, and adding greater contextual depth for a more complete picture of the market landscape and the potential short and long-term impact of macroeconomic trends.

The ability to forecast effectively, while still remaining nimble is strengthened by those nuggets of information that can provide the greatest confidence in affirming or dissuading hypotheses in both near-term and long-term scenario planning. An information edge is also obtained when these insights are discovered early, allowing for room to quickly and confidently execute ahead of competitors, identify opportunities, improve processes, or preemptively safeguard against unfavorable market conditions to mitigate impact on the bottom line.

Jack Kokko is the CEO and founder of AlphaSense, a groundbreaking AI-based market intelligence search engine. His mission is to leverage AI to help businesses acquire information more efficiently, and make better decisions more quickly and confidently. AlphaSense is currently used by over a thousand investment management firms and corporations across all industries, and has won numerous industry awards, including “Best Analytics Product” and “Best Mobile Solution.” Jack holds an MBA with a major in finance from the Wharton School of the University of Pennsylvania. He also holds a master’s degree in electrical engineering from the University of Oulu, Finland and a bachelor’s degree in finance from the Helsinki School of Economics.