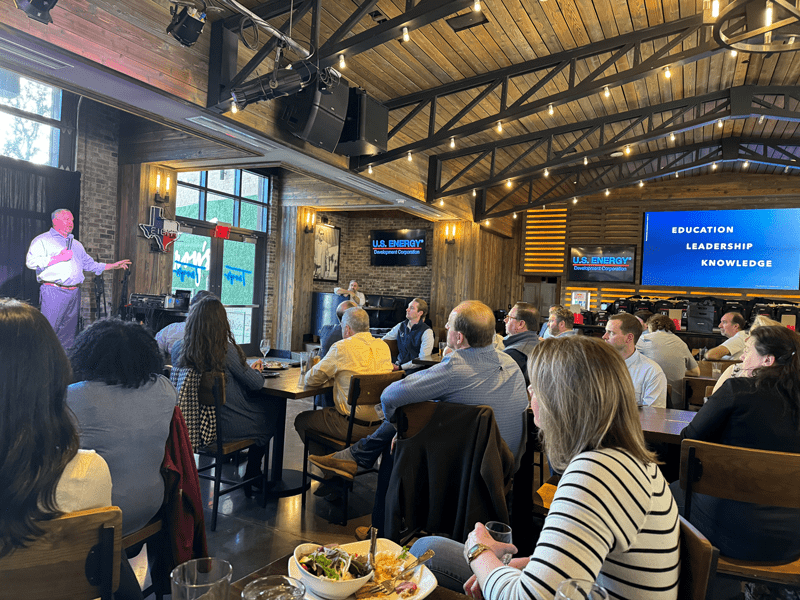

They say the backbone of the United States continues to be the birth and success of small businesses. When analyzing it from the oil and gas vantage point, U.S. Energy Development Corporation would be one of those inspirational success stories of small businesses forming in the most unlikely of places and then growing into a pillar of stability and longevity.

CEO Jordan Jayson returned from a career on Wall Street to lead U.S. Energy, started by his parents, to the next level as a competitive and stable independent production company utilizing intelligent business practices and a robust strategy to navigate the turbulent waters of today’s oil and gas industry. While stories of fortune permeate history and originate in popular plays like the Lonestar state and North Dakota’s Bakken, U.S. Energy hails from Buffalo, New York.

“In western New York and the southern tier of the state, there is a rich history specifically of shallow gas and deep wells, but there is a moratorium on chasing deep gas,” says Jayson. “The first natural gas well in the United States was actually discovered just over an hour from Buffalo.”

After some rebranding in 1980 and Jayson later joining the family business, the early 2000s dictated a new vision. The company began primarily by focusing on operating vertical wells in Appalachia and expanding joint ventures to other parts of the country. Soon, Jayson and the company would expand their footprint to Texas, Oklahoma and New Mexico. Texas proved to be such a hotbed of activity that U.S. Energy relocated its corporate headquarters to Arlington. Now, it has set its sights on moving to Fort Worth within the next six months.

Targeting Areas of Opportunity

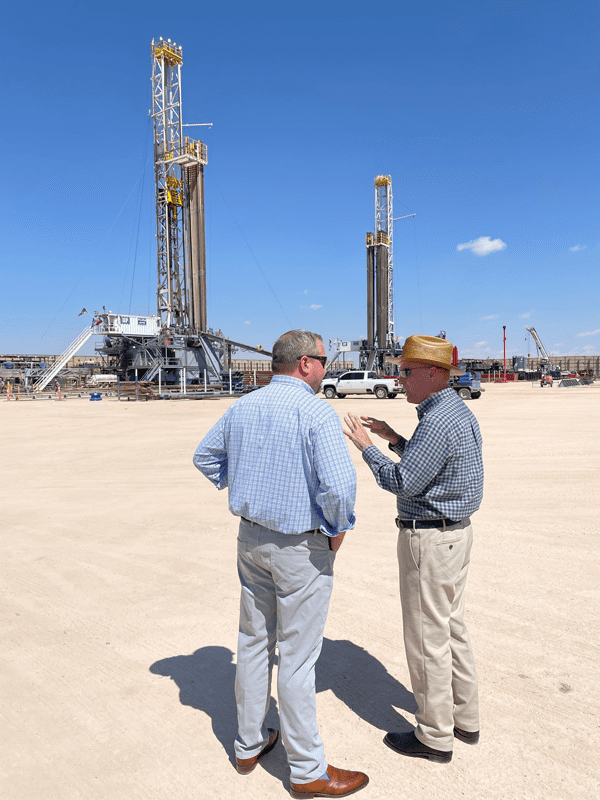

Driven by opportunity, Jayson points to interest in the Permian Basin, Eagle Ford, Powder River Basin, and the Haynesville plays. The company concentrates more on each new business prospect instead of focusing solely on the location, which allows for smart spending.

“As a firm, we are somewhat basin agnostic,” says Jayson. “We have a large non-op presence in the Bakken and have participated in DJ projects and shallow well projects in Kansas. We look at ourselves as opportunity-driven by returns and trying to do the best we can to deploy our capital and our partners’ capital.”

This strategy resonates as it supports the new oil and gas industry’s responsible and strategic spending theme. Over the past four to five years, new projects have accounted for approximately 85 percent of U.S. Energy’s capex in the Permian’s Delaware Basin.

“We have made some PDP production-type acquisitions over recent years in the Permian, but we are looking to drill wells as an operator or participate in drilling projects as a non-operator in those areas. The majority of our dollars go toward drilling new wells primarily at this point in the Permian.”

Addressing Flat Spending Predictions

As the oil and gas industry ramped up for 2024, many financial institutions analyzing the industry predicted an uptick in capex spending for the international and offshore markets. Still, North American shale would stagger through the year with a flat spending plague. Jayson indicates those predictions were accurate. With spending not showing signs of increase, he reasons consolidation will continue to play out for the remainder of the year.

“I think that it is pretty evident that the market likes when the E&P companies are drilling within cash flows and making distributions through dividends back to shareholders,” says Jayson. “The industry through consolidation provides opportunities for smaller companies through joint ventures.”

Through careful venture evaluation and spending allocation, Jayson has steered U.S. Energy away from consolidation and to opportunity instead. With its stable financial portfolio, the company can embrace growth and spending ease by partnering with other companies, like those who see consolidation as the only means of survival.

“We evaluate upward of 400 to 500 deals per year and traditionally buy somewhere between five to ten percent,” says Jayson. “We are constantly looking at new opportunities. That activity has not slowed down each year.”

But, if capex spending is flat, Jayson said it is not at a material level. He defines the current market situation as a good pricing environment with the service industry in a premier spot.

“Right now, companies are laser-focused on making good decisions, paying dividends, and being thoughtful in how they are spending their money,” says Jayson.

Regardless of the industry’s overall spending habits and the predictions wagered toward them, Jayson remains loyal to U.S. Energy’s spending blueprint. Because of the company’s size and commitment to operating within its means, Jayson says its spending must refrain from surpassing cash flow. As a result, the firm continues to be prudent in allocating funds.

“Our behavior and how we allocate dollars has changed drastically, and we look at the risk management side and talk about potential downturns,” says Jayson. “While it is a lot more fun to talk about growth, we have to talk about preparing for downturns and be thoughtful that if there is a correction in the market or production does go lower because of a group of wells that underperform, [then] we need to identify the adjustments we can make internally so we can continually improve our financial position.”

Identifying Funding

Spending strategies influence growth and new opportunities. In addition to capital limitations, focal areas influence where funds are allocated. While some companies might decide to follow technological advancement and seek to develop new ways to increase production, others might adhere to the traditional methods of drilling more wells. Current acquisitions include vast PDP components, production potential, and a high volume of locations to be drilled.

“I think it is a combination of gas [that] is lower than what we would like it to be, and oil has found a range while companies are looking at inventory to decide if it is a good time to buy drilling and production,” says Jayson. “From U.S. Energy’s standpoint of being a smaller company, we do the same thing but at a smaller scale. We are looking for good PDP-producing assets to negotiate and transact on and layer on additional locations.”

According to Jayson, funding parameters are a sizable principal factor in determining where to allocate these funds for growth. Traditional lending at the corporate banking level remains a challenge. Therefore, creative solutions must be wagered to secure funding.

“All E&Ps’ ability to lever companies up with traditional corporate banking is still impaired,” says Jayson. “They are not as aggressive as they once were, and they are extremely conservative right now, and they do not move very fast. Unless you have the right financial partner that has the dry powder to fund your acquisition and development growth, then there are a lot less players willing to fund A&D growth. Those remaining today are more conservative than 10 to 15 years ago.”

As a result, Jayson approaches funding through robust partnerships. Selecting the correct fit in a partner for ventures assists in taking some of the pressure off when it comes to financial costs, but it also opens the door to increased opportunity. Each party brings a strength that outweighs the partner’s weakness. When the match is made, the venture possesses a more significant opportunity to weather costs and gain profits.

Realizing the Political Component

While the political landscape can impact the oil and gas industry, Jayson does not feel it influences spending. Regulations directed at oil and gas carry a cost factor, but the areas affected are already included in companies’ calculations when operating the businesses.

“I frankly do not believe the political environment influences much on spending,” says Jayson. “Even a company our size has its ESG policies, HSE policies, and has been focused on the environment for at least the past 15 years.”

Jayson points to project development as a place where the political landscape impacts development. That influence can originate from both the federal and state levels and can bruise the potential for future growth.

“Some state regulatory bodies can severely impact development plans on different projects in those areas,” says Jayson. “From a federal standpoint, the government can come in and reduce the permitting in areas like the Gulf of Mexico and in Alaska, but that is all outside of companies self-implementing ESG. There is a lot of window dressing. The industry has been implementing best practices for years, and we continue to improve.”

Regardless of legislation implemented at the state and federal levels, Jayson remains focused on successfully managing U.S. Energy. From his vantage point, rules and regulations will continue to evolve. A more direct and head-on approach provides a better path to managing these issues and finding opportunities.

“We have a company to run, and we have to adjust and implement rules as they are mandated,” says Jayson. “At the end of the day, we need to find good projects, make good decisions, and hire great people.”

Headline Photo: Construction site visit at U.S. Energy’s future home in The Armour Building, located in the Fort Worth Stockyards Historic District.

Nick Vaccaro is a freelance writer and photographer. In addition to providing technical writing services, he is an HSE consultant in the oil and gas industry with twelve years of experience. Vaccaro also contributes to SHALE Oil and Gas Business Magazine, American Oil and Gas Investor, Oil and Gas Investor, Energies Magazine and Louisiana Sportsman Magazine. He has a BA in photojournalism from Loyola University and resides in the New Orleans area. Vaccaro can be reached at 985-966-0957 or nav@vaccarogroupllc.com.