In its 2008 modernization of reserves reporting rules, the U.S. Securities and Exchange Commission (SEC) introduced the idea of “reliable technology” as the basis for procedures proposed to estimate reserves. Reliable technology must be based on sound scientific and engineering principles, and must have been found in practice to lead to the correct conclusion the vast majority of the time when used to estimate proved reserves.

This idea provides both a challenge and an opportunity to reserves filers: The methodology we use to estimate proved reserves reported to the SEC must satisfy these criteria. However, if we are able to provide convincing evidence that methodology we use has, in fact, almost always led to correct conclusions in the past, then we can reasonably expect the SEC staff to accept our reserves filings. The prudent reserves filer will use reserves estimation techniques, including software, which meet the criteria for reliable technology. To ensure compliance, the software developer must be able to back up the claim of reliable technology with extensive field evidence.

The Problem

The SEC allows filers to use new and novel procedures to forecast production and reserves if the procedures satisfy the criteria for reliable technology. There are no constraints on what you can use, just criteria that have to be met.

The problem is that most filers are quite conservative and don’t want to break away from the tried and true methodology that they’ve been using for years. That problem means that many filers aren’t taking full advantage of the opportunities and flexibility in reserves estimation procedures provided by the ruling of the SEC to allow the use of reliable technology.

The Solution

If that’s the problem, then the solution is obviously that reserves filers need to become familiar with reliable technology and the criteria required to apply it. Of course, most of us don’t have time to pioneer reliable technology on our own. A few large companies do and have, but for most companies, it’s a better idea to let software developers do some of the heavy lifting. Let them propose new and novel technology to enhance accuracy of production forecasting and reserves estimation. But while they do that, filers need to be willing to break away from the tried and true to motivate software developers to pursue proven, reliable technology.

But Why Bother?

You may ask yourself, why bother going through this trouble if you know that your tried-and-true methods already meet SEC reserves reporting rules? Because the benefits of using new, reliable technology outweigh the possible inconvenience of ensuring the technology meets SEC standards, particularly if the software company does the heavy lifting to prove their methodology.

As examples, reliable technology can increase proved undeveloped reserves (PUDs) estimates in unconventional resources, by expanding proved area well beyond immediate offsets and increasing reserves with more favorable aggregation of individual well EURs. Reliable technology can improve the accuracy of type well construction, whereas current industry practices often lead to inaccurate results. Among the early adopters of reliable technology are companies using seismic to establish hydrocarbon-water contact much lower than LKH from drilling. All of these example have been accepted by the SEC.

What Makes Technology “Reliable”?

What about methods we haven’t thought about yet? What are the criteria that makes the technology “reliable”?

For a technology to be considered reliable, it must be based on sound engineering and scientific principles and have been shown in field applications to lead to correct conclusions the vast majority of time (for proved reserves). Ivory tower claims won’t cut it! When a filer can demonstrate to SEC staff that reliable technology criteria are satisfied, reported reserves then meet SEC standards.

Example of Reliable Technology for PUDs in Resource Plays

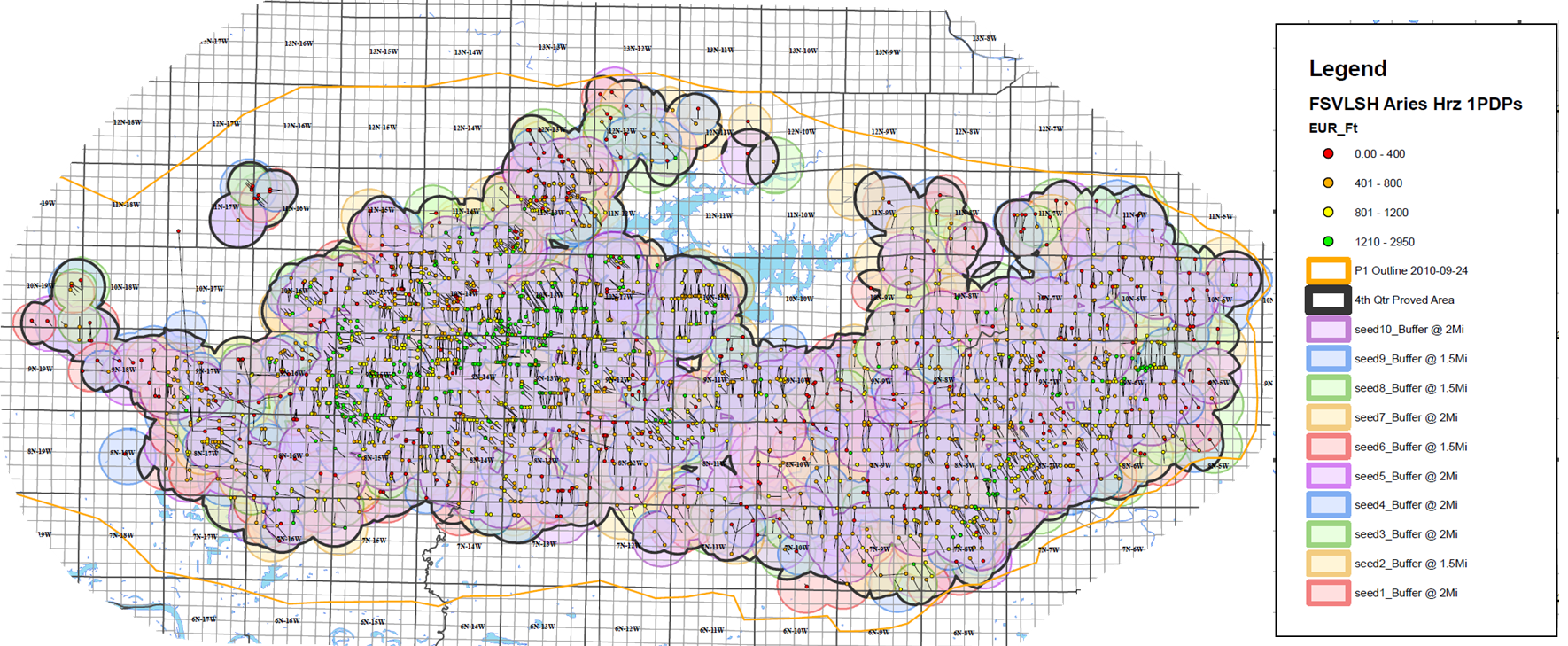

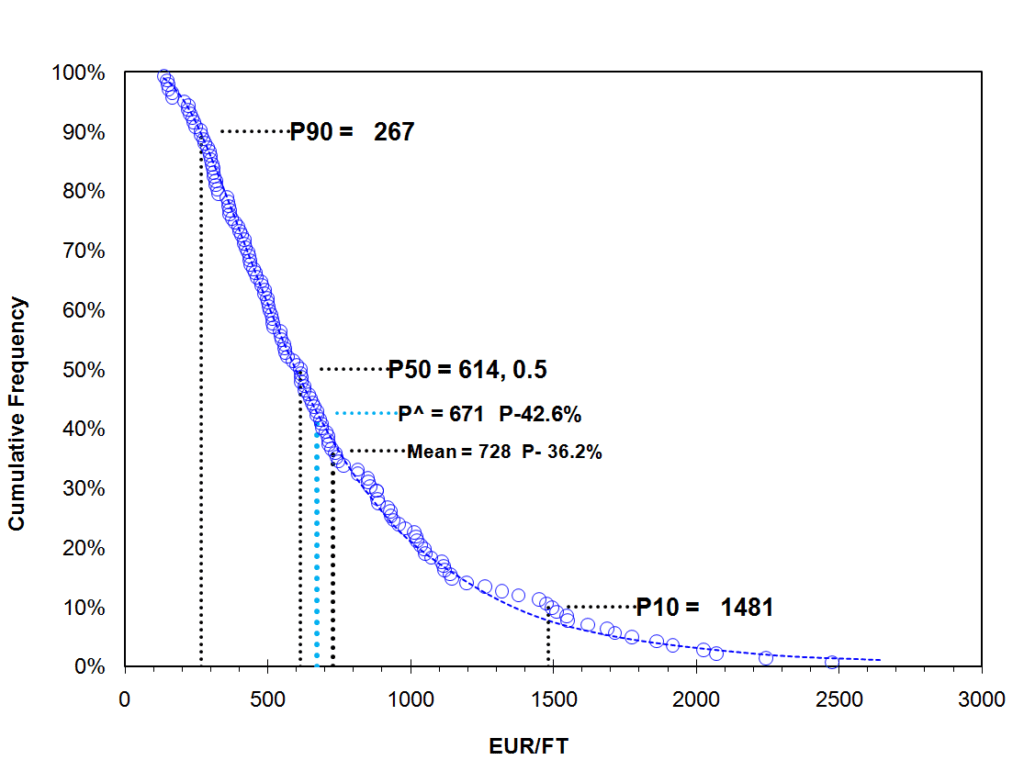

Here’s an example of reliable technology for PUDs in resource plays. In this technology, we have to come up with a probability distribution of the PUDs in the resource area. (Figure 1)

In the chart, under the old, conservative approach for an undrilled well, the P90 number would be the one reported from this distribution. But because of what’s been found in reliable technology, we know that the significantly higher number between the mean and the median is acceptable for reporting to the SEC.

The map is an example from the Fayetteville play. What the reporting company did was establish the size of the area in which the reserves could be considered as proved. They did this by showing that the estimated ultimate recovery for all the existing wells in the area fall on the same statistical distribution.

As long as they could make the claim that the entire colored area was proved, then any undrilled location could be considered a proved undeveloped location. Thus, its reserves could be claimed as a number near the mean of the entire distribution, rather than near the P90. This procedure had been proved valid as reliable technology by a number of filers, who then reaped the benefit of using it. (Figure 2)

So What Can We Do?

What can we do to take advantage of reliable technology? Identify places where the opportunity presents itself to use reliable technology to increase reported reserves. This approach applies to the examples I’ve given and things we haven’t even thought of yet.

There’s an opportunity to develop and validate technology if the resources are available. In lieu of this, you depend on technology developed and validated by others. For example, the best software developers work hard to develop and validate improved technologies. So when choosing your software partner, look for ones who have made the effort to develop reliable technology and meet the standards set by the SEC. If you do that, you can increase your reported reserves with the SEC.

Figure 2

Dr. W. John Lee serves as a Research Fellow for Energy Navigator and is currently a Professor of Petroleum Engineering at Texas A&M University. He can be reached at john-lee@tamu.edu.