Choosing the optimum oil drilling location is certainly not a straightforward process. Extensive planning is involved. It also requires various scientific parties to collaborate and, ultimately, a great deal of patience.

There are multiple factors that need to be considered. Geology, costs, the presence of infrastructure, proof of prior development, the list goes on. Tristone Holdings is a U.K. oil and gas company that plans on developing a new prospect in the U.S.

Director at Tristone Holdings, Henry Berry, has provided insight into this multi-layered and complex process, discussing the key variables that inform the process of selecting an oil field.

The Prospect Profile

Quite obviously, the first thing that needs to be identified is an area that will yield good levels of oil. It goes without saying that an oil field in a location without oil is entirely worthless. In order to identify an appropriate location for a new oil field, a petroleum geologist will need to conduct a geological profile. Oil typically will be found within sedimentary rock basins, meaning once a potential location has been identified, it will be necessary for the geologist to conduct a geophysical survey. This will be done in order to study the following aspects:

- Source. The hydrocarbons (oil) are generated by the source rock deep underground.

- Reservoir. The hydrocarbons seep from the source rock and are subsequently trapped within the reservoir rock.

- Seal. The hydrocarbons are unable to escape the reservoir rock due to the seal.

- Trap. Sandstones will provide a stratigraphic trap, while carbonate rocks will provide structural traps. It is at this point that the hydrocarbons are held in such a quantity that it becomes profitable to drill into the rock and extract them.

- Timing. Geologically speaking, it is essential that a specific sequence of events is indicated by the formation.

- Maturation. Immense heat and pressure must be applied to the source rock in order for the oil to be produced.

- Migration. This is the process of oil moving from the initial source rock into the reservoir rock.

The viability of the potential oil field can be determined by the geologist once he or she builds a profile of the land based on these various factors. Certain processes, such as mud-logging and seismic reflection, may assist in providing a positive picture. If this is the case, then oil companies will be able to move toward the next selection criteria of securing a new oil field.

Cost

Once it has been confirmed that a prospect is, indeed, suitable from the perspective of a drilling company, the economical feasibility must be assessed. Regardless how optimally they are run, or how much assistance can be provided by automation and AI, drilling operations certainly are not cheap. Putting an exact cost on what level of oil yield is needed in order to label it a profitable venture, however, is incredibly difficult. This difficulty is enhanced by the sheer, day-to-day, variability in the oil market.

It’s essential to ensure that an oil well will be profitable, especially when factoring in the increasingly punctilious legislation and government pressure, as well as the global trends toward more sustainable energy. There is virtually no room for error when choosing a new oil field. Tristone Holding’s own Viola prospect, for example, has been confirmed to have excellent potential for the commercial production of oil. This degree of surety is imperative.

Infrastructure

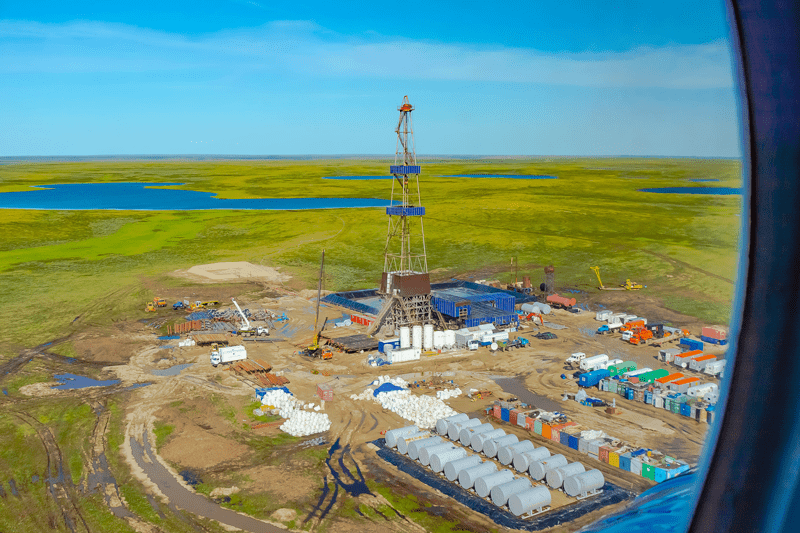

The infrastructure that surrounds an oil prospect is something that has a great effect upon the economics of a drilling project. There are multiple considerations that are important to bear in mind in regard to the fuel that is being transported through pipelines and tankers, as well as the site’s operations as a whole.

Should a well with lower yield, but superior, existing infrastructural frameworks be chosen? Or, would it be a better idea to investigate a high-production prospect, and set up an entire infrastructure, including pipelines and roads, from scratch? While this question may seem difficult enough in itself, the reality of this situation would never be as black or white as simply picking one or the other; there are multiple other considerations that must be factored into the equation.

Environmental concerns are one such consideration. The immediate area of the site will experience considerable ramifications in regard to CO2 emissions, as well as the distribution of nutrients within local ecosystems, if new roads are created, for example. These infrastructural implications must be considered with as much care as the site and its geology by any oil company involved.

Longevity

Finding and securing a potentially successful development is one thing, but it’s also important to understand what must be done when the well runs dry. Extensive prospects are sought after by most oil companies – prospects that go beyond the initial drilling project and provide maximum potential for future commercial oil projects. The previously mentioned Viola prospect, for example, has a substantial 480-acre lease block which can be worked with in the future.

Further to the consideration of how to utilize the site after the initial drilling project, it’s also important to consider what must be done when there is no oil left. Every oil field, eventually, will be completely exhausted once all of its oil has been recovered. Previously, many companies may have simply abandoned these fields. Nowadays, however, depleted oil fields are being utilized for the mass storage of gases, such as carbon dioxide. Their impervious physical characteristics make them ideal candidates for this job.

While choosing an oil field and drilling into it, obviously, is firmly dictated by the presence of oil underground, it should be clear that this isn’t the sole factor that must be considered. Discovering the perfect prospect that meets all of the criteria above is an exceptionally complex task that takes a considerable amount of time and a high level of expertise. While the presence of oil may be the main question, it certainly isn’t the only one.

Henry Berry is a director at Tristone Holdings, an energy company based in the U.K. with a primary focus in the U.S. It finds, develops and produces essential sources of energy and its portfolio includes high-quality conventional oil and natural gas assets in the top U.S. onshore plays. Currently, it is raising capital to acquire and expand its energy base, specifically in the oil and gas sector. For more information visit tristoneholdings.com.