The five largest global oil and gas supermajors—ExxonMobil, Chevron, Shell, BP, and TotalEnergies—have now reported their results for the second quarter. For oil bulls, the headlines were a disappointment, with all five enterprises reporting falling revenues and slimmer profits, stemming from a decline in global oil and gas prices.

Collectively, the supermajors’ disappointing financial results teach three key lessons about the cloudy prospects for the oil and gas business model.

- Oil and gas supermajors need high prices to thrive.

At heart, the oil and gas industry is a giant Rube Goldberg machine designed to turn hydrocarbons into cash. But that machine only functions when prices are high enough to cover costs. If oil and gas prices are too low, the machine simply can’t produce enough money to keep dividends high, debt low, cash reserves healthy, executive compensation attractive, and exploration budgets amply funded.

Compared to the second quarter of 2022, the price of oil fell by a third and the supermajors’ collective free cash flows—the cash generated by their operations, minus capital expenditures—fell by 56%. Investors were none too happy at the news, because free cash flow is what companies use both to pay down their debt and to reward shareholders.

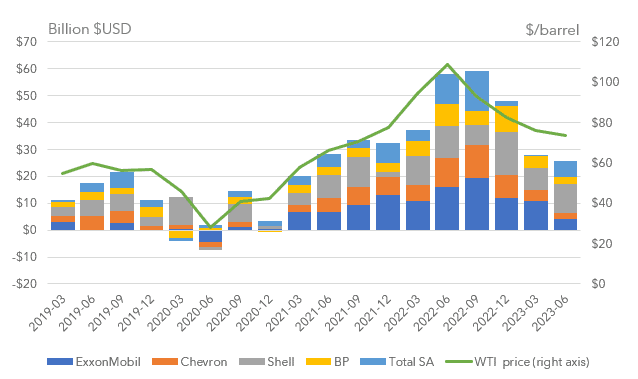

As troubling as the year-over-year results were, the longer-term trends were perhaps more disconcerting. As an example, compare last quarter’s results with the third quarter of 2021: Oil prices were slightly higher last quarter than they were in late 2021, but the supermajors’ free cash flows fell by more than a fifth. (See Figure 1.) The industry made less money despite selling their wares for higher prices.

Figure 1. Free cash flow from five supermajors, vs. West Texas Intermediate (WTI) oil price

Figure 1. Free cash flow from five supermajors, vs. West Texas Intermediate (WTI) oil price

Source: IEEFA, from company reports.

Falling cash flows amid rising prices highlight a serious problem in the supermajors’ long-term business model: To thrive, these enterprises need oil and gas prices to rise. More specifically, they need their revenues from oil, gas, refined products, and petrochemicals to grow quickly enough to cover the escalating cost of labor and materials, and to compensate for the ever-increasing difficulty of extracting new oil and gas reserves out of the ground.

At heart, oil is an inflationary commodity. Oil companies have long since exploited the cheapest and most abundant underground deposits, so they must forever chase smaller, harder to reach, and higher-cost barrels. Improvements in extraction technology have helped keep cost increases in check, but geology trumps technology: As the best oil deposits are exhausted, costs go up.

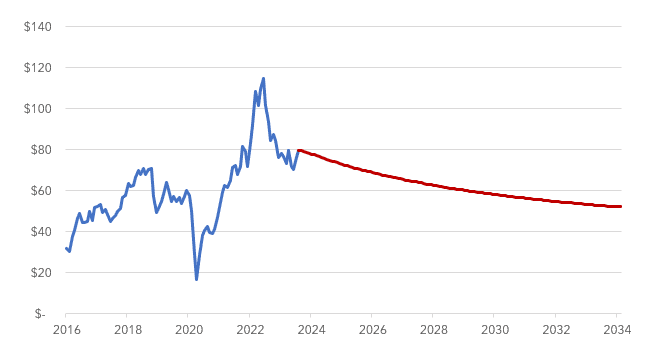

But while the cost of producing oil tends to rise, prices can follow a different trajectory. In fact, futures markets are currently betting that petroleum prices are going to fall. (See Figure 2.) Signs of flagging demand growth, coupled with the falling costs of alternative energy sources, are keeping a lid on expectations for long-term prices.

Futures markets are fickle, and often wrong. But investors staring at evidence of rising production costs can’t be happy about the possibility of a long-term decline in prices, which is exactly what the buyers of futures contracts are gambling on.

Figure 2. Historic U.S. oil prices (blue) vs. futures prices (red)

Figure 2. Historic U.S. oil prices (blue) vs. futures prices (red)

Source: U.S. Energy Information Administration and CME Group.

- The “Ukraine dividend” has faded.

Financially speaking, Russia’s invasion of Ukraine was the best thing to happen to the oil and gas industry in over a decade. In the waning months of 2021, amid Russian troop movements and escalating anti-Ukraine rhetoric from the Kremlin, speculators bet on the possibility that Russia would use energy as a weapon to pursue its territorial ambitions. In February 2022, Russia’s full-scale invasion of its neighbor sent oil prices skyrocketing across the globe over fears of supply disruptions and potential sabotage—fears that materialized in late 2022 with the destruction of the Nord Stream gas pipeline. International sanctions against Russian oil created still more chaos, as the world’s oil importers were forced to reorganize global supply chains virtually overnight.

The supermajors benefited handsomely from consumers’ pain related to the high prices, and from the havoc and devastation wreaked on Ukraine and its people. Oil prices spiked to their highest level since 2008, and oil industry profits and cash flows spiked to their highest level ever. For the first time in decades, the supermajors generated enough spare cash that they could boost payouts to shareholders, retire some debt, and stockpile cash, all at the same time.

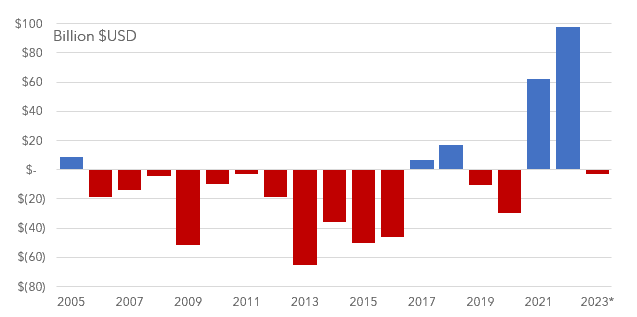

Figure 3. Free cash flow from five supermajors, minus dividends and net share buybacks.

Figure 3. Free cash flow from five supermajors, minus dividends and net share buybacks.

Source: IEEFA, from company reports. *2023 represents year-to-date results.

Nearly a year and a half later, that financial bonanza has ended. Global oil markets have largely adjusted to Russia’s chaos: Despite Saudi Arabia’s attempts to stem price declines by trimming output, oil prices have fallen back to earth over the past two quarters. The supermajors have seen their cash flows dwindle as a result. For now, the oil industry’s Ukraine dividend has evaporated—suggesting that talk of a long-term rebound in the oil industry’s prospects was mostly just talk.

- The oil industry has reverted to its old, deficit-spending ways.

In the wake of the Ukraine invasion, oil and gas firms boosted their shareholder payouts to their highest level ever. Collectively, the supermajors have trimmed shareholder rewards over the last two quarters. But even with those cuts, three of the companies—ExxonMobil, Chevron, and Total—have had to dip into their cash reserves in order to maintain dividends and share buybacks.

Deficit spending was a return to form: The oil and gas industry has long made a habit of paying out more to investors than they generated by selling their products. According to IEEFA calculations, from 2005 through 2020 the supermajors collectively paid about $325 billion more to investors than they generated in free cash flow. They were able to generate a cash surplus that they could use to replenish cash reserves and pay down debt in only three of those years. (See Figure 3.)

The companies made up these deficits primarily by borrowing money: All told, the supermajors boosted their long-term debt by more than $210 billion over that period. They also raised money by selling off assets, such as older oil and gas projects and refineries. The supermajors typically framed the sale of so-called “non-core assets” as a reasonable business strategy. That may be so. Nonetheless, selling a profitable enterprise in order to finance dividends can strike long-term investors as a risky move—a little like selling family heirlooms to pay for a night on the town.

Moving forward, the global oil giants can still draw down on cash reserves for a while to keep dividends flowing. They can borrow more money, or sell off assets.

What they can’t do is count on more geopolitical turmoil to inflate their revenues and profits. Sure, prices could go back up again. There could be another war. Russia or OPEC could make deeper cuts to their output.

Yet hoping for war, or relying on a global oil cartel to manipulate prices, is the opposite of a sustainable, low-risk business model. Any financial endeavor that depends on bloodshed and geopolitical machinations for its profits is, by its nature, a speculative, high-risk endeavor—a far cry from the blue-chip investment thesis that investors historically demanded from the oil and gas industry.

Related Content:

IEEFA: Taking stock of the oil and gas sector as the transition to sustainable finance proceeds apace.

IEEFA: Oil supermajors are meeting climate goals by selling assets—but still increasing emissions

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. IEEFA’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.