The oil price crash has forced Eagle Ford operators to re-evaluate their cash flows, cutting capital expenditure and rig count in 2020. By assessing the readjustment of capital expenditure (capex) of 16 companies, which account for approximately 75% of total Eagle Ford production, GlobalData, a leading data and analytics company, estimates a reduction of approximately 190.5 thousand barrels of oil equivalent per day (mboed) in output as compared to the forecast for 2020 before the crash. Over 66% of the production drop originates from crude oil while remaining being natural gas.

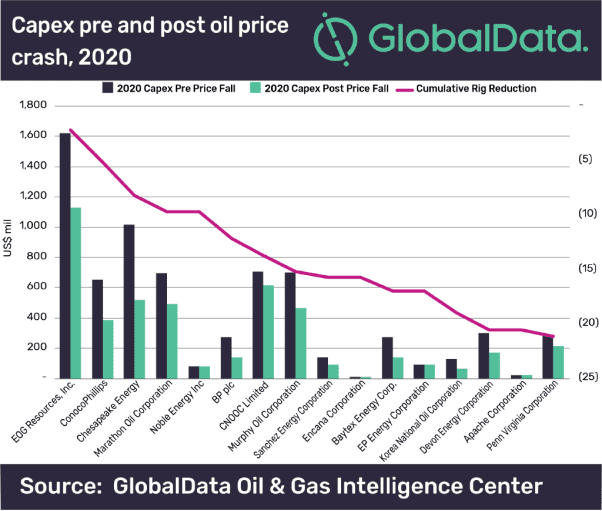

Steven Ho, Oil and Gas Analyst at GlobalData, comments: “GlobalData analysis shows a 21-rig reduction from the group of companies, from 50 in March 2020 to 29 by the end of 2020. Overall, this reduction is a result of capital expenditure (capex) cuts summing up to approximately US$2.36bn reported by operators.”

Ho continues: “It is also crucial for operators to hold a strong hedged position to bear through the economic crisis through 2020. Penn Virginia Corporation hedged 75% of its 2020 production, followed by Noble Energy with 60% and Chesapeake Energy with 60%. Although there are many uncertainties surrounding crude oil prices, the natural gas price outlook seems to be looking relatively promising due to the reduction of associated gas produced from oil wells.

Ho continues: “It is also crucial for operators to hold a strong hedged position to bear through the economic crisis through 2020. Penn Virginia Corporation hedged 75% of its 2020 production, followed by Noble Energy with 60% and Chesapeake Energy with 60%. Although there are many uncertainties surrounding crude oil prices, the natural gas price outlook seems to be looking relatively promising due to the reduction of associated gas produced from oil wells.

“Given the nature of Eagle Ford having multiple production windows, this might present an opportunity for operators to shift their strategy to include more natural gas into their production mix and allocate more capital into gas-bearing acreage within the play.”