In the last month, crude oil prices have retreated from four-high highs amid concerns of rising oil production worldwide and weakening demand from developing countries despite the U.S. re-imposing sanctions on Iran. The oil market sell-off has shaved more than a fifth off the global Brent crude benchmark and slashed the price of U.S. crude (West Texas Intermediate, or “WTI”) by 25% since early October, harkening back to similar trends seen during the oil price rout of late 2014.

More recently, on November 14, 2018, Brent and WTI crude futures snapped a record 12-day streak of losses and have since tried to recover. WTI futures posted a sixth straight weekly loss during the week ended November 16, 2018.

Crude Oil Sell-Off Overblown?

In light of recent events, we pose the question: Is the crude sell-off and bearish market sentiment overblown?

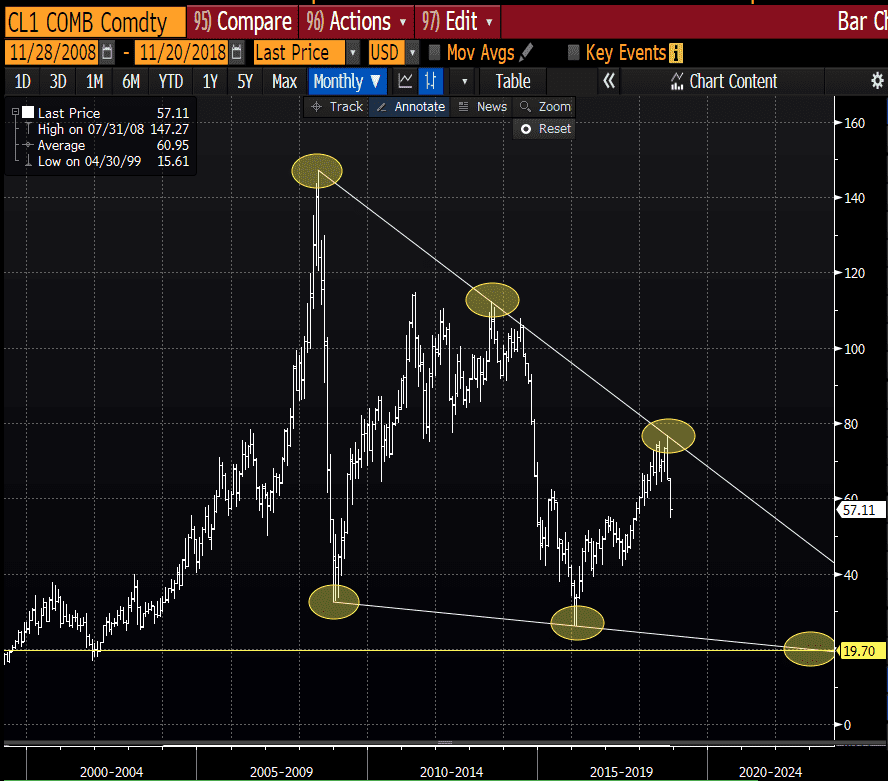

The short answer is no. The recent market movement falls directly in-line with one of my current, long-term bearish scenarios. If we take a step back to the summer of 2008, we were reeling from the peak oil prices of $150 per-barrel (/bbl). Before the year was out, crude was back in the low $30/bbl range. Five years later, we see another peak of $112/bbl followed by $26/bbl two and a half years later. Just last month, we were trading around $77/bbl before starting what I believe to be another long-term decent. If this same scenario holds, it would mean sub-$20/bbl crude oil would eventually unfold in early 2023.

Let’s look at key underpinnings over the last month that appear to be impacting, at least in part, this market sentiment:

- On November 14, 2018, the International Energy Agency (“IEA”) said in its monthly oil market report that big producers have “heeded the warnings” about price spikes and replacing Iranian and Venezuelan barrels. The world’s three largest producers – the U.S., Saudi Arabia and Russia – are all producing at record levels, according to the IEA. In addition, the IEA noted that global output last month was higher than the same time a year ago and said global oil demand is slowing in several non-OECD countries.

- S. President Donald Trump granted waivers to eight countries to continue buying Iranian oil despite U.S. sanctions on the country’s energy sector, which took effect November 4, 2018. But, other oil producers have more than compensated for the lost Iranian oil and market observers see a significant supply surplus with inventories building, putting pressure on prices.

- Speaking of Trump, the U.S. president, who has been outspoken about advocating for lower oil prices, on November 12, 2018 issued a tweet calling for even lower prices.

- Many crude oil refineries are in seasonal shutdown mode for maintenance activities to switch from summer- to winter-grade fuels, which can back up crude oil inventories in storage.

- Refinery maintenance comes at a time when U.S. crude production climbed to a record 11.7 million barrels per day (MMbbl/d) for the week ended November 9, 2018, according to the U.S. Energy Information Administration (“EIA”), which has added to concerns of oversupply.

I don’t consider myself to be a bear by any means, but as a Commodity Risk Advisor I am very sensitive to any downside scenarios. Helping my clients understand their unique exposure is a dynamic process. By having multiple views of the market and listening to its underpinning allows perspective. This helps frame both timing and price to develop company-specific strategies for current market environments.

Ryan is a Director at Opportune LLP. His industry experience includes commodity trading, risk management, supply chain optimization and derivative valuation. He is an expert in developing financial models to quantify complex/uncertain issues and deliver real-world solutions. He has extensive experience in the pricing, hedging and portfolio management of the retail natural gas markets. Ryan has led all aspects of commercial-deal structuring and pricing for wholesale natural gas trading and origination. He has over 15 years of experience in the energy industry. Ryan has an MBA from the University of Texas in San Antonio where he specialized in Finance.