Unconventional reservoirs present challenging problems for reservoir engineers tasked with predicting the future performance of undrilled and recently completed wells. In conventional reservoirs, there are many analytical techniques that can be used, but unconventional reservoirs present too many complexities, variations and unknowns to apply these methods. In particular, the extent, geometry and conductivity of the fracture network is unknown and perhaps impossible to model.

A common solution is to use production data from existing wells as analogues for future wells to generate a “type well profile” (TWP). TWPs, also called “type curves” are derived by selecting analogous wells, collecting their production history and key well information, and applying several mathematical adjustments to generate the prediction. The adjustments include steps like estimating the future production of existing wells; normalizing the data to the first month of production; scaling the data to account for differences in lateral length or fracture design; and binning the data according to other parameters, such as formation or operator. The scaled and normalized production can be used to generate average production forecasts for each of the bins.

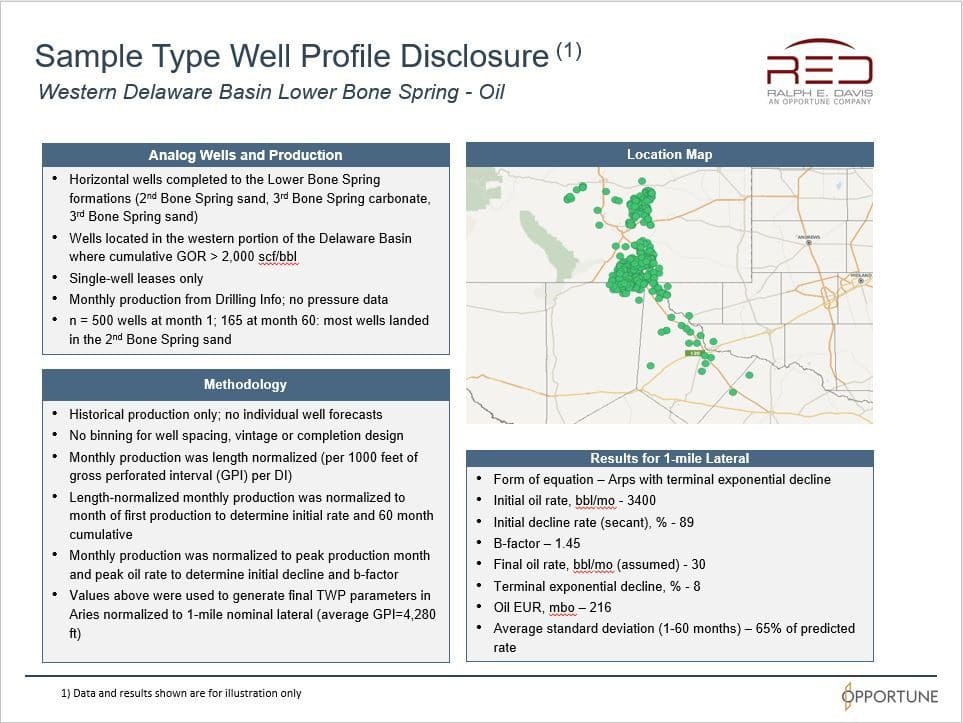

Operators use TWPs to make investment decisions, prepare reserve estimates and to inform their investors about the expected economics of their undrilled wells. Many of them are disclosed to the public in investor presentations and public filings. Although they are widely used, typically there is very little disclosure about how they are derived. There are no industry standards for the preparation of TWPs. Rather, they are created under many different circumstances and engineers have personal opinions about the best way to prepare them. However, some of these opinions are certainly better than others.

The development of best practices for TWP generation is currently under consideration by a committee of the Society of Petroleum Evaluation Engineers (SPEE). Ahead of that work, however, we at Ralph E. Davis Associates (RED) believe that improved disclosure about how a TWP was created would help users better understand the quality and reliability of the estimate. It would also provide more transparency to help them understand why different engineers in the same play and area generate different TWPs.

Recommendations for Better TWP Disclosure

We recommend that TWPs presented to the public or to other consumers be accompanied by a voluntary disclosure that explains or addresses the following items. A sample disclosure is provided at the end of this paper.

- Selection of Analogous Wells – A list of API numbers, a map or a description of the area that includes the analogous wells. If certain well types, operators, vintages, etc. were used to filter the list of wells, that should be disclosed. If the list of API numbers is not disclosed, the number of wells used should be disclosed for each TWP. The goal is to make it clear which wells were used and why.

- Source of the Production Data – Describe whether the data came from internal or public sources and cite the source. If lease-level data has been allocated to individual wells, that should be disclosed.

- Frequency of the Production Data – Describe whether daily or monthly production was used. Some public data is reported quarterly, so if the monthly data is calculated from quarterly values, that should be disclosed.

- Months of Production History Used – The disclosure should discuss how many months of production data was available and used in the TWP. One approach would be to provide the minimum, maximum and median number of producing months.

- Scaling and Binning – How was the production data for each analogue well scaled to account for variations in relevant variables (lateral length, for instance) and how were the analogues binned to generate the TWPs?

- “Project the Average” or “Average the Projections”? – Petroleum engineers may average the analogue wells’ production-month-normalized historical data and then project the average into the future, or they may project the future performance of the analogues and then average the wells’ combined history/projection data. If projections were used, what engineering methods were used to make them? Engineers that have access to detailed production and pressure history data will sometimes employ additional reservoir engineering techniques to project the analogue wells before aggregating them.

- Form of TWP Equation – What form of production rate versus time equation (Arps, etc.) is used to represent the type well?

- TWP Parameters – What are the relevant parameters of the resulting TWP? For example, initial rate, initial effective decline, b-factor, minimum decline, final rate, well life, expected ultimate recovery, etc.

- Reliability Measures – Statistical measures should be presented that allow the user to understand the uncertainty and reliability of the TWP. These could include confidence intervals around the TWP or standard deviation as a function of time (absolute or a percentage of the expected value).

Summary

There are many approaches to creating TWPs and they often rely on very limited data. We believe that their users should have enough information to understand how they were made so they can make informed decisions. A thorough disclosure of the data and methods used would be a good first step.

Steve Hendrickson is the President of Ralph E. Davis Associates, an Opportune LLP company. Steve has over 30 years of professional leadership experience in the energy industry with a proven track record of adding value through acquisitions, development and operations. In addition, Steve possesses extensive knowledge in petroleum economics, energy finance, reserves reporting and data management, and has deep expertise in reservoir engineering, production engineering and technical evaluations. Prior to joining Opportune, Steve was Principal of Hendrickson Engineering LLC, a licensed petroleum engineering firm focused on reserves assessment and property valuation supporting property acquisitions and corporate restructurings. Steve began his career at Shell Oil as an engineer in Permian Basin waterfloods and CO2 floods. Since then, he has focused on leading upstream oil and gas reserves evaluation/engineering projects serving in management or as an executive at several E&P companies, including El Paso Production Company, Montierra Minerals & Production LP and Eagle Rock Energy Partners LP. Steve is a licensed professional engineer in the state of Texas and holds an M.S. in Finance from the University of Houston and a B.S. in Chemical Engineering from The University of Texas at Austin. He currently serves as a board member of the Society of Petroleum Evaluation Engineers (SPEE).