The recent resurgence of drilling activity in the Haynesville shale is expected to continue for the foreseeable future, considering the projected rise in demand for natural gas worldwide and the ensuing increase in the US liquefied natural gas (LNG) exports, according to GlobalData, a leading data and analytics company.

The company’s latest report, ‘Haynesville Shale in the US, 2019’, reveals that the increasing natural gas production from the Haynesville Shale play will propel it as the main supplier to LNG operations along the US Gulf Coast (USGC).

According to the Energy Information Administration (EIA), the US produced just under 81 billion cubic feet of gas per day (bcfd) in August 2019. The Appalachia Basin and Haynesville sites accounted for over 50% of the total value, and are currently showing an increasing trend in their production levels – with the Appalachia Basin producing over 32bcfd, and the Haynesville over 11bcfd.

Andrew Folse, Oil and Gas Analyst at GlobalData, comments: “The demand of natural gas feedstock for conversion into LNG is focused on the USGC. This demand is expected to steadily increase over the next five years as there is approximately US$18bn to be invested in planned LNG facilities in Texas and Louisiana. Furthermore, an additional US$7.9bn is related to announced facilities, which could further increase natural gas demand. Given Haynesville’s proximity to the Gulf Coast, the natural gas produced in the play will have easy access to market, specifically to LNG plants which will depend on gas produced in the region.”

The Haynesville shale is spread across Northwest Louisiana and East Texas, in the US, covering an area of around 9,000 square miles. The strategic location of this shale play – near some of the world’s largest petrochemical complexes, LNG export facilities, and the Gulf of Mexico – makes it one of the most revenue-generating shale plays in the US. The facilities around the shale formation help in rapid ‘spud-to-sale’ cycle times, thus, making it more attractive to investors.

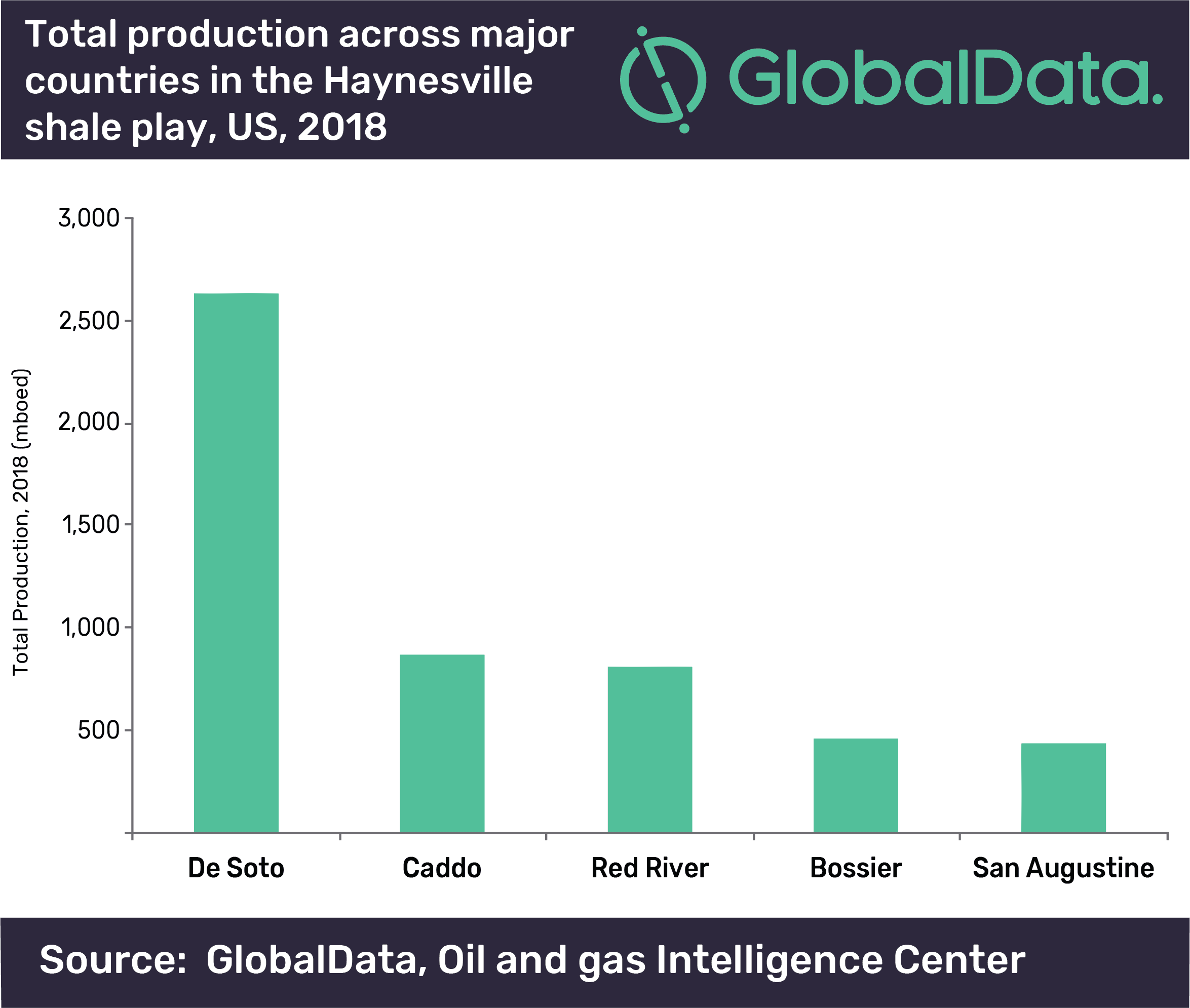

Folse adds: “In 2018, the most active-producing areas in the Haynesville shale were De Soto, Caddo, Red River and Bossier parishes in Louisiana, as well as San Augustine County in Texas.”

Folse concludes: “Chesapeake Energy, Indigo Natural Resources, Comstock Resources, BP and Range Resources were the leading producers in the Haynesville shale play in 2018.”

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.