Since the lifting of a decades-old ban on crude exports at the end of 2015, Houston has emerged as a major physical crude oil trading hub, overtaking the country’s primary crude benchmark (West Texas Intermediate, or “WTI”) pricing power long held in Cushing, Oklahoma due to access to major pipelines that run through it and ample storage space.

The surge in crude oil production can be tied to the shale boom, particularly in the Permian Basin in West Texas and New Mexico, where vast amounts of crude oil flow directly to the Gulf Coast – oftentimes bypassing Cushing altogether – to destinations such as Asia, Europe and Latin America. Traders and market observers say WTI crude at Houston is a preferred futures contract hub over WTI Cushing because it better reflects global market balance and offers a more liquid market for export customers.

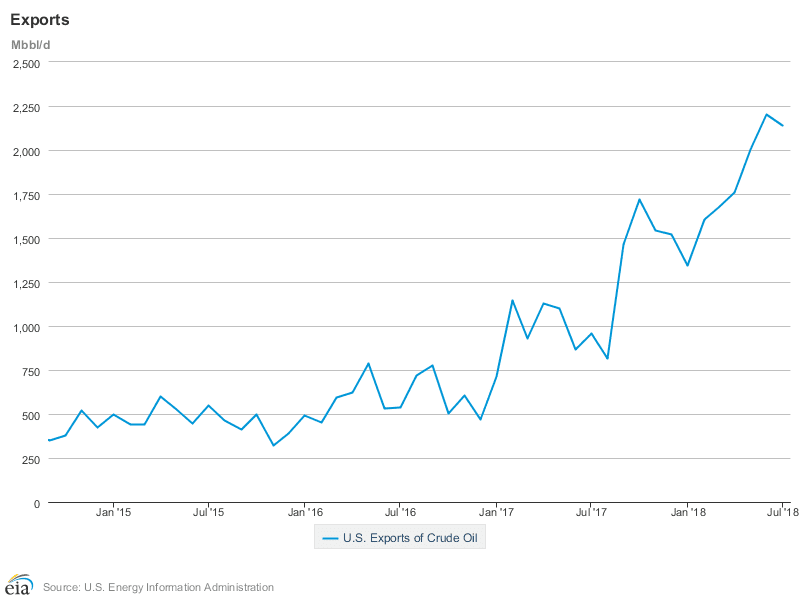

Since the lifting of the crude oil export ban, U.S. crude exports have surged nearly 350%, from 490,000 barrels per day (bbl/d) in January 2016 to a record 2.2 MMbbl/d in June 2018, according to the U.S. Energy Information Administration (EIA). Rising oil production in the Permian Basin, which is estimated at around 3.5 MMbbl/d, along with increased U.S. light sweet crude exports to overseas customers, have prompted the launch of new physical futures contracts in Houston that are set to debut later this year.

In fact, the U.S. port district of Houston-Galveston earlier this year began exporting more crude oil than it imported for the first time on record, according to EIA statistics. In April 2018, crude oil exports from Houston-Galveston surpassed crude oil imports by 15,000 bbl/d. In May 2018, the difference between crude oil exports and imports increased substantially to 470,000 bbl/d.

On July 17, 2018, the Intercontinental Exchange Inc. (“ICE”) announced plans to launch in the third quarter of this year a physically delivered Permian WTI crude oil futures contract, deliverable in Houston. According to ICE, the new futures contract “is designed to provide price discovery, settlement and delivery at Magellan Midstream Partners LP’s terminal in East Houston.”

The contract is expected to provide ample liquidity for traders and brokers seeking flexible hedging and trading opportunities for export shipments.

Meanwhile, CME Group on September 24, 2018, announced that it intends to offer a new WTI Houston crude oil futures contract with three physical delivery locations on the Enterprise Houston system, pending regulatory review. WTI Houston crude oil futures will be listed with and subject to the rules of NYMEX, beginning with the January 2019 contract month.

The new WTI Houston crude oil futures contract expands CME Group’s already robust suite of crude oil futures and options and will complement its global benchmark NYMEX WTI Light Sweet Crude Oil futures. Participants will have the flexibility to make or take delivery of U.S. light sweet crude oil at the Enterprise Crude Houston (“ECHO”) terminal, Enterprise Houston Ship Channel (“EHSC”) or Genoa Junction through the new contract.

Enterprise has a network of 19 ship docks along the U.S. Gulf Coast and is the largest exporter of crude oil in the U.S. and the ideal provider of delivery points for this physical WTI Houston futures contract, according to CME Group. Through its network of pipelines, storage and marine terminals, the firm has the capability to handle the flow of more than 4 MMbbl/d of crude oil. Participants will also benefit from access to a diverse group of refiners, storage facilities and export facilities through the Enterprise network.

What We’re Hearing

Opportune LLP has heard very little from existing clients about the new WTI Permian crude oil contracts delivered into Houston. That being said, we routinely see examples of management teams executing hedging mismatches. For instance, some companies have marketing agreements that sell WTI at Cushing and are erroneously hedged with Brent crude contracts. These pricing relationships tend to deteriorate over time and eventually result in both losses on production and the hedge itself. These costly mistakes can easily be avoided.

Ryan is a Director at Opportune LLP. His industry experience includes commodity trading, risk management, supply chain optimization and derivative valuation. He is an expert in developing financial models to quantify complex/uncertain issues and deliver real-world solutions. He has extensive experience in the pricing, hedging and portfolio management of the retail natural gas markets. Ryan has led all aspects of commercial-deal structuring and pricing for wholesale natural gas trading and origination. He has over 15 years of experience in the energy industry. Ryan has an MBA from the University of Texas in San Antonio where he specialized in Finance.