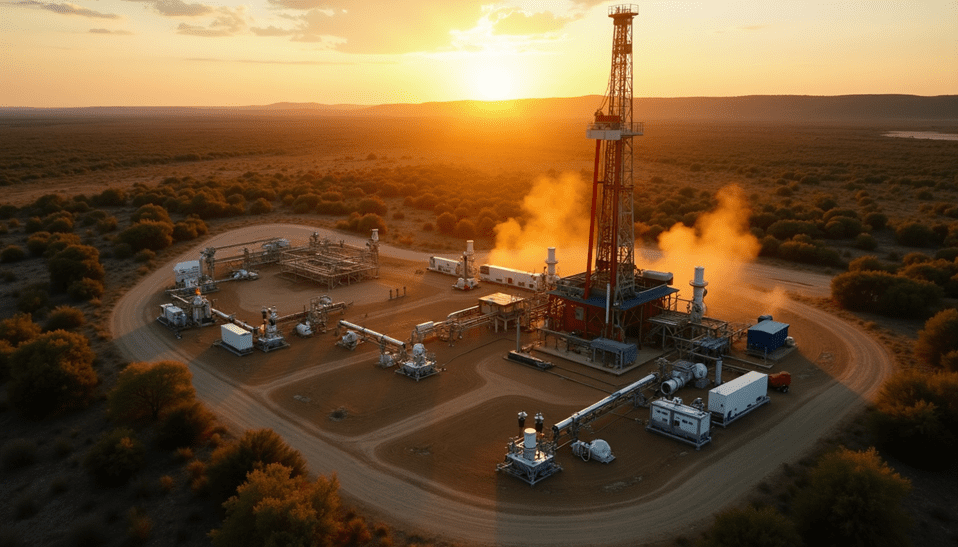

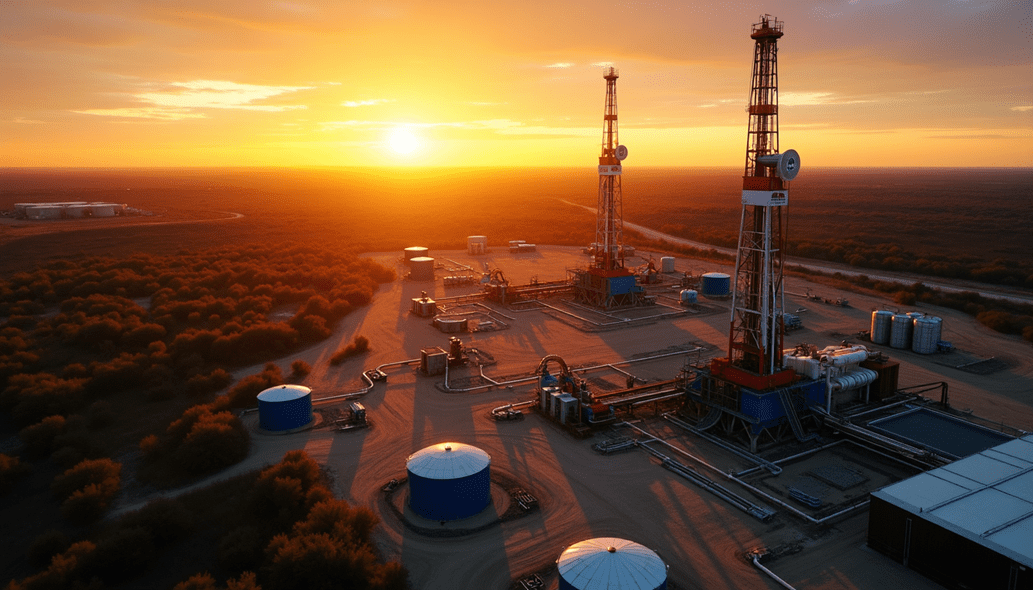

The Eagle Ford Shale region has witnessed a remarkable transformation over the past decade, largely due to revolutionary well completion technologies. These advanced completions have turned previously uneconomic reserves into highly productive assets, dramatically changing the energy landscape of South Texas.

Modern completion techniques combine sophisticated engineering with cutting-edge technology to maximize hydrocarbon recovery. From multi-stage fracturing to smart monitoring systems, these innovations have redefined how operators approach well development and production optimization in the Eagle Ford formation.

This article explores how completions are reshaping the Eagle Ford Shale region. We’ll examine the evolution of completion technologies, advanced fracturing techniques, well design optimization strategies, smart completion systems, and their economic impact on field development.

Evolution of Completion Technologies in Eagle Ford

The Eagle Ford Shale’s technological journey began with a dramatic shift from vertical to horizontal drilling. In 2007, horizontal wells were non-existent in the region, but by 2011, operators had secured over 2,800 drilling permits, almost exclusively for horizontal wells [1].

Traditional completion methods

Early completion techniques in the Eagle Ford were relatively straightforward, focusing on basic hydraulic fracturing methods. The formation’s unique characteristics – low clay content and high carbonate composition – made it particularly suitable for fracturing operations [1]. Initially, operators experimented with various completion methods, including basic slickwater treatments in dry gas areas [1].

Modern completion innovations

The evolution of completion technologies brought significant innovations, particularly the plug and perforation technique, which became the preferred method due to its ability to create complex fractures cost-effectively [1]. A notable advancement was the introduction of channel fracturing technology, which demonstrated remarkable results with initial production increases of 32-37% compared to conventional methods [1].

Modern completion designs now incorporate sophisticated monitoring systems. The implementation of engineered completion strategies has significantly improved perforation cluster efficiency, increasing from the traditional 64% average to an impressive 82% in monitored wells [2]. These advanced systems enable real-time optimization, with one operator reporting a 5.4% boost in completion efficiency, resulting in 7 additional completed zones and 2.78 million pounds more proppant placement [2].

Impact on production efficiency

The evolution of completion technologies has dramatically improved production efficiency across the Eagle Ford. Engineers have identified optimal operating ranges for high-productive wells, particularly in Tier 1 zones, where the most successful completions utilize perforated intervals of 4,600-6,800 feet. In the Lower Eagle Ford, these high-performing wells typically employ proppant quantities ranging from 1,900-3,000 lbs/feet with slickwater fluid pumped at 25-61 barrels per foot [3].

Recent optimization efforts have led to significant economic benefits. Analysis of over 1,400 wells revealed that fine-tuning completion designs could enhance EUR (Estimated Ultimate Recovery) per unit of well cost by 19%, representing substantial savings in drilling and completion capital expenditure [3].

Advanced Hydraulic Fracturing Techniques

Hydraulic fracturing techniques in the Eagle Ford have undergone significant advancement since the initial drilling activities began in 2009 [4]. These innovations have revolutionized how operators approach well stimulation and production optimization.

Multi-stage fracturing developments

Modern completion designs have evolved to optimize stage spacing and cluster efficiency. Studies show that wells with 270-280 feet of spacing perform significantly better than those with spacing exceeding 280 feet [5]. A critical discovery revealed that reducing space between perforation clusters to within 35 feet doubles the percentage of propped section near the wellbore [5].

The implementation of zipper fracturing has become increasingly popular, allowing operators to stimulate multiple wells simultaneously. This technique has demonstrated remarkable efficiency in creating complex fracture networks and maximizing stimulated reservoir volume (SRV) [6].

Proppant technology advancements

Proppant selection and deployment strategies have seen substantial innovation. At depths between 9,000 and 11,000 feet TVD, operators have observed significant impacts on proppant performance [7]. Key considerations for modern proppant deployment include:

- Conductivity optimization at high closure stress

- Cost-effectiveness analysis for different proppant types

- Performance monitoring through advanced tracking systems

In wells reaching 12,500 feet TVD with a fracture gradient of approximately 1.05 psi/ft, operators have documented that more than 95% of white sand experiences damage at 12,000 psi closure stress [7]. This has led to the development of more resilient proppant solutions.

Pressure monitoring systems

The introduction of Sealed Wellbore Pressure Monitoring (SWPM) has transformed completion optimization. This technology has been implemented across North and South America, monitoring over 16,000 stages [8]. SWPM systems utilize surface pressure gages to detect hydraulically induced fracture arrivals at horizontal monitor locations [9].

Recent developments include automated history-matching capabilities for volume to first response (VFR) measurements [8]. In one notable case study, a five-well monitor array recorded 160 fracture arrivals at varying vertical and lateral distances, providing crucial insights into propagation rates and geometry [9]. The system demonstrated that traversing vertically through high-stress intervals yielded a 30% reduction in arrival frequency [9].

Pressure communication studies have revealed connectivity between wells hundreds to thousands of feet apart [10]. This understanding has led to more precise completion designs, with operators now able to regulate proppant concentration more effectively to minimize pressure buildup towards the end of each stage [10].

Well Design and Completion Optimization

Optimizing well design and completion strategies has become increasingly sophisticated in the Eagle Ford, with operators leveraging advanced technologies and data-driven approaches to maximize production efficiency. A consortium of four Eagle Ford operators and Schlumberger demonstrated that engineered completion designs could significantly improve well performance [11].

Lateral length optimization

The industry has witnessed a continuous evolution in lateral length strategies. While longer laterals generally improve production, efficiency varies across different sections. Studies reveal that increasing well lengths doesn’t always result in proportionate production gains, with some 2-mile laterals producing only 85% of the normalized production compared to 1-mile laterals [12].

Key optimization factors include:

- Reservoir characterization quality

- Completion design modifications

- Surface facility capabilities

- Operational efficiency in longer wellbores

Cluster spacing innovations

Recent innovations in cluster spacing have revolutionized completion efficiency. Research shows that reducing space between perforation clusters to within 35 feet doubles the percentage of propped section near the wellbore [5]. The implementation of engineered completion strategies has improved cluster efficiency from 64% to an impressive 82% [1].

In the Lower Eagle Ford, optimal results have been achieved with proppant quantities ranging from 1,900-3,000 lbs/feet and slickwater fluid pumped at 25-61 barrels/feet [3]. This precision in cluster spacing has proven crucial for maximizing reservoir contact and enhancing production rates.

Completion design software

Advanced software solutions have transformed the completion optimization process. Modern completion design tools now incorporate petrophysical and geomechanical analyzes to generate optimized well designs [11]. These systems automatically group intervals with similar properties into fracture stages, effectively reducing overall stress differential [1].

The implementation of reservoir-centric stimulation design software has enabled operators to simulate hydraulic fractures with unprecedented accuracy. This technology incorporates various data points, including petrophysical information from vertical pilot holes, horizon interpretation, and discrete fracture network models [13]. The result is a more precise and efficient completion process, with some operators reporting a 19% enhancement in EUR per unit of well cost [3].

Production Enhancement Through Smart Completions

Smart completion technologies have emerged as game-changers in the Eagle Ford Shale, transforming traditional well operations into sophisticated, data-driven production systems. These advanced solutions combine real-time monitoring capabilities with automated control systems to maximize recovery and operational efficiency.

Real-time monitoring systems

The implementation of advanced monitoring technologies has revolutionized well performance tracking. Flow Scanner production logging has demonstrated remarkable improvements in completion efficiency, with 89% of perforation clusters actively producing oil in monitored wells [1]. This represents a significant advancement from the traditional 64% average achieved with conventional geometric spacing [1].

Key monitoring innovations include:

- ThruBit logging services for efficient through-the-bit quad-combo logs

- Sonic Scanner acoustic platforms for 3D mechanical properties assessment

- Flow Scanner horizontal and deviated well production logging systems

Automated flow control devices

The integration of automated control systems has delivered substantial operational improvements. In one Eagle Ford implementation, automated systems reduced the average number of downtime events from nine to five per well monthly, marking a 44% improvement [14]. The duration of unscheduled downtime events decreased by 25%, from 20 to 15 hours [14].

These smart systems have enabled operators to achieve remarkable efficiency gains. The well-to-technician ratio improved by over 400%, significantly exceeding the targeted 25% improvement [14]. Additionally, monthly mileage reduction surpassed 50%, freeing approximately 40 hours per month for each technician [14].

Data-driven optimization

The adoption of data-driven approaches has yielded significant economic benefits. Advanced completion designs incorporating real-time data analysis have demonstrated a $1.5 million increase in NPV during the first year of production [1]. This improvement came at a minimal additional cost of less than $100,000 for logging support [1].

Modern completion systems now utilize sophisticated software platforms for real-time optimization. These systems enable:

- Automatic grouping of intervals with similar properties

- Precise alignment of perforation clusters with fracture stages

- Reduction in fracture initiation pressure variation from 700 psi to approximately 250 psi [1]

The implementation of intelligent well pad programs has transformed operational efficiency. Surveillance centers now support centralized well and pad monitoring, enabling exception-based interventions that minimize unnecessary field visits [14]. These advanced systems integrate real-time data acquisition with automated control mechanisms, providing operators with unprecedented visibility into well performance and production optimization opportunities.

Economic Impact of Enhanced Completions

Enhanced completion technologies have revolutionized the economic landscape of Eagle Ford operations, delivering substantial returns through optimized well performance and improved recovery rates. A comprehensive analysis reveals the transformative financial impact of these advanced completion strategies.

Cost-benefit analysis

The implementation of optimized completion designs has yielded remarkable cost efficiencies across the Eagle Ford. Studies show that operators could enhance their capital efficiency by 19% through optimal completion strategies [3]. This improvement translates to significant savings in drilling and completion capital expenditure while maintaining similar production levels [3].

Recent technological advances have demonstrated impressive cost-reduction potential:

- Savings of up to 35% in total field operating costs annually [15]

- Production efficiency improvements worth $21 million identified [15]

- Individual well completion innovations saving operators up to $1 million per well [16]

Production improvements

Enhanced completion technologies have driven substantial production gains across the Eagle Ford region. The formation’s output has experienced remarkable growth, increasing from 581 barrels per day in 2008 to over 1.1 million barrels per day by mid-2014 [17]. Natural gas production has similarly flourished, exceeding 4 billion cubic feet per day [17].

The implementation of data-driven completion strategies has yielded impressive results. Recent studies indicate that wells utilizing modern completion designs have achieved:

- 15% higher year-end field production rates compared to original base production forecasts [18]

- Production improvements of up to three to four times higher recovery rates compared to vintage completion designs [19]

Return on investment metrics

Return on investment figures demonstrate the compelling economics of enhanced completions in the Eagle Ford. Leading operators have reported exceptional returns:

- Pioneer Natural Resources: 70% pre-tax rate of return [2]

- EOG Resources: 80% return rate [2]

- Marathon Oil: Over 100% return on some condensate wells [2]

The economic impact extends beyond individual well performance to regional prosperity. The University of Texas at San Antonio reported the Eagle Ford Shale’s economic impact reached $87 billion in 2013, a substantial increase from $61 billion in 2012 [20]. Projections suggest continued growth, with estimates exceeding $137 billion for 2023 [20].

Modern completion technologies have particularly benefited refracturing operations, with some operators reporting internal rates of return greater than 65% on refrac programs [18]. These impressive returns are supported by the Eagle Ford’s strategic advantages, including its proximity to Gulf Coast markets and diverse resource potential [21].

The sustainability of these economic benefits is reinforced by recent surveys indicating that operators need approximately $56 per barrel to profitably drill new wells in the Eagle Ford, well below the average WTI price of $69 per barrel during the survey period [21]. With an estimated 30 trillion cubic feet of technically recoverable natural gas and 3.6 billion barrels of technically recoverable oil remaining, the Eagle Ford continues to present compelling economic opportunities through advanced completion technologies [21].

Conclusion

Eagle Ford Shale’s transformation through advanced completion technologies stands as a testament to modern engineering excellence. These innovations have delivered remarkable results across the region, with production rates climbing from 581 barrels per day to over 1.1 million barrels daily.

Smart completion systems, coupled with sophisticated monitoring technologies, have redefined operational efficiency. Operators now achieve cluster efficiency rates of 82%, while automated systems cut downtime events by 44%. These improvements translate directly to substantial economic gains, with some operators reporting returns exceeding 100% on their investments.

The economic impact reaches far beyond individual well performance. The region’s contribution to the economy grew from $61 billion in 2012 to $87 billion in 2013, with projections suggesting continued growth beyond $137 billion for 2023. With technically recoverable reserves of 30 trillion cubic feet of natural gas and 3.6 billion barrels of oil, Eagle Ford’s future remains promising through these advanced completion technologies.

The combination of optimized well designs, smart completion systems, and data-driven approaches has created a sustainable model for resource development. These technologies continue to push the boundaries of what’s possible in shale production, making Eagle Ford a blueprint for successful field development worldwide.