The unprecedented growth of the US energy sector has seen several energy majors outline new development plans for projects. MPLX, a major midstream energy project developer with interests in several essential pipelines in the US, recently detailed the activities for the Bay Runner, Blackcomb, and Rio Bravo pipelines ahead of the planned in-service dates this year, providing a clear and transparent picture of the company’s expected growth over the years to come in the United States energy market.

Will 2026 see the expansion of the United States midstream sector?

BY all accounts, yes, it certainly will. Since starting his second term in the most powerful office in the world, Donald Trump has led the rapid expansion of the US energy market through his executive orders. The President and his administration have accelerated the approval of several energy developments that strengthen the US energy security and position the nation at the forefront of the global energy expansion.

Trump and his administration have even made the controversial decision to roll back permits for several renewable energy developments. Despite this clear dislike for the renewable energy sector, the US Energy Department has published a new long-term strategy for hydrogen and fuel-cell technology development.

The US energy sector: a paradox between investing in the new, or relying on the old

The reality is that most states are moving ahead with renewable energy project developments despite the stance of the federal government. In contrast, MPLX has recently detailed the progress made in the company’s myriad of pipelines that will strengthen the US midstream sector. Expectations are for the litany of pipelines that MPLX owns and operates to reach key milestones this year, ahead of their planned in-service dates.

MPLX: an exemplar of midstream growth in the United States

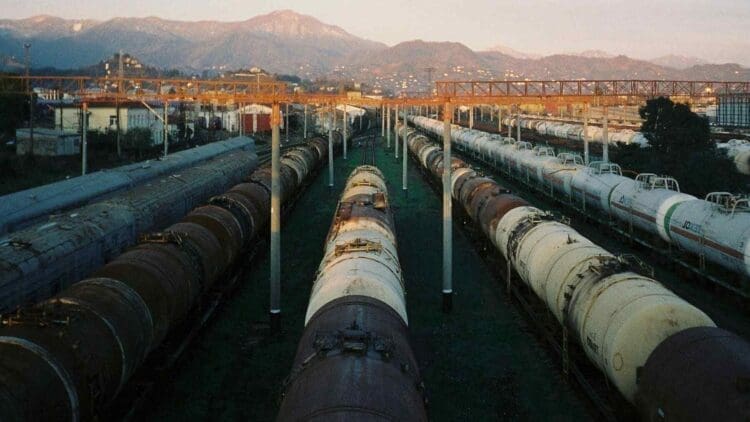

MPLX has recently provided some much-needed updates on the litany of pipelines that the company has in the Permian and other regions in the United States energy market. The notable midstream assets that the company has in the US are:

- Bay Runner pipeline: designed to transport approximately 5.3 Bcf/d of natural gas from the Texas-based Agua Dulce hub to export markets, the Bay Runner Pipeline is expected to come online by Q3 of 2026.

- Rio Bravo Pipeline: The company has an interest in the Enbridge-owned Rio Bravo Pipeline, which will transport up to 4.5 billion cubic feet per day from the iconic Permian basin to the Rio Grande LNG facility near Brownsville, Texas

- Blackcomb Pipeline: This pipeline exemplifies the remarkable strategic importance of the Permian basin as it aims to connect supply from the Permian to export facilities and further on to shippers along the Gulf Coast of the US.

Thanks to the expansion of the US energy market, the Bay Runner, Blackcomb, and Rio Bravo pipelines are slated to come online over the coming year, with the Rio Bravo Pipeline set to play a vital role in advancing MPLX’s plans for the midstream market in the United States over the coming years and decades.

Can the US midstream market meet the needs of the global energy sector?

Through the litany of pipelines planned for 2026, the US midstream market is set to grow exponentially. Market data has revealed that the US oil and gas pipeline capacity is set to continue on its expansionary path this year, and MPLX stands at the precipice of a new era of midstream energy transportation, thanks to the myriad of energy pipelines that the company has set in place for commissioning this year. The question becomes, can the federal government support MPLX’s plans for the US midstream sector this year and potentially into the future as well?