Following a drastic drop in the Waha Hub natural gas price earlier this week, Adrian Lara, Senior Oil and Gas Analyst at GlobalData, a leading data and analytics company, offers his view on the impact on the upstream sector:

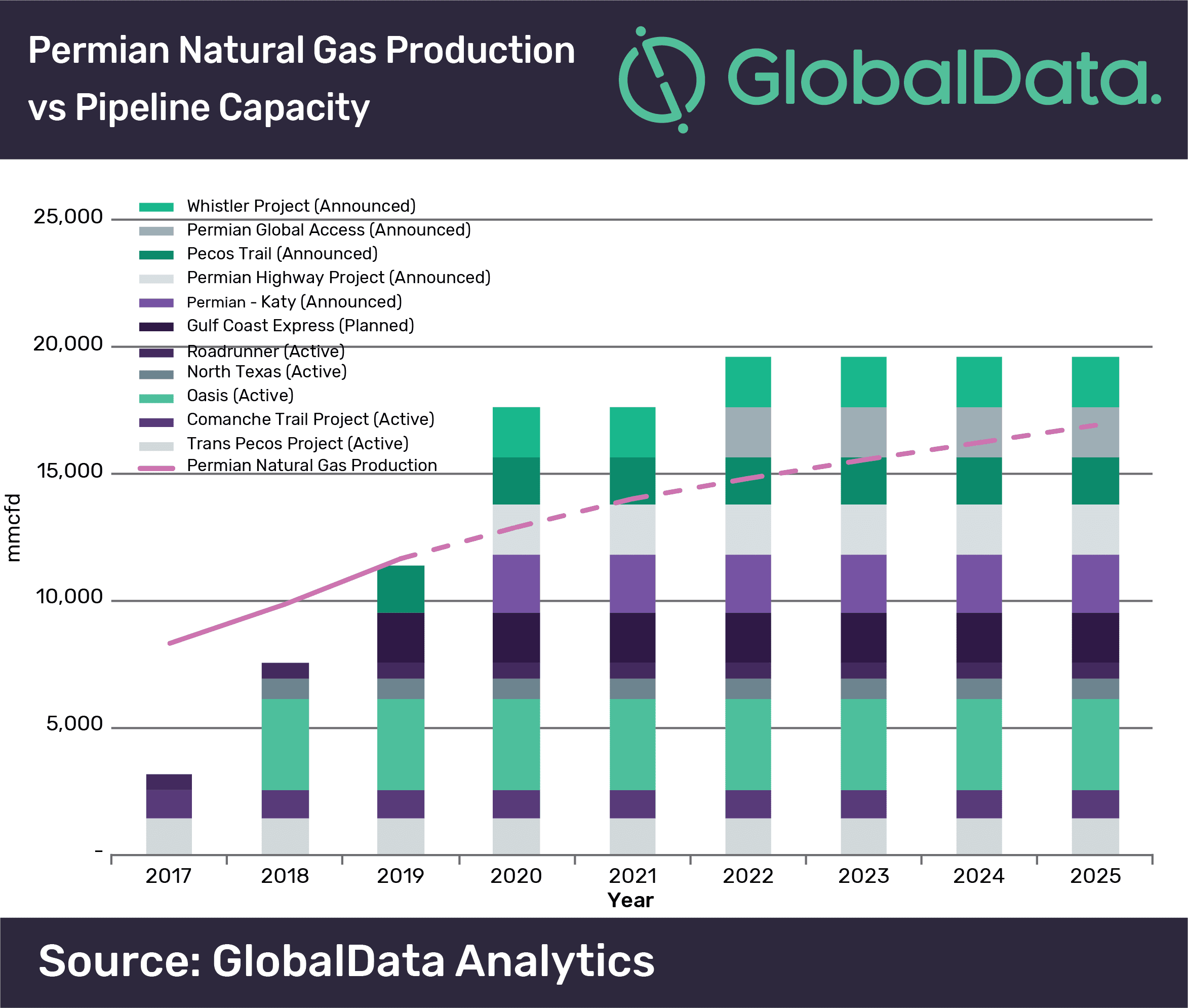

“A direct consequence of the excess of natural gas supply is the low prices at which Permian gas is traded at the Waha Hub in

“With an assumed increase in the export to Mexico and the potential for new LNG plants in the USGC, natural gas from Permian is expected to be matched by this additional demand. However, pipeline projects in Mexico are facing delays and direct consequence total seven planned projects that should have started by Q4 2018, five are delayed.

“Recently the TransCanada pipeline project, aimed at moving natural gas from Tuxpan on Mexico’s USGC to Tula nearby Mexico City, was stalled due to the difficulties in negotiating with local communities.

“In any case, none of these scenarios of increased demand for regional natural gas and its corresponding infrastructure in place will occur before 2020, which means WahaHub prices will likely continue to be volatile and with a larger than normal discount to Henry Hub for at least one more year.”

About GlobalData

has averaged of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis