The global COVID-19 pandemic has disrupted the energy industry. Declining demand for oil and gas has led companies to reduce overall oil production and supply, resulting in historic impacts on the market as oil prices dropped to below zero, their lowest to date. The overall depletion in revenue and low oil prices, stemming from consumers staying home and businesses moving to remote work, is resulting in companies evaluating their operations—including financials, resources, contracts and labor—to make adjustments for sustainability.

As a part of this analysis, the industry should look closely at their leasing arrangements, particularly as it pertains to fluctuating storage needs, to identify any changes that might be beneficial to the financial results of the business. Leases should be in focus in context of flexibility and liquidity, but privately-owned oil and gas companies must also ensure preparation for a significant lease accounting overhaul.

The New Rules and Balance Sheet Impact

Prior to the pandemic, private oil and gas company executives were gearing up for compliance under new Financial Accounting Standard Board rules on lease accounting, also known as ASC 842, which require recording leases as a liability on the balance sheet for the first time. The rules were slated to be effective for calendar-year entities beginning in 2021, but in June 2020, the FASB approved a one-year delay in the compliance deadline to allow companies to focus on their business operations. While the FASB is offering companies more time to focus on operational issues associated with the pandemic, for private companies that have the resources, they may find that continuing the process of implementing the new lease accounting standard may allow them greater insight into their lease arrangements to enhance decision making and scenario planning during a challenging time.

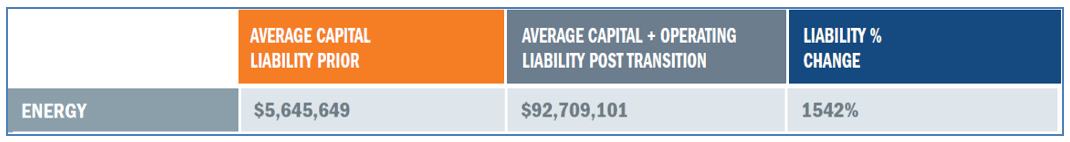

While business continuity is critical at this time, private oil and gas companies should not overlook either the effort that will be required with the ASC 842 implementation nor the dramatic impact on financial statements. In an analysis of more than 400 public companies’ balance sheets pre- and post-transition to the new lease accounting rule, the Lease Liabilities Index revealed an astonishing 1,542 percent liability increase in energy companies’ balance sheets as a result of this mandatory accounting change.

While business continuity is critical at this time, private oil and gas companies should not overlook either the effort that will be required with the ASC 842 implementation nor the dramatic impact on financial statements. In an analysis of more than 400 public companies’ balance sheets pre- and post-transition to the new lease accounting rule, the Lease Liabilities Index revealed an astonishing 1,542 percent liability increase in energy companies’ balance sheets as a result of this mandatory accounting change.

A Complex Path Ahead

Oil and gas companies must understand the new guidance and its impact on their business in order to become compliant under ASC 842. That process is no small feat. A survey of more than 200 accountants across industries showed that 67 percent of companies in the later stages of their lease accounting transition experienced difficulty with the implementation, while just 37 percent in earlier stages anticipated difficulty. It is wise for private oil and gas companies to follow the warning of those who have already transitioned and begin implementation as soon as possible.

While the process of compliance has been a big undertaking for all companies, companies in the energy sector may find it even more time consuming given that the definition of a lease, which was formerly based on capacity under ASC 840, is now changed to be based on control under ASC 842. As a result, some public energy companies who have already adopted the standard found that they had to re-assess whether some of their lease agreements met the definition of a lease under the new rules.

The Quest for Embedded Leases

After analyzing the new accounting standard, energy companies must perform an in-depth analysis of all lease agreements. The first step in this process involves connecting all company departments in order to understand various lease arrangements. This is essential as leases and contracts are not always handled by the accounting department. Often, service contracts are either kept with procurement or operations.

Oil and gas companies are likely to have transportation, drilling and storage contracts as well as equipment, land and facility leases. Additionally, many service contracts, such as IT service agreements, may contain embedded leases, which are lease agreements that exist within contracts. Energy companies may also have nuances such as land easements and take-or-pay provisions within their leases, which makes in-depth analyses of leases all the more crucial.

It is also important to determine if a contract contains an identified asset and if the right to “control” that asset is determined by the lessee. For example, for a lease embedded in a service contract, it is imperative for accountants to separate the contract into lease and non-lease components. With the complexity of embedded leases, there is even more reason for internal communication and cooperation to establish compliance with the new standard.

On the Road to Compliance

As oil and gas companies understand the full breadth of the new lease accounting regulation, private companies should start their implementation process as soon as their business operations allow, given that transitioning can take at least a year. Securing the right tools, technology and internal team leaders is essential. According to a survey, 56 percent of companies had only one or two staff members or external consultants on their transition team, making it more important to set a reasonable timeline and leverage technology to gather, organize and report leases.

Uncovering Efficiency and Insight

Engaging in the lease accounting transition process as soon as possible brings sooner access to the benefits. Now more than ever, companies need visibility into their operations and financial obligations to ensure they receive the most out of their investments. At a time when many companies have liquidity concerns, businesses can look to their lease portfolio insights to perform cash flow forecasting of their commitments. Furthermore, companies can organize the operational side of leases, including monitoring and evaluating lease terms, allowing the opportunity for them to take advantage of automatic renewals and consider termination clauses.

In short, better line of sight into leases gives oil and gas financial executives a new tool for better decision making, which could ultimately identify operational and liquidity efficiencies in a challenging time.

Jennifer Booth is the VP of Accounting at LeaseQuery, a purpose-built, CPA-approved lease accounting software solution for the most comprehensive regulatory reform in 40 years. For more information, visit LeaseQuery.com.