Crude oil prices are making a comeback, but natural gas has the summer blues.

Crude oil prices on the New York Mercantile Exchange closed Wednesday at $41.96 for 30-day delivery, which is a $1.67 increase over last week, but natural gas dropped again to $1.675 per million British thermal units (MMBtu).

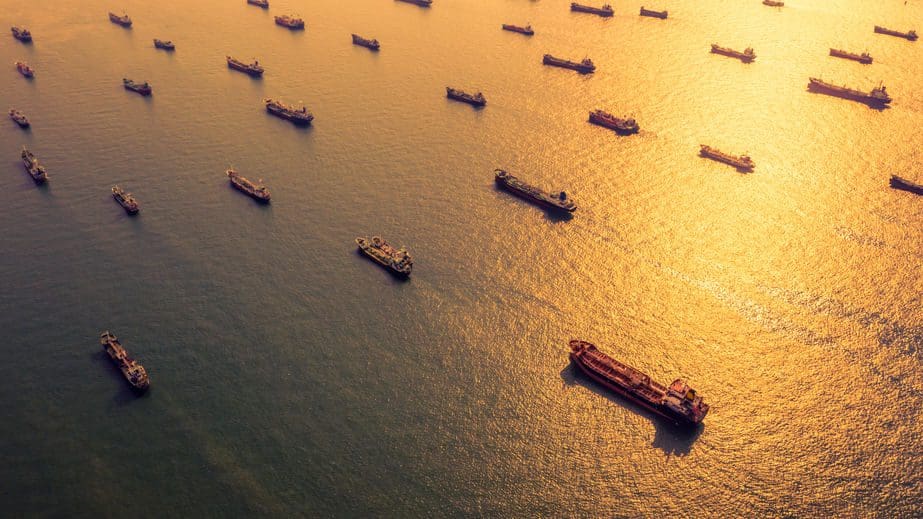

Even though crude oil inventories continue to be high, traders believe demand will continue to rise in the U.S. and globally narrowing the oversupply gap.

Three recent reports from the International Energy Agency (IEA), the Energy Information Administration (EIA), and the Organization of Petroleum Exporting Countries (OPEC) are key reasons for the optimism. All three organizations recently revised their second quarter demand figures resulting in a smaller demand decline than originally projected. The initial demand decline was as much as 20 million barrels per day (b/d). Their current estimate is 7.9 million b/d.

On the supply side, U.S. oil production has declined about 2 million barrels per day from roughly 13 million (b/d) to 11 million b/d currently. OPEC and some other oil producing countries reduced production by 9.6 million b/d in May, June, and July, but will change to 7.7 million b/d starting in August. OPEC’s leadership was concerned about some countries over producing their quotas, and it formed a committee to monitor compliance. The committee reported June compliance was an impressive 112 percent. Three countries – Iraq, Nigeria, and Angola – did not stay within their quotas, but said they would reduce production in the future to make up the difference.

U.S. and global oil inventories are near record levels, but the three forecasts believe the production cuts and the increase in demand because of increased economic activity will reduce the oversupply and return to pre-coronavirus levels by the third quarter of 2021.

Natural gas suffers some of the same problems as crude oil. The primary market for natural gas is electricity generation. Demand for electricity is down because economic activity is down. Liquified natural gas (LNG) exports to other countries have dropped, too. Natural gas inventories are at record levels.

Natural gas prices at the U.S. Henry Hub benchmark reached record lows during the first half of this year, according to EIA. “The average monthly Henry Hub spot price in the first six months of the year was $1.81 per MMBtu,” EIA reported. “Monthly prices reached a low of $1.63/MMBtu in June, the lowest monthly inflation-adjusted (real) price since at least 1989. Prices started the year low because of mild winter weather, which resulted in less natural gas demand for space heating. Beginning in March, spring weather and the economic slowdown induced by mitigation efforts for the coronavirus disease 2019 (COVID-19) contributed to lower demand, further lowering prices.”

“Contributing to high U.S. storage levels and lower prices has been a decline in LNG exports,” EIA stated. Demand for U.S. LNG exports has fallen by half in the first half of 2020, from 9.8 billion cubic feet per day (Bcf/d) in late March to less than 4.0 Bcf/d in June.

Drilling for new production and well completions are off more than 50 percent. Many companies have slashed budgets in an effort to avoid bankruptcy. Surviving the economic crunch is top priority.

Alex Mills is the former President of the Texas Alliance of Energy Producers.

Alex Mills is the former President of the Texas Alliance of Energy Producers. The Alliance is the largest state oil and gas associations in the nation with more than 3,000 members in 305 cities and 28 states.