The onshore segment is expected to undergo a declining phase during the forecast period 2018-2026. On the flip side, the offshore segment is projected to emerge as the fastest growing segment during the forecast period owing to the increasing investment in gas assets and subsea oil.

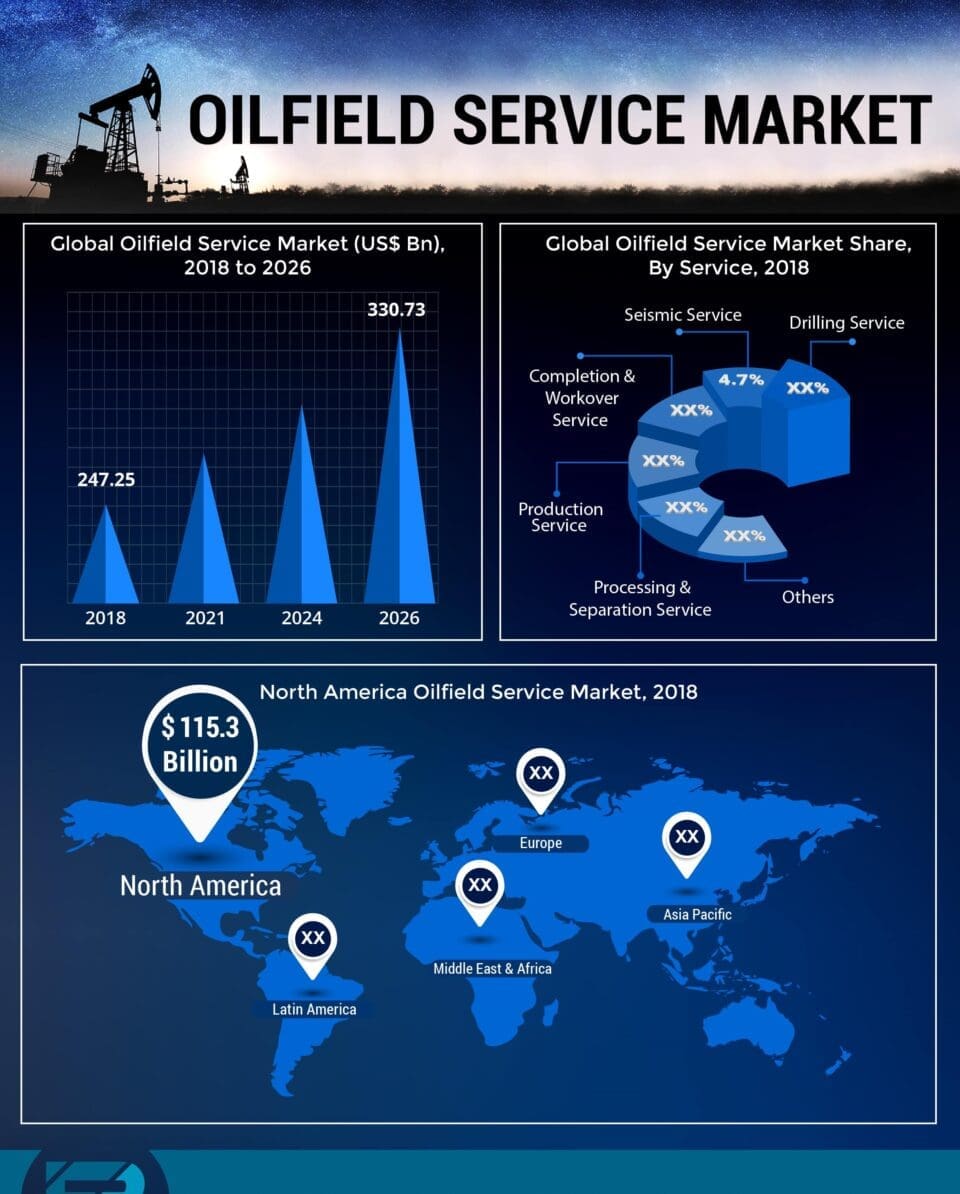

Moreover, several oilfield service providers are investing in offshore assets to improve their well reservoir performance, productivity, and overall life cycle of the well. This is likely to increases the demand in the global oilfield service market. As per a report published by Fortune Business Insights, in 2018, the global oilfield service market was valued at US$ 250 Bn and is projected to exhibit a CAGR of 3.7 percent and reach US$ 330 Bn by the end of 2026.

Schlumberger is the leading organization in the global oilfield service market. Some of the other organizations operating in the global market are Halliburton, National Oilwell Varco, SGS S.A., Baker Hughes, Transocean, Fluor, Weatherford International, Saipem, BJ Services Company, Petrofac, Oil States Industries, Weir Oil and Gas and China Oilfield Services Ltd.

Discovery of New Oil Well to Drive the Global Market

“Oilfield service providers are likely to focus and invest in subsea well intervention. It is the recent trend in the oil and gas industry and is anticipated to introduce new sources of oil and gas,” said a lead analyst at Fortune Business Insights.

Constantly increasing demand for oil, huge investments made in order to increase the productivity of existing wells, and introduction of advent technology are a few factors expected to drive the global oilfield service market during the forecast period 2018-2026. Besides this, increasing demand for oil is leading to exploration of new wells this is likely to propel the growth rate in the global oilfield service market.

However, the increasing demand and supply gap for oil and decreasing production capacity of wells are some factors that may restrain the global oilfield service market during the forecast period.

The Middle East and Africa to take over the Global Oilfield Service Market

In 2018, the oilfield service market in North America was valued at US$ 115 Bn, followed by Asia Pacific and Europe. The trend is expected to remain the same during the forecast period owing to certain activities that are expected to take place in offshore assets in the North Sea and Gulf of Mexico. Additionally, in 2017 globally the U.S. accounted for 50 percent of the new well drilled, followed by China and other Asian nations.

The Middle East and Africa are projected to expand at a higher CAGR during 2019-2026. Several projects are initiated and investments are made by leading oilfield service providers in the region. Besides this, increasing focus on offshore assets and huge budget capabilities in the Gulf Nations are likely to increase the production rate in the region.

Fortune Business Insight’s report also provides an insightful overview of opportunities, strategies used by the leading organization in the market, and the potential areas of development.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.

![Why Enhanced Geothermal Energy Could Be Your Next Smart Investment [2025 Guide]](https://b1006343.smushcdn.com/1006343/wp-content/uploads/2025/06/Why-Enhanced-Geothermal-Energy-Could-Be-Your-Next-Smart-Investment-2025-Guide-500x280.jpg?lossy=2&strip=1&webp=1)