Pennsylvania natural gas production in 2020 hit an all-time high, as producers become more proficient drillers and commodity prices remained low, but one industry insider predicts for the near future this is as good as it gets – for now.

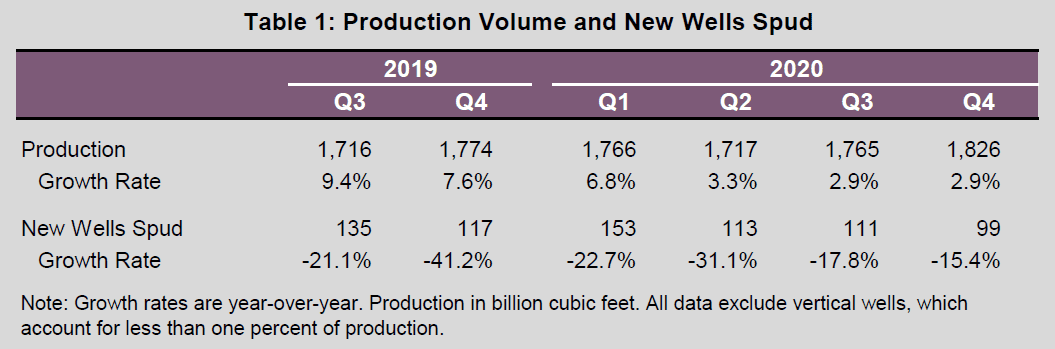

Number wise, 2020 was a boom after a couple of bust years. When most oil and gas industries were hard hit by the COVID-19 pandemic, Pennsylvania drillers saw record-breaking numbers. Last week the Independent Fiscal Office reported production in the Keystone State increased 3.9 percent in 2020 over 2019. Overall, Pennsylvania horizontal wells produced 1.826 bcf during 4Q20.

Fourth-quarter “growth was driven by production in December, which grew by 6.3 percent year-over-year,” the report reads.

The five-page report focused mainly on the 4Q20, which saw:

- 476 new unconventional wells put into production in 2020, a 22.5 percent decline from the year before.

- 99 new horizontal wells spud.

- 10,332 total producing wells in the 4Q20, an increase of 5.5 percent from the year before.

- Horizontal producing wells, which make up 99 percent of production, saw an increase of 5.9 percent from the same time last year.

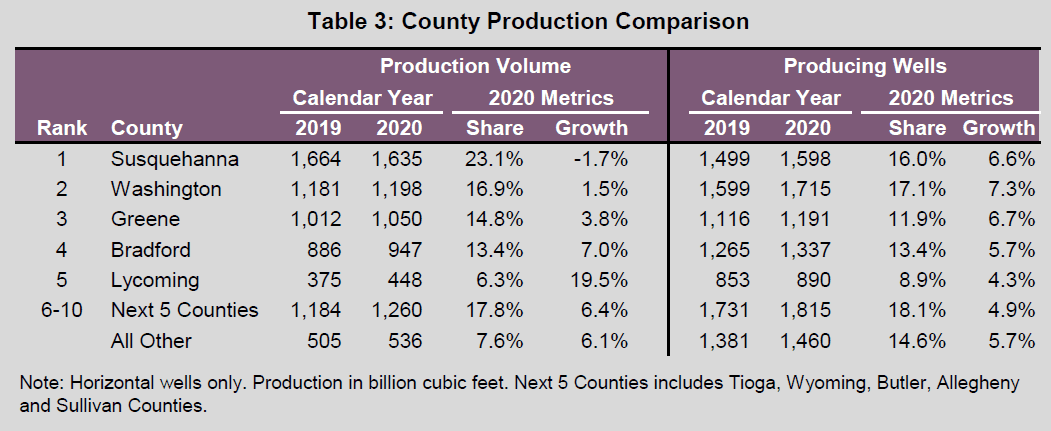

- The top five producing counties produced nearly 75 percent of production and more than 67 percent of wells production statewide. These counties include Susquehanna, Washington, Greene, Bradford, and Lycoming. Even though Susquehanna remains the top producer during the period, overall output was down 1.7 percent during the last quarter of 2020. Washington was up 1.5 percent, Greene up 3.8 percent, Bradford 7 percent and Lycoming up an extremely healthy 19.5 percent.

- The Henry Hub price skyrocketed 5.6 percent in the fourth quarter compared to 2019, the first year-over-year price increase since 2018.

- Even with increase pricing in the third fiscal quarter, the Pennsylvania price declined relative to the same time last year.

The decelerating growth in producing wells, the report states, is due to less drilling activity and older wells being plugged or shut down.

The mix numbers, said Dan Weaver, president and executive director of the Pennsylvania Independent Oil and Gas Association reflect the market conditions of 2020, including low commodity prices and a continuing need for more takeaway infrastructure out of the Appalachian Basin. This means fewer wells drilled, a trend likely to continue in the immediate future.

“What is clear from the steady production increases we are seeing; however, is that producers are becoming increasingly efficient at drilling, completing and recovering natural gas as the Marcellus and Utica plays mature,” he told Oilman Magazine.

He pointed out this is reflected in total natural gas production from shale wells during 4Q20 at, 1.8 Tcf, which is the largest volume ever produced in a single quarter in Pennsylvania.

“We expect well counts to dip slightly in the months ahead and expect production to remain somewhat steady as those efficient wells are brought online,” he said.

Pennsylvania is an anomaly in the natural gas market. According to the EIA, in 2020 marketed natural gas production levels fell 2 percent from 2019 levels amid response to COVID-19. The federal government predicts, “that annual U.S. marketed natural gas production will decline another 2 [percent] to average 95.9 billion cubic feet per day in 2021.”

The fall in production will reverse in 2022, when the EIA predicts natural gas production will increase by 2 percent to 97.6 Bcf/d.

Dan Tyson has covered the energy industry for more than a decade, focusing mainly on coal and natural gas.