At the start of August 2019, Abu Dhabi National Oil Company (Adnoc) has said it will acquire a 10 percent stake in VTTI, a Vitol-backed global energy storage company, as part of the state-run UAE energy firm’s transformation drive and its expansion into oil trading.

Adnoc’s acquisition of the stake in VTTI should allow the UAE company to secure storage in global export markets as well as at the port of Fujairah, a regional bunkering and storage hub in the UAE.

Obligatory (mandatory) petroleum stocks are now held for emergency mainly on requirements of the International Energy Agency (IEA) and the European Union (EU). In particular, in line with the March 2001 agreement, all 28 members of the IEA must have a petroleum reserve equal to 90 days of prior year’s net oil imports of the respective country. Only net-exporter members of the IEA were exempt from the reserve requirement. The exempt countries were Canada, Denmark, Norway, and the United Kingdom. However, Denmark and the UK have both created strategic petroleum reserves (see below) due to their obligations as of members of the European Union.

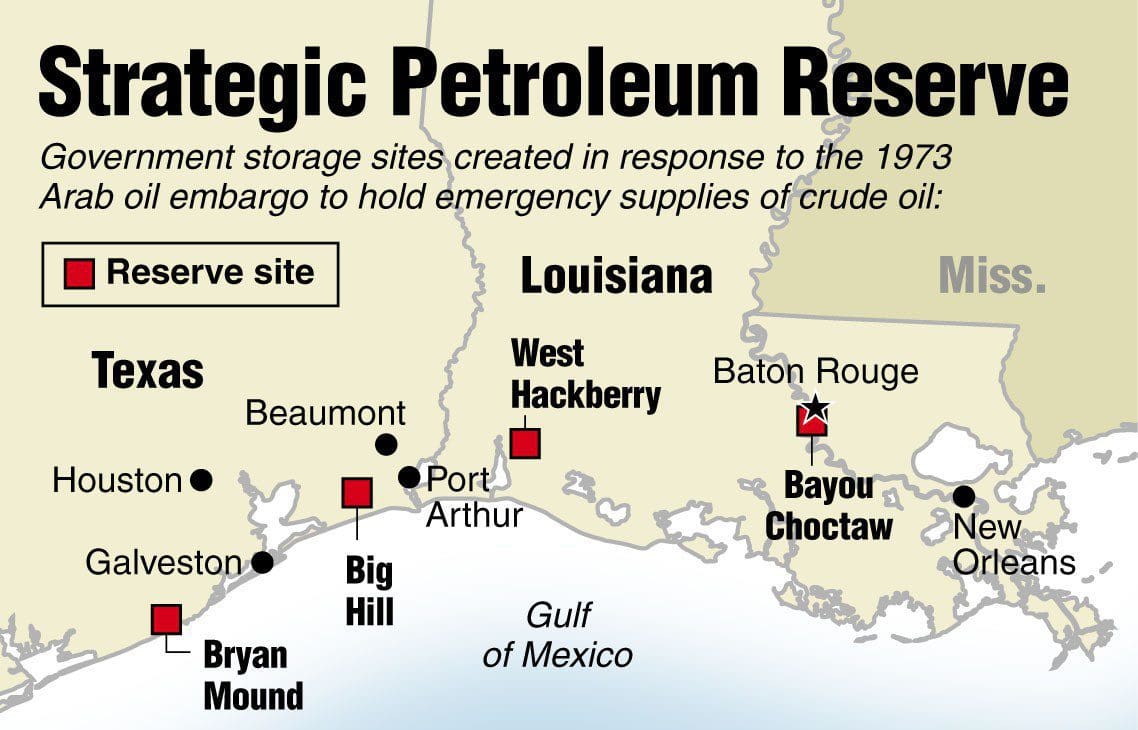

In addition to emergency crude and product stocks, many countries hold their own strategic petroleum reserves. Nowadays, strategic petroleum reserves exist or are being created in the Czech Republic (20.3 mln bbl or 100 days of domestic consumption), Denmark (1.4 mln tonnes of oil products or 81 days of consumption), Finland (62.4 mln bbl), France (around 65 mln bbl), Germany (250 mln bbl of crude and products as of 1997 – the largest SPR in Europe), Hungary (11.88 mln bbl or 90 days of consumption), Ireland (around 31 days of consumption plus 9 days of storages in fellow EU member states), Poland (90 days of consumption), Portugal (22.44 mln bbl or 90 days of consumption), Russia (which is not an IEA member) (2 mln tonnes of oil products by 2020), the Slovak Republic (around 0.748 mln bbl), Spain (around 120 mln bbl), Sweden (around 13.3 mln bbl), Switzerland (4.5 months of oil product use) and the United Kingdom (unpublished size and location). This compares to almost 645 mln bbl (nearly 90 mln tonnes) or an equivalent of some 143 days of import protection (based on 2016 net petroleum imports) of sweet and sour crude oils kept today (mid-July 2019) in four washed-out salt caverns in Texas and Louisiana of the Strategic Petroleum Reserve of the USA (SRP), being filled up since July 1977.

According to a March 2001 agreement, all 28 members of the International Energy Agency must have a strategic petroleum reserve equal to 90 days of the previous year’s net oil imports for their respective countries. Only net-exporter members of the IEA are exempt from this requirement. The exempt countries are Canada, Denmark, Norway, and the United Kingdom.

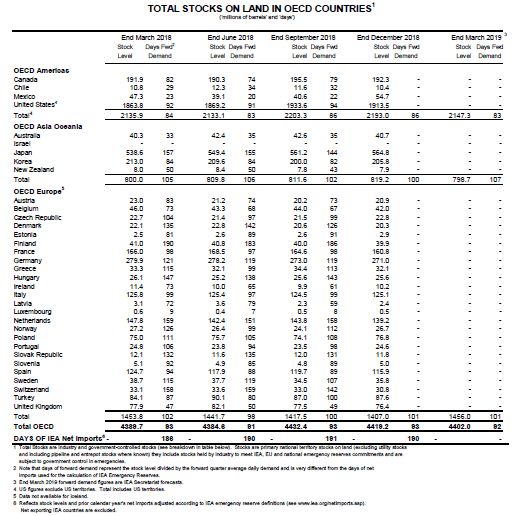

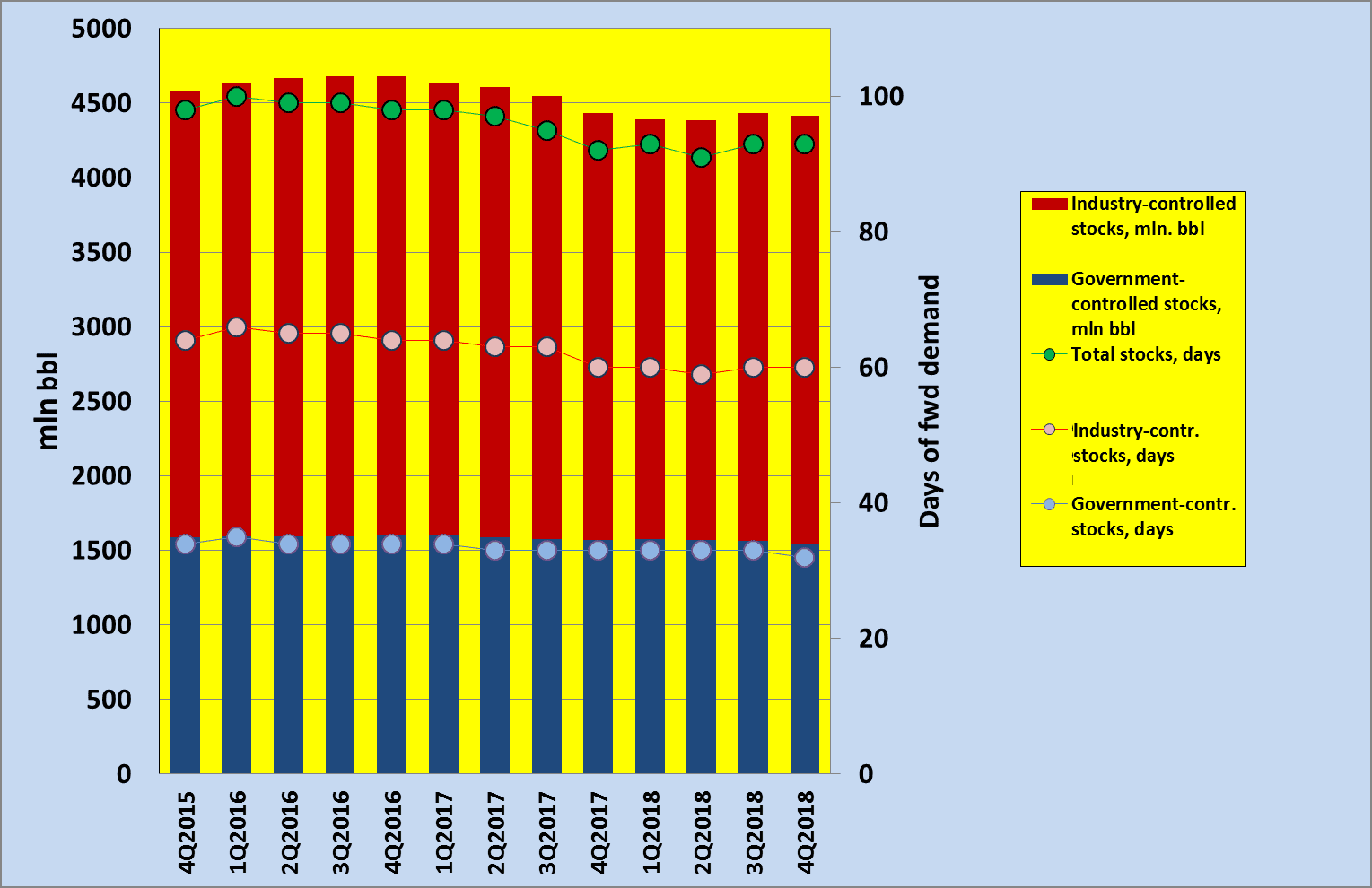

According to the IEA, by the end of 2018, non-strategic on-land stocks of crude oil and oil products in the OECD countries were recorded at over 4,419 mln bbl (Table X), including 1,547 mln bbl of government-controlled stocks and 2,872 mln bbl of industry ones. This was an estimated equivalent of 93 days of forward petroleum demand (respectively 33 and 60 days) and 190 days of net imports (67 and 123 days respectively). Relatively, petroleum stocks were especially high in Finland (183-190 days of forward demand for the available period of 2017-2018).

At the same time of particular concern were low petroleum stocks of Australia, Chile, Mexico and, especially, of the little European Luxembourg, where the national stocks, existing as of the end of September 2018, covered only 35, 32, 22 and 8 (!) days of forward oil demand respectively (Table 1).

Table 1. Total Non-Strategic Petroleum Stocks on Land in OECD Countries in 2018-2019, in mln bbl and days of demand/net imports.

Luxembourg’s problem with its low oil stocks was soon solved by their substantial buildup, the Mexican government has stated that it was too costly (“between 50 and 60 cents a month per barrel”) to finance the holding of the inventories, while Chile’s finance minister, Nicolas Eyzaguirre, has said that the lower world oil prices prompted a strong growth of the national economy, which should help to resolve the problem of the low petroleum stocks. As for Australia, in August 2019 the country was in active talks with the United States for buying crude oil from the U.S. Strategic Petroleum Reserve in order to boost its own crude oil and gasoline stocks, which, according to the Australian energy ministry, cover at that time just 28 days of Australia’s petroleum demand (that is substantially below the IEA’s 90-day standard.

Several countries have agreements to share their stockpiles with other countries in the event of an emergency.

In particular, in 2007, Japan announced a plan to share its strategic reserves with other countries in the region. In line with the oil-sharing deal concluded between Japan and New Zealand in 2009, Japan sells part of its strategic reserves to New Zealand in the event of an emergency. New Zealand would be required to pay the market price for the oil, plus negotiated option fees for the amount of oil previously held for them by Japan.

Also, in 2009, South Korea and Japan have agreed to share their oil reserves in the event of an emergency.

According to the 1975 Second Sinai withdrawal document signed by the United States and Israel, in an emergency, the U.S. is obligated, since 2010, to make oil available for sale to Israel for a period of up to five years.

Since 1965, France, Germany and Italy have an oil-sharing agreement in place that allows them to buy oil from each other in the event of an emergency. In 1968, the six members of the European Economic Community – Belgium, France, Germany, Italy, Luxembourg and the Netherlands – agreed to maintain a minimum level of crude oil stocks and oil products corresponding to 65 days’ worth of domestic consumption. In 1972, this obligation was raised to 90 days.

Kuwait has a joint stockpile located in South Korea. The deal gives South Korea first rights to purchase the oil. As of 2006, the size of the stockpile was 2 million barrels (320,000 m3).

Throughout the summer of 2019 Abu Dhabi Fund for Development (ADFD) funded the building of joint (Jordan–Abu Dhabi) $210 mln petroleum storage facilities in Jordan, which have a capacity of 356,000 tonnes and include 22 storage tanks for light petroleum products such as liquefied petroleum gas and derivatives such as diesel, gasoline, and jet fuel.

Despite the huge oil stockpiles in China (see above), the country (or rather its state-run company Sinopec) shares an oil-storage facility in Fujairah (U.A.E.), which is designed for light distillates and works since the start of 2015.

In the European Union, according to Council Directive 68/414/EEC of 20 December 1968, all its members must have petroleum stocks within the territory of the EU equal to at least 90 days of ave-rage daily internal consumption during a previous year.

In addition to emergency crude and product stocks, many countries hold their own strategic petroleum reserves. Nowadays, strategic petroleum reserves exist or are being created in the Czech Republic (20.3 mln bbl or 100 days of domestic consumption), Denmark (1.4 mln tonnes of oil products or 81 days of consumption; not accounting for military/defense purposes), Finland (around 62.4 mln bbl), France (around 65 mln bbl), Germany (250 mln bbl of crude and products as of 1997 – the largest SPR in Europe), Hungary (11.88 mln bbl or 90 days of consumption), Ireland (around 31 days of consumption plus 9 days of storages in fellow EU member states), Poland (90 days of consumption), Portugal (22.44 mln bbl or 90 days of consumption), Russia (which is not an IEA member) (2 mln tonnes of oil products by 2020), the Slovak Republic (around 0.748 mln bbl), Spain (around 120 mln bbl), Sweden (around 13.3 mln bbl), Switzerland (4.5 months of oil product use) and the United Kingdom (unpublished size and location). As of 2008, New Zealand had a strategic reserve with a size of 170,000 tons or 1,200,000 barrels (190,000 m3). Much of this reserve is based upon ticketed option contracts with Australia, Japan, the United Kingdom and the Netherlands, which allow for guaranteed purchases of petroleum in the event of an emergency. As of 2008, Australia held three weeks of petroleum, instead of the allotted 90 days that was agreed upon, according to the study ‘Liquid Fuel Security’ authored by the retired Air Vice-Marshal John Blackburn. As of 2011, Russia was accumulating strategic reserves of refined oil products to be held by Rosneftegaz, a state-owned company. The reserves will be held at commercial refineries, Transneft facilities and state reserve facilities. It was decided that the planned size of the national SPR would be some 14.67 mln bbl (2,331,704.8 m3).

This compares to almost 645 mln bbl (nearly 90 mln tonnes) or an equivalent of some 143 days of import protection (based on 2016 net petroleum imports) of sweet and sour crude oils kept today (mid-July 2019) in four washed-out salt caverns in Texas and Louisiana of the Strategic Petroleum Reserve of the USA (SRP), being filled up since July 1977. As of February 1, 2019, the inventory was 649.1 million barrels (103,200,000 m3). This equates to about 35 days of oil at 2013 daily U.S. consumption levels of 18.49 mln b/d (2,940,000 m3/d) or 67 days of oil at 2013 daily U.S. import levels of 9.859 mln b/d (1,567,500 m3/d).

On July 10, 2000, President of the United States Bill Clinton directed Energy Secretary Bill Richardson to establish a much smaller 2-million-barrel home heating oil component of the Strategic Petroleum Reserve in the Northeast. The intent was to create a buffer large enough to allow commercial companies to compensate for interruptions in supply or severe winter weather, but not so large as to dissuade suppliers from responding to increasing prices as a sign that more supply is needed.

The reserve was opened for the first time in November 2012. Two million gallons were made available to local and federal agencies for relief efforts in the wake of Superstorm Sandy.

Storing facilities of this part of the U.S. SPR include:

- Perth Amboy (near Woodbridge, New Jersey). Capacity 965,000 barrels;

- Groton, Connecticut. Capacity 250,000 barrels;

- New Haven, Connecticut. Capacity 750,000 barrels.

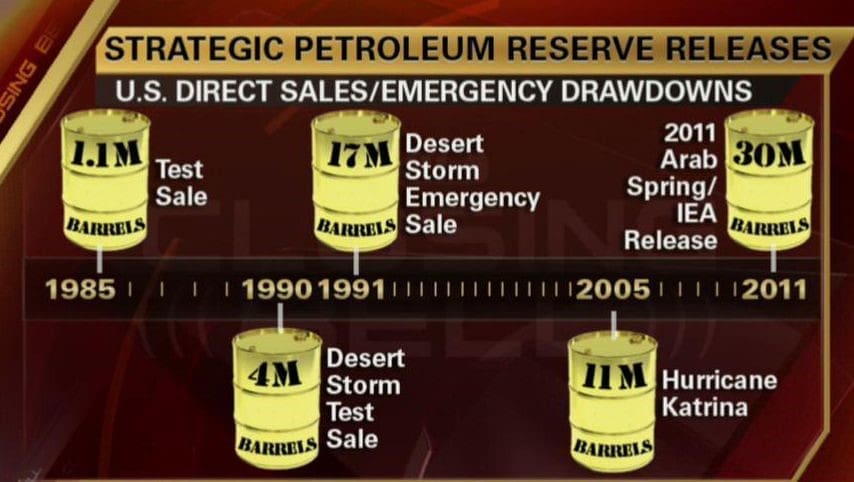

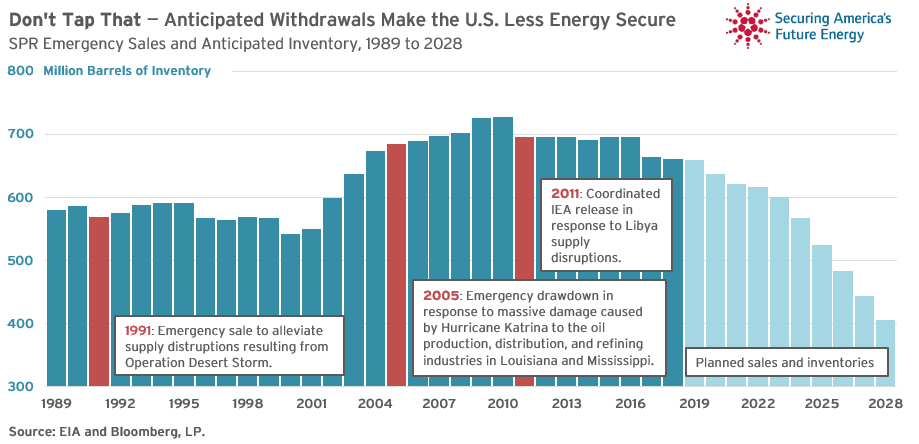

The SPR’s inventory stands at 644.8 million bbl as of August 2, 2019, according to U.S. Office of Fossil Energy (the U.S. DoE) data. The four storage caverns have a total capacity of 727 million bbl. Since the time of its establishment crude oil from the U.S. SPR was sold (released) 5 times – in 1985 (test withdrawal), 1990, 1991, 2005 and finally in 2011 (Fig.1).

The SPR’s inventory stands at 644.8 million bbl as of August 2, 2019, according to U.S. Office of Fossil Energy (the U.S. DoE) data. The four storage caverns have a total capacity of 727 million bbl. Since the time of its establishment crude oil from the U.S. SPR was sold (released) 5 times – in 1985 (test withdrawal), 1990, 1991, 2005 and finally in 2011 (Fig.1).

In 1975, the U.S. Congress created the Strategic Petroleum Reserve (SPR) to reduce the impact of oil market disruptions on U.S. consumers. As of June 2018, the SPR held more than 660 million barrels of crude oil or approximately 110 days of net imports (down from the 727 million barrels the stockpile held in June 2011). In its four decades of existence, SPR stockpiles have occasionally been tapped for emergency relief from supply disruptions and corresponding price spikes. Recently, policymakers have discussed tapping the SPR to provide downward pressure on gasoline prices. “The SPR is only effective if it can get its petroleum to market quickly and efficiently in the event of a supply emergency,” SAFE’s CEO Robbie Diamond said earlier this year in response to the passage of the 2018 Bipartisan Budget Act. Unfortunately, geopolitical supply risk is alive and well in the oil market. Earlier this week, the Senate heard testimony from energy experts who cautioned that severe outages in Libya, Nigeria, and Venezuela represent serious risks in a tightened oil market. “Geopolitical factors are central to determining prices,” IEA’s Keisuke Sadamori said. With demand rising globally and limited investment in long-term upstream projects, the likelihood of a tighter market in the next decade is increasing. In that case, the SPR will be needed to serve as an important security buffer to counter supply losses.

Only Chinese SPR may be compared by size with the one in the States. The Strategic Petroleum Reserve (SPR) is an emergency fuel store of oil maintained by the People’s Republic of China National Development and Reform Commission. China doesn’t officially report its SPR volume but it’s estimated to be approximately 400 million barrels in total, with a planned capacity of around 500 million barrels. China has been building up its SPR stocks all the time, it rarely discloses its commercial or strategic oil reserve data, so it is difficult to estimate the pace of its buildup. However, the IEA estimated that, at the beginning of September 2015, 218.9 mln bbl of petroleum products and crude oil were already filled into the Chinese SPR, 132.3 mln bbl of its storing capacity was under construction and 148.8 of the capacity was planned to be built by 2020, according to official information.

First phase facilities:

- Dalian, Liaoning Province. Capacity of 19 million barrels (3,000,000 m³), filled as of September 2009;

- Qingdao, Shandong Province. Capacity of 19 million barrels (3,000,000 m³), filled as of September 2009;

- Zhenhai, Zhejiang Province. 52 storage tanks with a capacity of 33 million barrels (5,200,000 m³), filled as of December 2007;

- Zhoushan, Zhejiang Province. Capacity of 33 million barrels (5,200,000 m³), 7.6 million barrels (1,210,000 m3) filled as of June 2007.

Second phase facilities:

- Dushanzi, Karamay City, Xinjiang Uygur Autonomous Region. Planned capacity of 34 million barrels (5,400,000 m³);

- Lanzhou, Gansu province. Planned capacity of 19 million barrels (3,000,000 m³), with completion by 2011;

- Huangdao, Shandong Province;

- Jinzhou, Liaoning Province;

- Four other facilities, location and size to be determined.

Third phase facilities:

- Wanzhou, Chongqing Municipality;

- Henan Province;

- Caofeidian, Hebei Province;

- Planned capacity of 150 million barrels (20,000,000 m³), with completion by 2023;

- Guangdong Province has begun plans for an expanded reserve from 20 days to 90 days;

- Hainan Province has begun plans for a reserve.[20]

- Shanshan, Xinjiang Uygur Autonomous Region has begun plans for a reserve.

- Caofeidian, Hebei province has begun plans for a reserve.

- Wanzhou, Chongqing municipality has begun plans for a reserve.

Currently, the enterprise reserves comprise a smaller portion of the overall SPR with a 209.44-million-barrel strategic reserve planned (35.33 million barrels completed, 51.5 million barrels under construction).

In 2007 China announced an expansion of their crude reserves into a two-part system. Chinese reserves would consist of a government-controlled strategic reserve complemented by mandated commercial reserves, held mostly by major Chinese state-run oil companies, PetroChina, Sinopec and CNOOC and which include:

- PetroChina facility, Shanshan County, Xinjiang Uygur Autonomous Region. Completed with a capacity of 6.3 million barrels (1,000,000 m3);

- PetroChina facility, Tieling, Liaoning Province. Completed with a capacity of 5.03 million barrels (800,000 m3), completion October 2008;

- Sinopec facility, Ningbo, Zhejiang Province. Completed with a capacity of 24 million barrels (3,800,000 m3);

- Sinopec facility, Rizhao, Shandong Province, under construction. Planned capacity of 20.1 million barrels (3,200,000 m³);

- Sinopec facility, Beihai, Guangxi region, under construction. Planned capacity by 2011 of 20.1 million barrels (3,200,000 m³);

- Sinopec facility, Zhanjiang, under construction;

- Sinopec facility, Caofeidian, under construction;

- Sinopec facility, Shanghai, under construction;

- Sinochem facility, under construction;

- Unknown company, Heilongjiang Province;

- CNOOC facility, Gansu Province, under construction. Planned capacity of 11.3 million barrels (1,800,000 m3).

The planned state reserves of 475.9 million barrels plus the planned enterprise reserves of 209.44 million barrels will provide around 90 days of consumption or a total of 685.34 million barrels

According to the IEA, by the end of 2018, non-strategic on-land stocks of crude oil and oil products in the OECD countries were recorded at over 4,419 mln bbl (see Table 1), including 1,547 mln bbl of government-controlled stocks and 2,872 mln bbl of industry ones. This was an estimated equivalent of 93 days of forward petroleum demand (respectively 33 and 60 days) and 190 days of net imports (67 and 123 days respectively). Relatively, petroleum stocks were especially high in Finland (183-190 days of forward demand for the available period of 2017-2018).

Under the EU’s Oil Stocks Directive (2009/119/EC):

- EU countries must maintain emergency stocks of crude oil and/or petroleum products equal to at least 90 days of net imports or 61 days of consumption, whichever is higher;

- Stocks must be readily available so that in the event of a crisis they can be allocated quickly to where they are most needed;

- EU countries must send the European Commission a statistical summary of their stocks at the end of each month. This summary must state the number of days of net imports or consumption that the stocks represent;

- During a supply crisis, the Commission is responsible for organizing a consultation between EU countries. Withdrawals from stocks should not be made before this consultation, except in a very urgent situation.

So, in the European Union, according to Council Directive 68/414/ EEC of 20 December 1968, all its members must have petroleum stocks within the territory of the EU equal to at least 90 days of the country’s average daily net imports of crude oil + oil products during a previous year.

Besides, since 1965, France, Germany and Italy have an oil-sharing agreement in place that allows them to buy oil from each other in the event of an emergency. In early 1968, the six members of the European Economic Community – Belgium, France, Germany, Italy, Luxembourg and the Netherlands – agreed to maintain a minimum level of crude oil and oil products stocks corresponding to 65 days’ worth of domestic consumption. In 1972, this obligation was raised to 90 days.

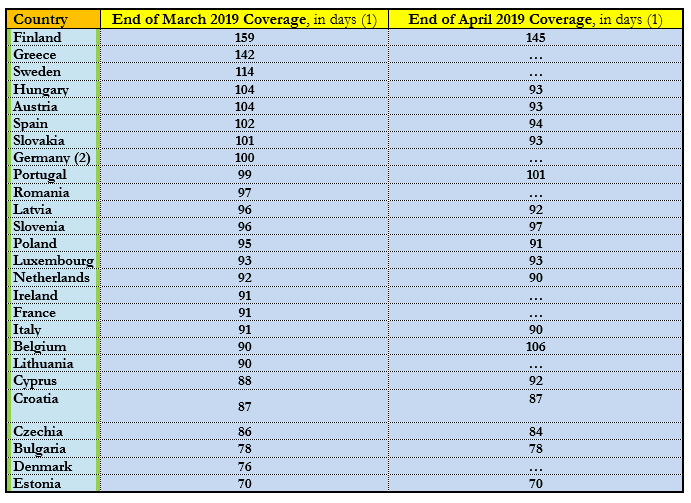

As of the end of April 2019, according to the Eurostat, daily coverage of 2018 net oil imports by emergency petroleum stocks varied from maximum 145 days in Finland to minimum 70 days in Estonia (Table 2).

The Middle East and Africa region (MEA) is the key contributor in the global oil storage market and is expected to expand at a strong CAGR of 7.9 percent from 2016 to 2024, according to a recent forecast of the India-based consultancy Transparency Market Research (TMR), to retain its lead throughout the forecast period. Saudi Arabia, Iran, UAE, Oman, Qatar, and Nigeria are some of the prominent countries in the MEA oil storage market. This region is primarily driven by surging oil production and declining oil prices.

The North America oil storage market was next in line, accounting for a share of around 24 percent in 2015. The market in this region is fueled by the rising need for additional oil storage space. The demand for increased storage capacity is the result of the shale revolution. The revolution has stimulated growth in crude oil production and is the primary reason for crude oil oversupply in North America. High investment in the expansion of storage capacity is expected to boost the oil storage market in North America during the forecast period.

Asia Pacific is also a key market for oil storage and the region is projected to expand at the fastest CAGR of 8.2 percent from 2016 to 2024. China, South Korea, Japan, and Singapore are the leading countries in terms of volume of oil storage in this region, fueled by the rise in investments in petroleum reserves.

Commercial petroleum stocks expand at a rapid pace fueled by deviations in oil prices. Based on the type of reserve, the oil storage market is bifurcated into commercial petroleum reserve and strategic petroleum reserve. Accounting for a massive 79.2 percent share in 2015, strategic petroleum reserves were the key contributors toward the overall oil storage market. However, strategic petroleum reserves are growing at a gradual pace as the expansion of these reserves requires large investments from governments.

Commercial petroleum reserves, on the other hand, are expected to expand at a CAGR of 7.8 percent from 2016 to 2024. Large deviations in oil prices have led to the growth in storage capacity expansion, driving the demand for commercial petroleum reserves. Oil storage in commercial petroleum reserves influences the prices and planning of future oil storage and this helps in formulating expansion strategies for oil storage facilities.

All in all, level of non-strategic petroleum stocks in the OECD peaked at the end of 3Q2016 at 4,679 mln bbl, while daily coverage of such oil stocks – at the end of 1Q of 2016 at 100 days of estimated forward demand. As of the end of 2018, the stocks stood at 4,418 mln bbl, including 1,547 mln bbl of government-controlled stocks and 2,870 mln bbl of industry-controlled ones, while their coverage was 32 and 60 days of total internal demand respectively (Fig. 3).

[FYI]: Government-controlled petroleum stocks in OECD countries refer to non-commercial obligatory inventories of crude oil and oil products, which are owned or mandated or supported by national governments and monitored by them, and include emergency oil stocks and SPRs].

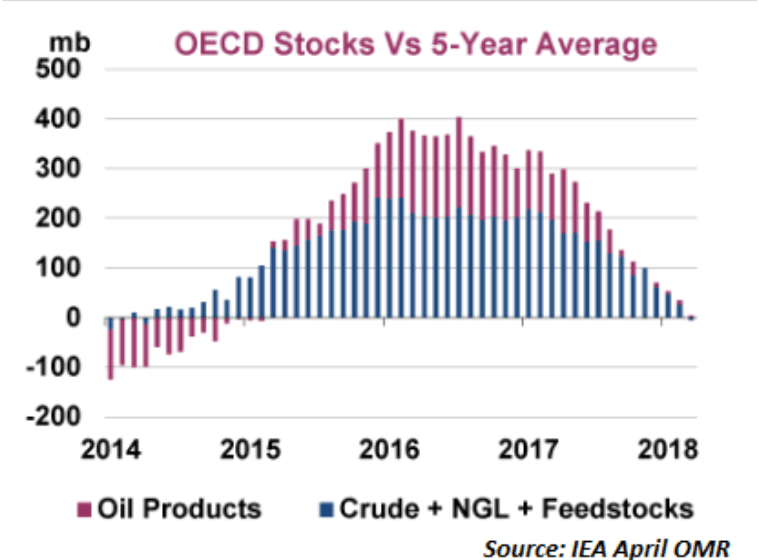

Actually, non-strategic OECD oil stocks (and especially those of oil products) have a tendency to relatively decrease since the beginning of 2017, which can be clearly seen on the below graph (Fig.4) and which may be explained by a kind of widespread complacency in the long absence of another oil crisis.

The prominent vendors in the global oil storage market include Horizon Terminals Ltd., Sunoco Logistics Partners L.P., Magellan Midstream Partners L.P., CLH Group, CIM-CCMP Group, Vitol Tank Terminals International B.V., Oiltanking Gmbh, NuStar Energy L.P., Ghazanfar Group, Royal Vopak N.V., Buckeye Partners L.P., Kinder Morgan Inc., and International-Matex Tank Terminals, Inc.

Eugene M. Khartukov is a professor at the Moscow State Institute/University for International Relations, (MGIMO), head of the Moscow-based Center for Petroleum Business Studies (CPBS) and of the World Energy Analyses and Forecasting Group (GAPMER), and vice president (for Eurasia) of the Geneva-based Petro-Logistics S.A. He is the author and co-author of over 360 scientific publications and speaker at more than 170 international oil, gas, energy or economic fora. Email: khartukov@gmail.com.

Oil and gas operations are commonly found in remote locations far from company headquarters. Now, it's possible to monitor pump operations, collate and analyze seismic data, and track employees around the world from almost anywhere. Whether employees are in the office or in the field, the internet and related applications enable a greater multidirectional flow of information – and control – than ever before.