Following the expected cuts in capital expenditure (capex) for shale operators in the Bakken due to demand shock from the coronavirus (COVID-19) and supply shock from the Russia-Saudi price war;

Adrian Lara, Oil and Gas Analyst at GlobalData, a leading data and analytics company, offers his view:

“Whenever available, companies will try to focus on their best acreage but most operators have already squeezed their best land and so the room for improving well initial production (IP) rates might be limited. Moreover, Bakken operators need to make all their wells profitable, not only the new wells, and generate enough free cash flow to cover operating expenses.

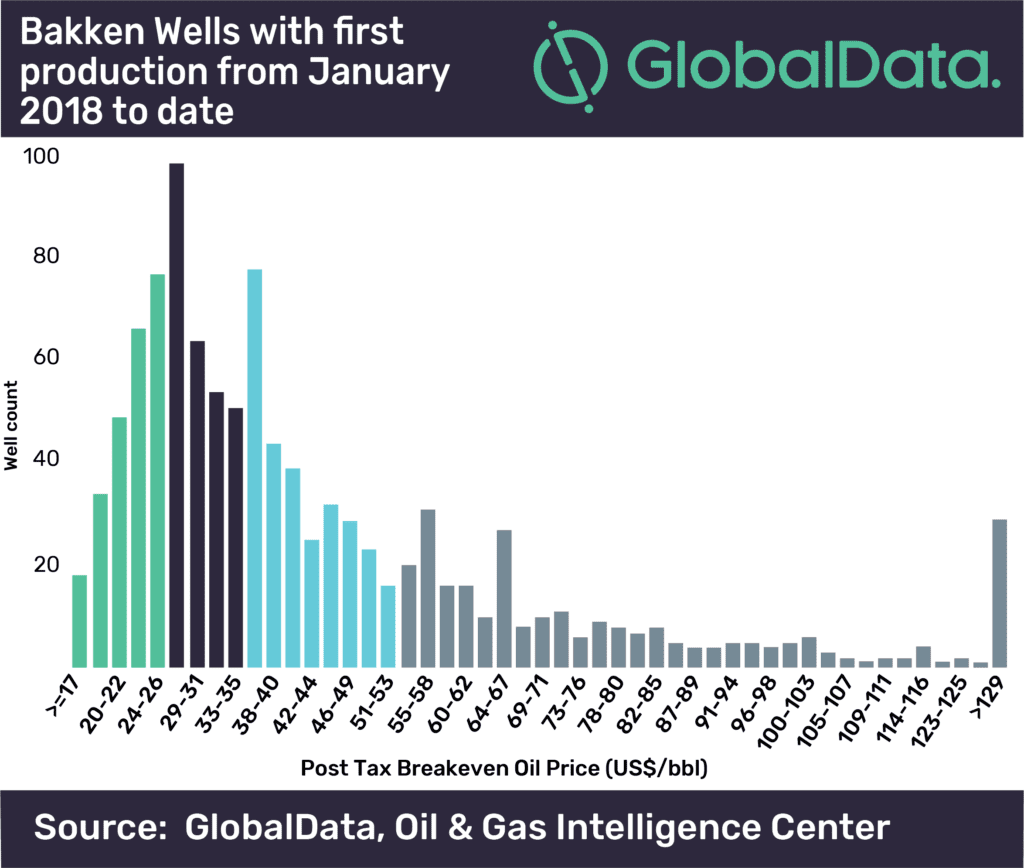

“These legacy producing wells require different levels of oil price to recover their investment and cover expenses depending on when they were drilled. In particular, relatively recent drilled and completed wells, for instance wells brought to first production during the last two years, are very likely to still be in a period of recovering their investment and their required breakeven price is in average above US$46 per barrel (bbl).

“GlobalData estimates that for key operators in Bakken, a reduction of 50% in the number of rigs brings down their capex an average of 40% and this translates into a drop of 36% in their remaining net present value (NPV). GlobalData’s modelling indicates a drop of around 170 thousand barrels of oil equivalent per day in total Bakken production by the end of 2020.

“GlobalData estimates that for key operators in Bakken, a reduction of 50% in the number of rigs brings down their capex an average of 40% and this translates into a drop of 36% in their remaining net present value (NPV). GlobalData’s modelling indicates a drop of around 170 thousand barrels of oil equivalent per day in total Bakken production by the end of 2020.

“Furthermore, as per GlobalData estimates, the average position full cycle breakeven oil price of top operators in Bakken is US$46 per bbl. The full cycle position is relevant since it takes into account wells brought into production during the last two years, which bring an important share of production and are arguably still recovering their investment. By contrast the remaining breakeven oil price is at an average of US$26 per bbl, which indicates that operators have become very efficient in keeping their operation economically robust to cover their ongoing expenses.”