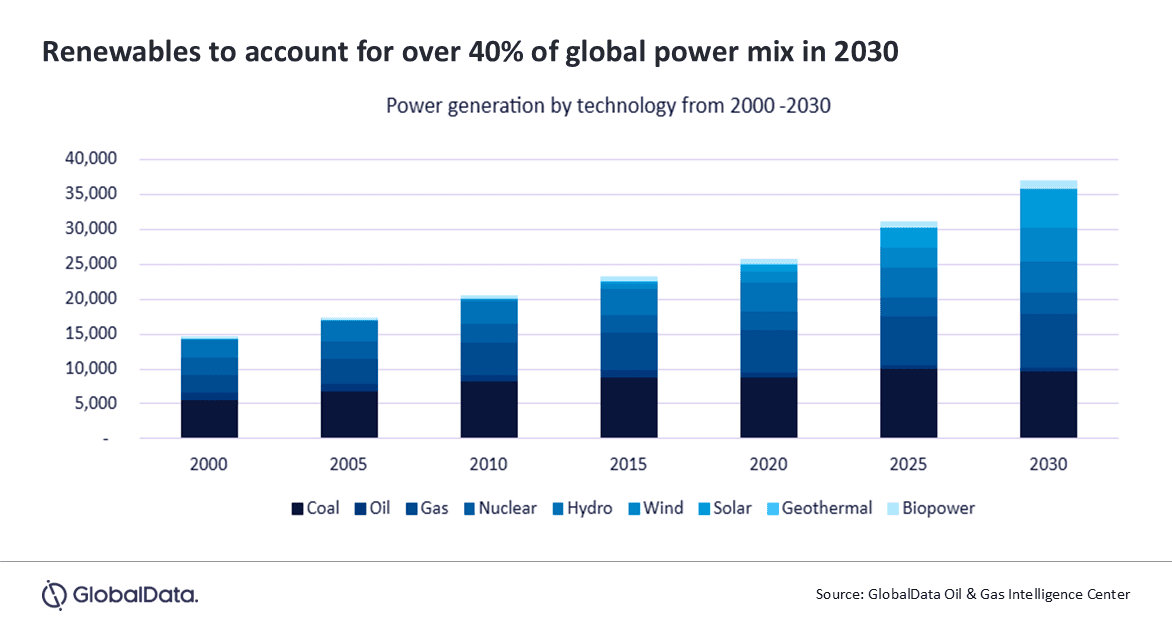

Global power generation is increasingly shifting toward renewable sources, reducing the reliance on fossil fuels. While global energy generation has risen by around 30% in the past ten years, renewable energy has nearly doubled over this timeframe. With the share of renewables in the global energy mix forecast to reach over 40% by 2030, it is expected to play a key role in the product portfolios of oil and gas companies, which are relatively new entrants in the space, according to GlobalData, a leading data and analytics company.

GlobalData’s Strategic Intelligence report, “Renewable Energy in Oil & Gas,” evaluates the role of oil and gas players in the renewable energy theme. It further benchmarks the efforts of oil majors, such as TotalEnergies, BP, Shell, Petrobras, Equinor, Eni, and Repsol, in the renewable energy value chain.

Ravindra Puranik, Oil and Gas Analyst at GlobalData, comments: “The oil and gas industry—including producers, service providers, and contractors—are relatively new entrants in renewable energy. Despite this, they are making notable movements in the competitive landscape for renewable energy, particularly in offshore wind. TotalEnergies is anticipated to be the fourth largest producer of wind energy globally towards the end of this decade, if all its proposed projects go online. Even BP, Shell, and several other European players are building considerable renewable power capacity.”

Lately, companies have somewhat slowed down the pace of investments flowing into renewable energy over the past year. While BP recently withdrew its permit application for its Beacon Wind project offshore New York, Equinor has lowered its renewable energy targets citing cost pressures.

Puranik continues: “Nevertheless, they still fare a lot better than the notable US-based oil majors, ExxonMobil and Chevron, that are clear laggards in the renewable energy segment. These two companies have negligible capacity footprint in this theme and have no plans to alter this scenario in the near future.”

Global power output has nearly doubled over the years, from around 14,500 TWh in 2000. The global power generation is estimated to reach around 31,000 TWh and rise further to 37,000 TWh by 2030, according to GlobalData.

Puranik concludes: “This growth is primarily driven by the rising electrification in emerging markets and the increasing energy demand from data centers, cryptocurrency miners, and other expanding digital technologies. Additionally, the growing adoption of electric vehicles (EVs), particularly in Europe, the US, and China, where their market penetration is higher, is contributing to the rising demand for power.

“Considering all this, it is logical for energy companies to shift towards alternate, emission-friendly sources, such as solar and wind power. Early adopters of renewable energy may secure long-term sustainability in the evolving energy landscape.”