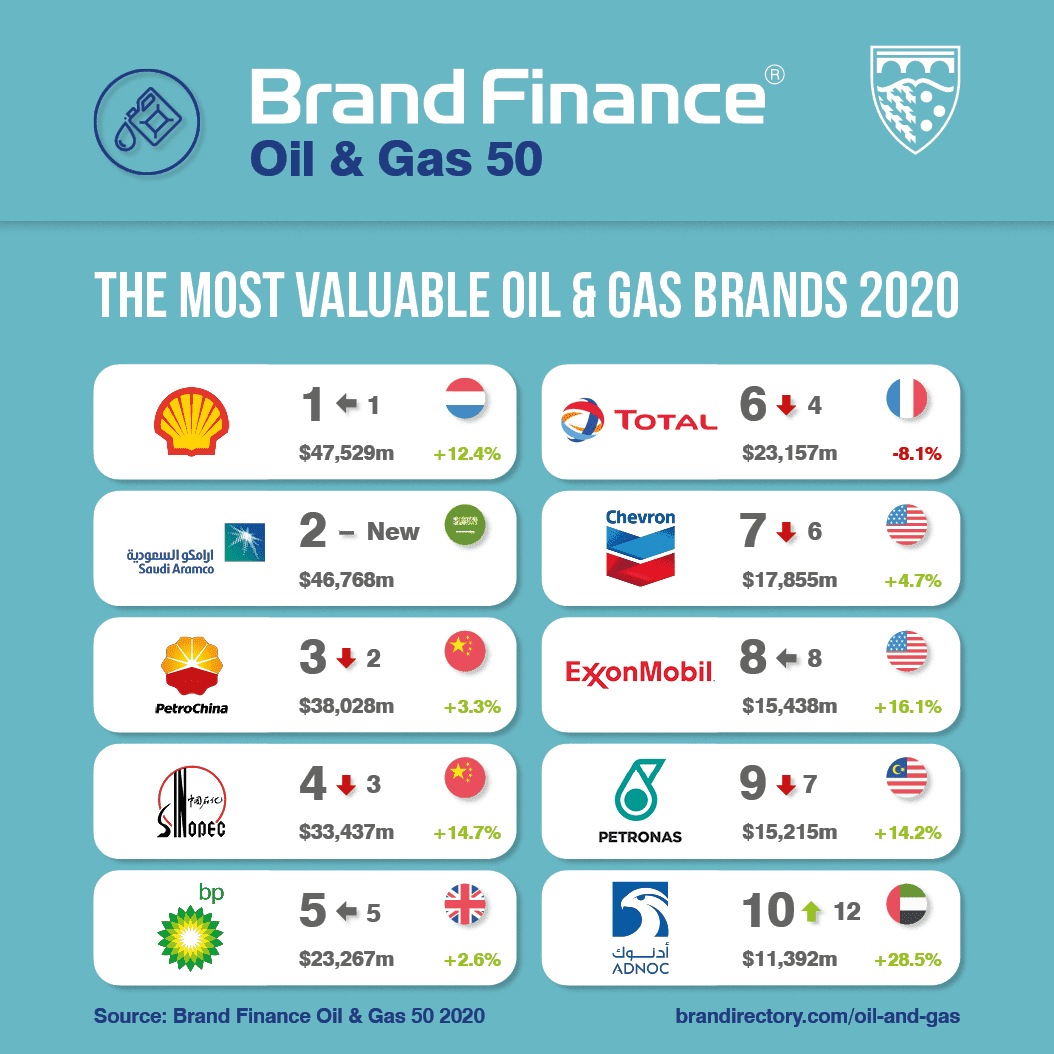

Shell has retained its title of the world’s most valuable oil and gas brand for the fifth consecutive year, recording a 12% increase in brand value to US$47.5 billion, according to the latest report by Brand Finance, the world’s leading independent brand valuation consultancy.

Despite sustained lower oil and gas prices, the Anglo-Dutch titan continues to achieve a significant price and volume premium thanks to its strong brand. Shell recently shared a new strategy to enable the brand to thrive through the transition to a lower-carbon energy system, placing focus on new energy investments that will shape the portfolio and help drive growth over the next few years.

Recently undertaking the largest IPO in history, Saudi Aramco has caused a stir, entering the ranking for the first time as the second most valuable oil and gas brand in the world. With a brand value of US$46.8 billion, the oil giant is now only a fraction behind long-standing leader Shell. The brand is also the highest new entrant in the newly released Brand Finance Global 500, in 24th position, and has claimed the title of the most valuable brand in the Middle East.

The IPO has proven to be successful for the brand as Saudi Aramco raised US$25.6 billion. Even after navigating through recent attacks on two of its oil processing sites, it is now the world’s most valuable listed company, comfortably ahead of tech titans Apple and Microsoft. Saudi Aramco is focused on leveraging its strength in upstream, while growing its downstream operations through acquisitions, both in Saudi Arabia and key global markets. The brand must now focus on developing international perceptions of the brand in order to open it up further for partnerships and investment.

David Haigh, CEO of Brand Finance, commented:

“Some might argue that the end is nigh for Big Oil, but many sectors will be difficult to decarbonise and will likely need oil and gas for decades to come. The challenge at hand for the industry is to make the production and use of oil and gas as efficient as possible throughout this transition, while actively preparing for the future by investing in renewables.”

Total lagging while ADNOC thrives

All brands in the top 10 have recorded solid brand value growth, apart from France’s Total (down 8% to US$23.2 billion). As one of the six supermajor oil brands in the world, Total has traditionally performed well in the ranking, however following a year of heightened market volatility, the brand’s profits have dented considerably. The brand has sold a significant amount of assets, an attempt to protect against low oil prices and concentrate on areas of the business that can withstand oil price fluctuation.

In contrast, Abu Dhabi National Oil Company (ADNOC) has entered the top 10 after recording the fastest brand value growth in the top 20, up 29% to US$11.4 billion. The brand is also the first UAE brand to achieve a brand valuation of more than US$10 billion, a testament to the success of the Group’s ongoing transformation strategy. Since 1971, ADNOC has created thousands of jobs, driven the growth of a diverse knowledge-based economy, and played a key role in Abu Dhabi’s global emergence. ADNOC continues to look for new and innovative ways to maximise the value of its resources, pioneering those approaches and technologies that will ensure it is able to meet the demands of an ever-changing energy market, and continue to have a positive impact on the Abu Dhabi economy for generations to come.

PETRONAS sector’s strongest

In addition to measuring overall brand value, Brand Finance also evaluates the relative strength of brands, based on factors such as marketing investment, familiarity, loyalty, staff satisfaction, and corporate reputation. Alongside revenue forecasts, brand strength is a crucial driver of brand value. According to these criteria, PETRONAS (up 14% to US$15.2 billion) has claimed the title of the world’s strongest oil and gas brand, with a Brand Strength Index (BSI) score of 86.3 out of 100 and a corresponding AAA brand strength rating.

The Malaysian Government-owned brand has flourished as sales volumes for petroleum products have increased and the ringgit has weakened against the US dollar, all while ensuring there is sufficient provision for inevitable market volatility. This year, the brand has focused on streamlining and improving its operational and technical functions, striving towards digital transformation and innovation to be future-ready.

David Haigh, CEO of Brand Finance, commented:

“PETRONAS, along with all the oil & gas giants, are facing persistent market volatility, which brands needs to be ready to tackle. PETRONAS has clearly set its intentions to strive towards new and alternative oil and gas solutions – while maintaining it cautious optimism – in a bid to protect the brand in the future.”