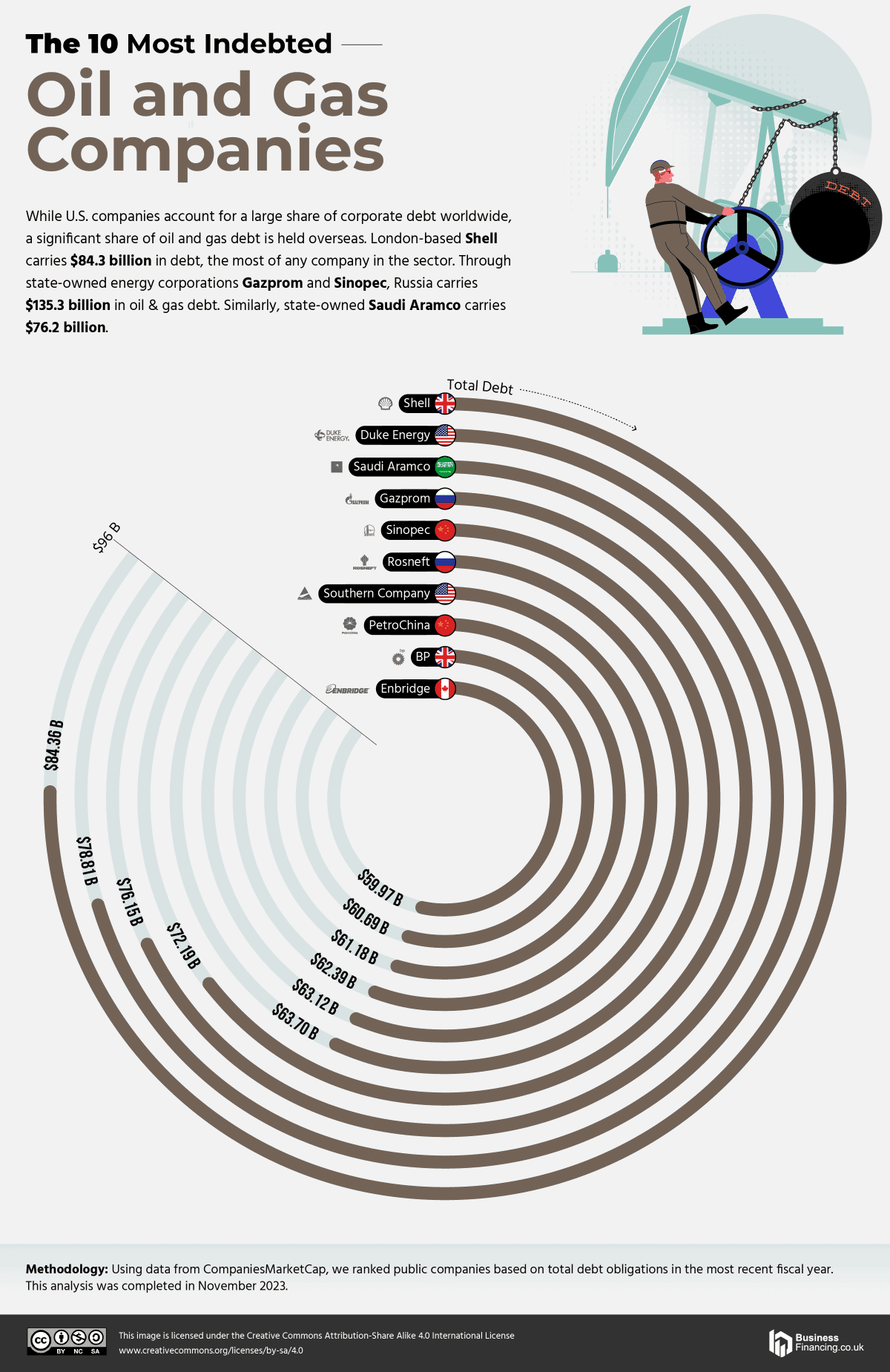

Two UK oil companies feature among the global top ten for corporate debt, including the overall number one: Shell. The company states its strategy is to “maintain a strong balance sheet which provides, through the commodity cycle: efficient access to the debt capital markets; financial resilience; and sufficient flexibility for continued growth.”

In fact, Shell is enjoying record profits right now in light of massive price hikes for consumers. “Shell handed more back to its shareholders last year than it invested in any type of future energy, clean or dirty,” reports the Financial Times. “[I]ts overall capital expenditure was about $24.8bn, of which just $3.5bn was spent in its renewables and energy solutions business.”