The U.S. will drive the growth of the refining industry in North America between 2018 and 2022, as the country is set to add the most planned refining capacity among all countries in the region, according to GlobalData, a leading data and analytics company.

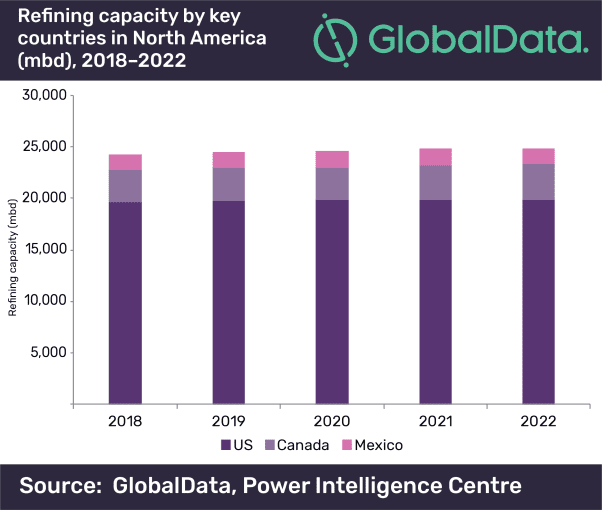

The company’s report: ‘Refining Industry Outlook in North America to 2022’ states that in 2018, North America will account for 23.6% of the total global refining capacity. The refining capacity in the region is expected to increase from 24,285 thousand barrels per day (mbd) in 2018 to 24,904 mbd in 2022. North America is expected to have an estimated capital expenditure (capex) of US$30.1bn on new build projects, of which, around 92% will be spent by Canada and the remaining will be spent by the U.S., during the outlook period.

In North America, the U.S. has the highest planned refining capacity additions of 339 mbd in 2022. Among the Petroleum Administration for Defense Districts (PADD) areas in the country, Midwest is expected to have the highest capacity additions of 170 mbd during the outlook period. Gulf Coast and Rocky Mountain are the remaining districts with additions of 140 mbd and 29 mbd, respectively.

Soorya Tejomoortula, Oil & Gas Analyst at GlobalData, explains: “Booming shale and tight oil production in the U.S. is in turn driving the refinery capacity growth in the country. Growing petroleum product exports is also driving the new refinery capacity additions in the U.S.”

GlobalData identifies Canada as the second highest in North America in terms of capacity additions, and the highest in terms of capex on new build refineries, with planned investment of $27.7bn on new build projects to increase the refining capacity by 255 mbd, from 3,123 mbd in 2018 to 3,378 mbd by 2022.

Tejomoortula adds: “Canada is mainly focusing on building upgraders, with six of the seven projects that are expected to start operations by 2022 being upgraders. These upgraders will help to convert bitumen into synthetic crude, which can be processed in the majority of refineries globally.”

Mexico is the lowest contributor to the refinery capacity growth in North America. The country’s refining capacity will increase slightly by 25 mbd due to the expansion of Tula I’s refinery capacity from 315 mbd to 340 mbd.

In terms of capacity, Advanced Tristar in Canada is the top planned refinery in North America with a capacity of 120 mbd in 2022. Pecos County in the U.S. and Heartland in Canada, are the next two top refineries with capacities of 100 mbd and 86.8 mbd respectively.

With reference to capex, Advanced Tristar in Canada once again leads with capex of $3.1bn between 2018 and 2022. North West Redwater and Heartland, both in Canada, follow next with capex of US$2.3bn and US$1.5bn respectively.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.