Total SA’s (Total) robust upstream business tops the European majors’ peer group when assessed against the impact of COVID-19 and the current oil price volatility, says GlobalData, a leading data and analytics company.

Daniel Rogers, Upstream Oil and Gas Analyst at GlobalData, comments: “Our latest research indicates that Total’s upstream business is well positioned to handle the market volatility and industry disruption this year. This is due to the company’s limited exposure to the U.S. shale business, strong exploration performance over the recent years, and a comparably low debt to equity coming into 2020.”

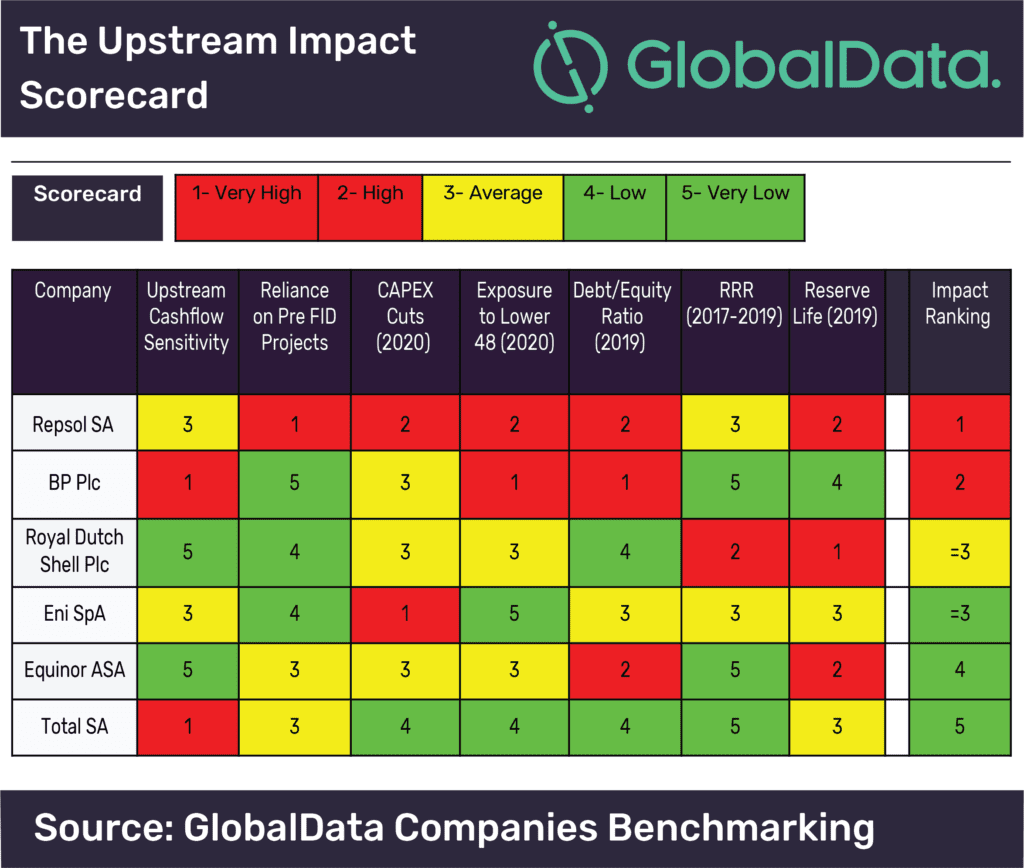

The company’s upstream impact scorecard highlights the relative resilience compared to its peers in areas such as reserve replacement, debt to equity ratio and budget revisions for 2020. However, the company’s upstream cashflow is particularly sensitive to weakened oil prices due to operational footprints in countries that offer less downside oil price protection in their fiscal regimes, such as Nigeria.

The company’s upstream impact scorecard highlights the relative resilience compared to its peers in areas such as reserve replacement, debt to equity ratio and budget revisions for 2020. However, the company’s upstream cashflow is particularly sensitive to weakened oil prices due to operational footprints in countries that offer less downside oil price protection in their fiscal regimes, such as Nigeria.

Rogers continues: “Elements of Repsol’s business, particularly in the upstream segment, position the company at the highest risk in the respective peer group. Repsol’s upstream cashflow outlook under the current prices looks particularly vulnerable. In addition, the company’s strongly leveraged finances coming into 2020 and significant U.S. shale position makes the company particularly vulnerable.”

Each of the European major has a significant downstream business that can support a weakened upstream performance in low oil price periods. However, COVID-19 has resulted in demand destruction for refined petroleum products and companies, therefore cannot rely on support from the downstream business as heavily as in the previous downturns.

Rogers concludes: “The entire peer group saw both revenue and debt deteriorate coming into 2020 and the recent Q1 earnings from Shell and BP saw quarterly year on year revenue decline. Further pain is likely to continue into Q2 and we could see revenues dip to multi-year lows for the group.”